Napa Auto Parts 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Genuine Parts Company and Subsidiaries

Notes to Consolidated Financial Statements — (Continued)

December 31, 2015

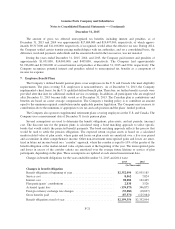

marketing and promotional initiatives, pricing and selling activities, credit decisions, monitoring and maintaining

appropriate inventories, and store hours. Separately, the Company concluded the affiliates are not variable inter-

est entities. The Company’s maximum exposure to loss as a result of its involvement with these independents and

affiliates is generally equal to the total borrowings subject to the Company’s guarantee. While such borrowings

of the independents and affiliates are outstanding, the Company is required to maintain compliance with certain

covenants, including a maximum debt to capitalization ratio and certain limitations on additional borrowings. At

December 31, 2015, the Company was in compliance with all such covenants.

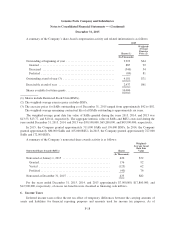

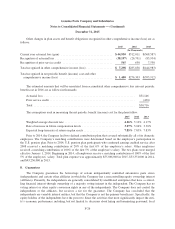

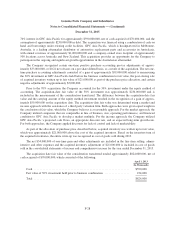

At December 31, 2015, the total borrowings of the independents and affiliates subject to guarantee by the

Company were approximately $332,632,000. These loans generally mature over periods from one to six years. In

the event that the Company is required to make payments in connection with guaranteed obligations of the

independents or the affiliates, the Company would obtain and liquidate certain collateral (e.g., accounts receiv-

able and inventory) to recover all or a portion of the amounts paid under the guarantee. When it is deemed prob-

able that the Company will incur a loss in connection with a guarantee, a liability is recorded equal to this

estimated loss. To date, the Company has had no significant losses in connection with guarantees of

independents’ and affiliates’ borrowings.

The Company has recognized certain assets and liabilities amounting to $35,000,000 and $29,000,000 for

the guarantees related to the independents’ and affiliates’ borrowings at December 31, 2015 and 2014,

respectively. These assets and liabilities are included in other assets and other long-term liabilities in the con-

solidated balance sheets.

9. Acquisitions

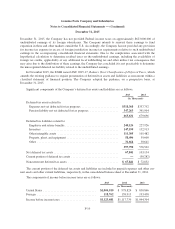

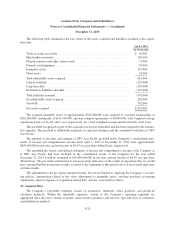

During 2015, the Company acquired one company in the Electrical/Electronic Materials Group, three compa-

nies in the Office Products Group, four companies in the Industrial Group, and five store groups in the Automo-

tive Parts Group for approximately $120,000,000, net of cash acquired. During 2014, the Company acquired two

companies each in the Automotive Group, Office Products Group, and Electrical/Electronic Materials Group and

one company in the Industrial Group for approximately $260,000,000, net of cash acquired. During 2013, the

Company acquired one company each in the Automotive Group (including GPC Asia Pacific), Industrial Group,

and Electrical/Electronic Materials Group for approximately $650,000,000, net of cash acquired.

For each acquisition, the Company allocated the purchase price to the assets acquired and the liabilities

assumed based on their fair values as of their respective acquisition dates. The results of operations for the

acquired companies were included in the Company’s consolidated statements of income and comprehensive

income beginning on their respective acquisition dates. The Company recorded approximately $90,000,000,

$200,000,000 and $950,000,000 of goodwill and other intangible assets associated with the 2015, 2014, and 2013

acquisitions, respectively.

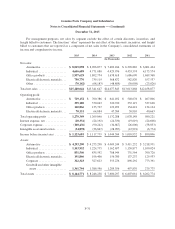

For the 2015 acquisitions, other intangible assets acquired consisted of customer relationships of

$39,000,000 with weighted average amortization lives of 15 years. For the 2014 acquisitions, other intangible

assets acquired consisted of customer relationships of $82,000,000 and trademarks of $28,000,000 with weighted

average amortization lives of 18 and 40 years, respectively. For the 2013 acquisitions, other intangible assets

acquired consisted of customer relationships of $235,000,000, trademarks of $141,000,000, and non-competition

agreements of $4,000,000 with weighted average amortization lives of 15, 40, and 1 years, respectively.

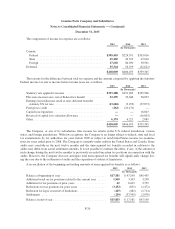

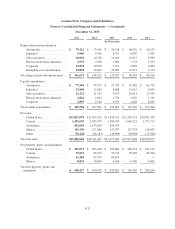

Additional disclosure on the 2013 automotive acquisition of GPC Asia Pacific is provided below.

GPC Asia Pacific

The Company acquired a 30% investment in GPC Asia Pacific, formerly known as the Exego Group, for

approximately $166,000,000 effective January 1, 2012. On April 1, 2013, the Company acquired the remaining

F-27