Motorola 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

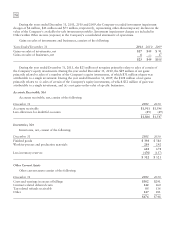

4. Debt and Credit Facilities

Long-Term Debt

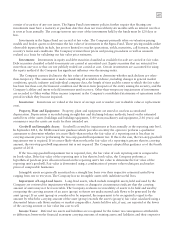

December 31 2011 2010

8.0% notes due 2011 $—$ 600

5.375% senior notes due 2012 400 400

6.0% senior notes due 2017 399 399

6.5% debentures due 2025 118 313

7.5% debentures due 2025 346 346

6.5% debentures due 2028 36 209

6.625% senior notes due 2037 54 224

5.22% debentures due 2097 89 89

Other long-term debt 50 53

1,492 2,633

Adjustments, primarily unamortized gains on interest rate swap terminations 43 70

Less: current portion (405) (605)

Long-term debt $1,130 $2,098

In November 2011, the Company repaid, at maturity, the entire $600 million aggregate principal amount

outstanding of its 8.0% Notes due November 1, 2011.

During the year ended December 31, 2011, the Company repurchased $540 million of its outstanding long-

term debt for a purchase price of $615 million, excluding approximately $6 million of accrued interest, all of which

occurred during the three months ended July 2, 2011. The $540 million of long-term debt repurchased included

principal amounts of: (i) $196 million of the $314 million then outstanding of the 6.50% Debentures due 2025 (the

“2025 Debentures”), (ii) $174 million of the $210 million then outstanding of the 6.50% Debentures due 2028 (the

“2028 Debentures”), and (iii) $170 million of the $225 million then outstanding of the 6.625% Senior Notes due

2037 (the “2037 Senior Notes”). After accelerating the amortization of debt issuance costs and debt discounts, the

Company recognized a loss of approximately $81 million related to this debt tender in Other within Other income

(expense) in the consolidated statements of operations.

In November 2010, the Company repaid at maturity, the entire $527 million aggregate principal amount

outstanding of its 7.625% Notes due November 15, 2010. During the year ended December 31, 2010, the Company

repurchased approximately $500 million of its outstanding long-term debt for a purchase price of $477 million,

excluding approximately $5 million of accrued interest, all of which occurred during the three months ended July 3,

2010. The $500 million of long-term debt repurchased included principal amounts of: (i) $65 million of the

$379 million then outstanding of the 2025 Debentures, (ii) $75 million of the $286 million then outstanding of the

2028 Debentures, (iii) $222 million of the $446 million then outstanding of the 2037 Senior Notes, and

(iv) $138 million of the $252 million then outstanding of the 5.22% Debentures due 2097. After accelerating the

amortization of debt issuance costs and debt discounts, the Company recognized a loss of approximately

$12 million related to this debt tender in Other within Other income (expense) in the consolidated statements of

operations.

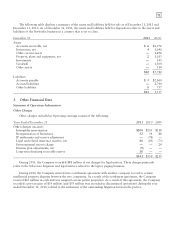

Aggregate requirements for long-term debt maturities during the next five years are as follows: 2012—

$405 million; 2013—$5 million; 2014—$4 million; 2015—$4 million; and 2016—$5 million.

Credit Facilities

As of December 31, 2011, the Company had a $1.5 billion unsecured syndicated revolving credit facility (the

“2011 Motorola Solutions Credit Agreement”) that is scheduled to expire on June 30, 2014. The 2011 Motorola

Solutions Credit Agreement includes a provision pursuant to which the Company can increase the aggregate credit

facility size up to a maximum of $2.0 billion by adding lenders or having existing lenders increase their

commitments. The Company must comply with certain customary covenants, including maintaining maximum

leverage and minimum interest coverage ratios as defined in the 2011 Motorola Solutions Credit Agreement. The

Company was in compliance with its financial covenants as of December 31, 2011. The Company did not borrow

under the 2011 Motorola Solutions Credit Agreement during 2011.