Motorola 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

The risk-free interest rate assumption is based upon the average daily closing rates during the year for U.S.

treasury notes that have a life which approximates the expected life of the option. The dividend yield assumption is

based on the Company’s future expectation of dividend payouts. The expected life of employee stock options

represents the average of the contractual term of the options and the weighted-average vesting period for all option

tranches.

The Company has applied forfeiture rates, estimated based on historical data, of 13%-50% to the option fair

values calculated by the Black-Scholes option pricing model. These estimated forfeiture rates are applied to grants

based on their remaining vesting term and may be revised in subsequent periods if actual forfeitures differ from

these estimates.

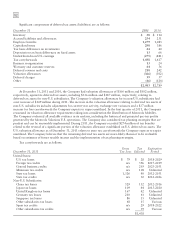

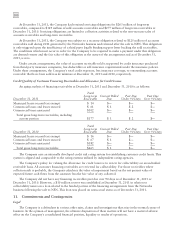

Stock option activity was as follows (in thousands, except exercise price and employee data):

2011 2010 2009

Years Ended December 31

Shares

Subject to

Options

Wtd. Avg.

Exercise

Price

Shares

Subject to

Options

Wtd. Avg.

Exercise

Price

Shares

Subject to

Options

Wtd. Avg.

Exercise

Price

Options outstanding at January 1 19,614 $81 23,061 $ 84 32,592 $120

Options granted 3,155 39 1,630 50 8,939 45

Options exercised (4,475) 27 (1,559) 42 (206) 42

Adjustments to options outstanding to

reflect Mobility spin-off 7,756 39 —— ——

Options terminated, cancelled or expired (10,321) 59 (3,518) 104 (18,264) 128

Options outstanding at December 31 15,729 63 19,614 81 23,061 84

Options exercisable at December 31 11,184 74 12,429 99 11,037 121

Approx. number of employees granted

options 270 529 22,095

At December 31, 2011, the Company had $36 million of total unrecognized compensation expense, net of

estimated forfeitures, related to stock option plans and the employee stock purchase plan that will be recognized

over the weighted average period of approximately two years. Cash received from stock option exercises and the

employee stock purchase plan was $192 million, $179 million and $116 million for the years ended December 31,

2011, 2010 and 2009, respectively. The total intrinsic value of options exercised during the years ended

December 31, 2011, 2010 and 2009 was $73 million, $17 million and $1 million, respectively. The aggregate

intrinsic value for options outstanding and exercisable as of December 31, 2011 was $146 million and $100 million,

respectively, based on a December 31, 2011 stock price of $46.29 per share. Pursuant to the completion of the

Separation on January 4, 2011, approximately 8.0 million stock options were cancelled.

At December 31, 2011 and 2010, 23.7 million shares and 6.6 million shares, respectively, were available for

future share-based award grants under the current share-based compensation plan, covering all equity awards to

employees and non-employee directors.

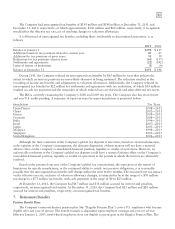

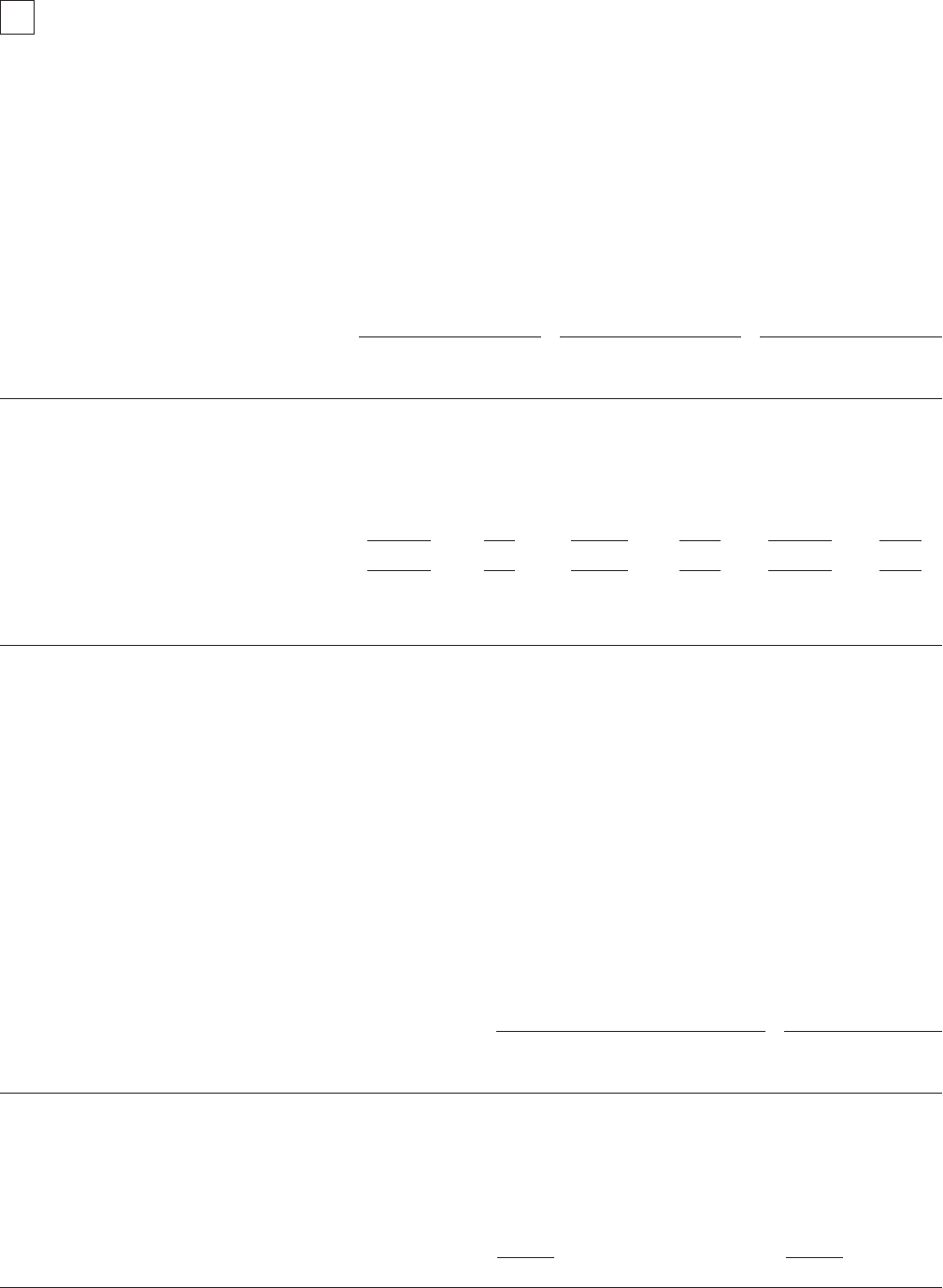

The following table summarizes information about stock options outstanding and exercisable at December 31,

2011 (in thousands, except exercise price and years):

Options Outstanding

Options

Exercisable

Exercise price range

No. of

options

Wtd. avg.

Exercise

Price

Wtd. avg.

contractual

life (in yrs.)

No. of

options

Wtd. avg.

Exercise

Price

Under $30 4,984 $ 26 7 3,752 $ 26

$30-$40 4,641 37 7 2,009 34

$41-$50 747 45 8 176 43

$51-$60 737 55 1 628 54

$61-$70 1,056 68 3 1,055 68

$71-$80 311 74 5 311 74

$81 and over 3,253 161 3 3,253 161

15,729 11,184