Napa Auto Parts 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

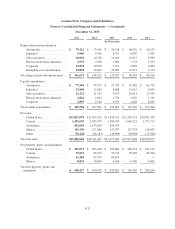

Genuine Parts Company and Subsidiaries

Notes to Consolidated Financial Statements — (Continued)

December 31, 2015

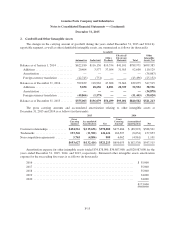

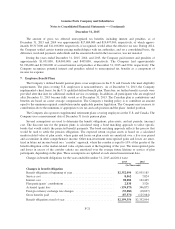

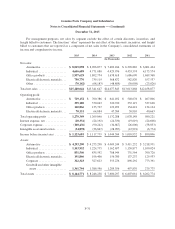

2014

Total

Quoted

Prices

in Active

Markets for

Identical

Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(In Thousands)

Equity Securities

Common stocks — mutual funds — equity ............. $ 366,716 $ 366,716 $ — $ —

Genuine Parts Company common stock ................ 215,477 215,477 — —

Other stocks ..................................... 822,782 822,782 — —

Debt Securities

Short-term investments ............................. 41,882 41,882 — —

Cash and equivalents .............................. 8,921 8,921 — —

Government bonds ................................ 192,413 96,480 95,933 —

Corporate bonds .................................. 178,214 — 178,214 —

Asset-backed and mortgage–backed securities .......... 27,756 — 27,756 —

Convertible securities .............................. 633 — 633 —

Other-international ................................ 25,137 21,815 3,322 —

Municipal bonds .................................. 6,435 — 6,435 —

Mutual funds — fixed income ....................... 132,752 — 132,752 —

Other

Options and futures ................................ 7 7 — —

Cash surrender value of life insurance policies .......... 2,712 — — 2,712

Total ........................................... $2,021,837 $1,574,080 $445,045 $2,712

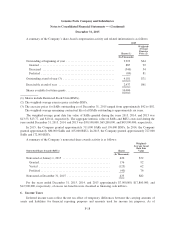

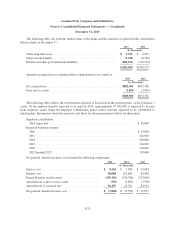

Equity securities include Genuine Parts Company common stock in the amounts of $173,363,000 (9% of

total plan assets) and $215,477,000 (11% of total plan assets) at December 31, 2015 and 2014, respectively.

Dividend payments received by the plan on Company stock totaled approximately $4,965,000 and $4,650,000 in

2015 and 2014, respectively. Fees paid during the year for services rendered by parties in interest were based on

customary and reasonable rates for such services.

The changes in the fair value measurement of plan assets using significant unobservable inputs (Level 3)

during 2015 and 2014 were not material.

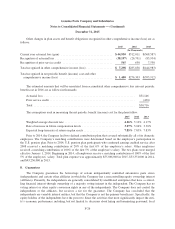

Based on the investment policy for the pension plans, as well as an asset study that was performed based on

the Company’s asset allocations and future expectations, the Company’s expected rate of return on plan assets for

measuring 2016 pension cost or income is 7.83% for the plans. The asset study forecasted expected rates of

return for the approximate duration of the Company’s benefit obligations, using capital market data and historical

relationships.

F-24