Motorola 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

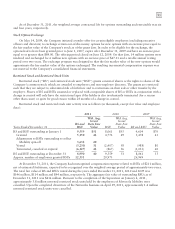

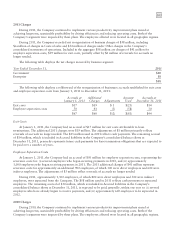

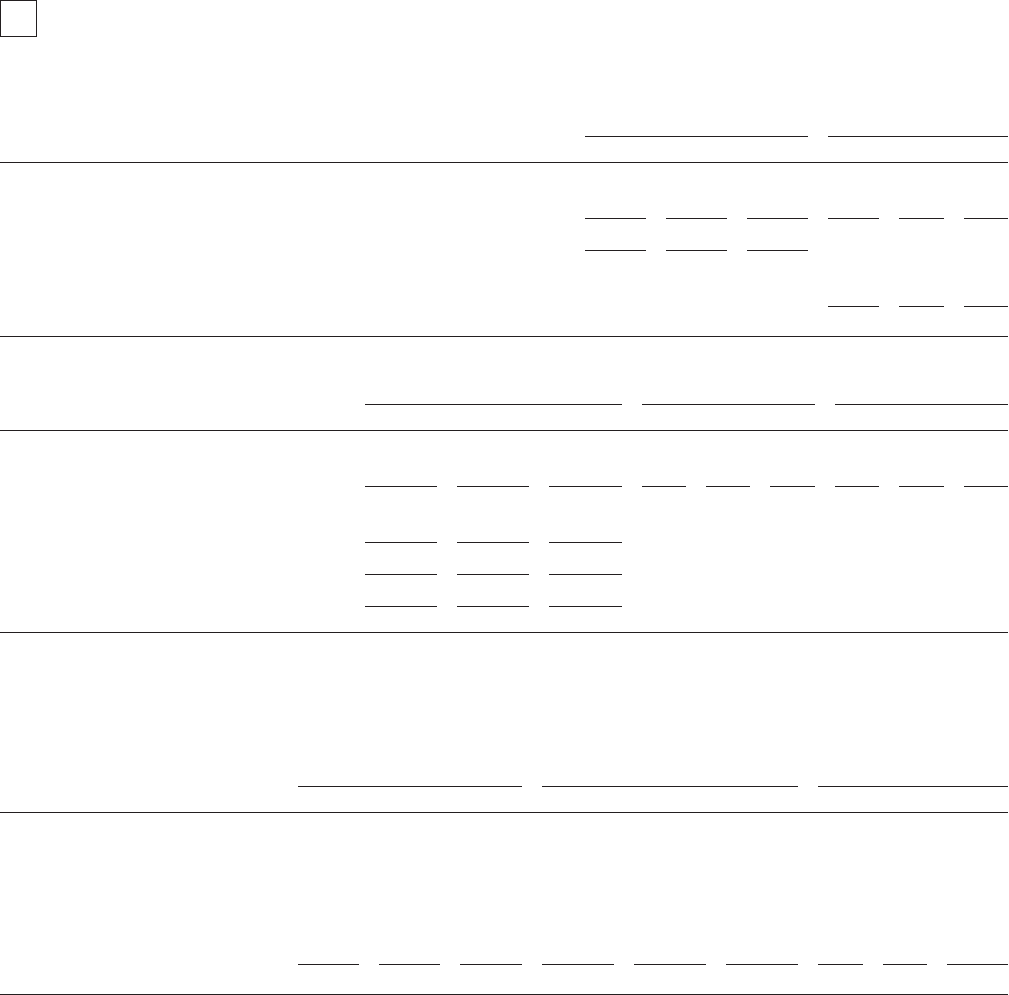

Segment information

Net Sales Operating Earnings

Years Ended December 31 2011 2010 2009 2011 2010 2009

Government $5,358 $5,049 $4,796 $ 616 $534 $534

Enterprise 2,845 2,568 2,151 242 217 33

8,203 7,617 6,947

Operating earnings 858 751 567

Total other income (expense) (120) (87) 66

Earnings from continuing operations before income taxes $ 738 $664 $633

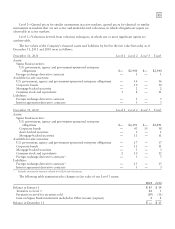

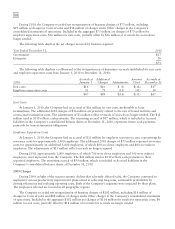

Assets

Capital

Expenditures

Depreciation

Expense

Years Ended December 31 2011 2010 2009 2011 2010 2009 2011 2010 2009

Government $ 2,892 $ 3,424 $ 2,873 $159 $172 $115 $128 $110 $115

Enterprise 2,264 2,724 2,853 27 20 21 37 40 55

5,156 6,148 5,726 186 192 136 165 150 170

Other 8,761 11,649 11,771

13,917 17,797 17,497

Discontinued Operations 12 7,780 8,106

$13,929 $25,577 $25,603

Assets in Other include primarily cash and cash equivalents, Sigma Fund, deferred income taxes, short-term investments, property, plant and

equipment, investments, and the administrative headquarters of the Company.

Geographic area information

Net Sales Assets

Property, Plant, and

Equipment, net

Years Ended December 31 2011 2010 2009 2011 2010 2009 2011 2010 2009

United States $4,399 $4,157 $3,938 $ 8,888 $10,501 $10,063 $504 $484 $ 351

China 322 307 241 860 1,823 1,716 14 913

United Kingdom 670 568 513 584 850 1,084 21 23 26

Israel 173 225 240 1,128 1,366 1,321 26 40 172

Japan 97 99 95 553 724 684 60 61 56

Other, net of eliminations 2,542 2,261 1,920 1,904 2,533 2,629 271 305 394

$8,203 $7,617 $6,947 $13,917 $17,797 $17,497 $896 $922 $1,012

Net sales by geographic region are measured by the locale of end customer. For 2009 and 2010, all U.S. federal government sales were reclassified

from “Other, net of eliminations” to the United States to conform to current year’s presentation.

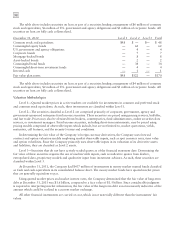

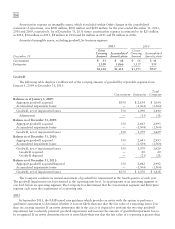

13. Reorganization of Businesses

The Company maintains a formal Involuntary Severance Plan (the “Severance Plan”), which permits the

Company to offer eligible employees severance benefits based on years of service and employment grade level in the

event that employment is involuntarily terminated as a result of a reduction-in-force or restructuring. The Company

recognizes termination benefits based on formulas per the Severance Plan at the point in time that future settlement

is probable and can be reasonably estimated based on estimates prepared at the time a restructuring plan is

approved by management. Exit costs consist of future minimum lease payments on vacated facilities and other

contractual terminations. At each reporting date, the Company evaluates its accruals for employee separation and

exit costs to ensure the accruals are still appropriate. In certain circumstances, accruals are no longer needed because

of efficiencies in carrying out the plans or because employees previously identified for separation resigned from the

Company and did not receive severance or were redeployed due to circumstances not foreseen when the original

plans were initiated. In these cases, the Company reverses accruals through the consolidated statements of

operations where the original charges were recorded when it is determined they are no longer needed.