Motorola 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

the benefit obligation when due. The long-term rates of return on plan assets represents an estimate of long-term

returns on an investment portfolio consisting of a mixture of equities, fixed income, cash and other investments

similar to the actual investment mix. In determining the long-term return on plan assets, the Company considers

long-term rates of return on the asset classes (both historical and forecasted) in which the Company expects the plan

funds to be invested.

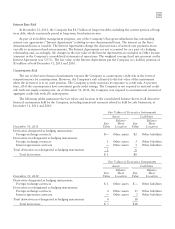

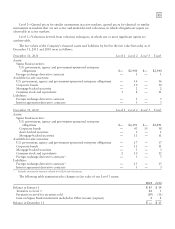

Weighted average actuarial assumptions used to determine costs for the plans were as follows:

2011 2010

December 31 U.S. Non U.S. U.S. Non U.S.

Discount rate 5.75% 5.01% 6.00% 5.39%

Investment return assumption (Regular Plan) 8.25% 6.50% 8.25% 6.86%

Investment return assumption (Officers’ Plan) 6.00% N/A 6.00% N/A

Weighted average actuarial assumptions used to determine benefit obligations for the plans were as follows:

2011 2010

December 31 U.S. Non U.S. U.S. Non U.S.

Discount rate 5.10% 4.58% 5.75% 5.07%

Future compensation increase rate (Regular Plan) 0.00% 2.56% 0.00% 2.61%

Future compensation increase rate (Officers’ Plan) 0.00% N/A 0.00% N/A

The accumulated benefit obligations for the plans were as follows:

2011 2010

December 31 Regular

Officers’

and

MSPP Non

U.S. Regular

Officers’

and

MSPP

Non

U.S.

Accumulated benefit obligation $6,948 $ 38 $1,588 $6,129 $ 44 $1,423

The Company has adopted a pension investment policy designed to meet or exceed the expected rate of return

on plan assets assumption. To achieve this, the pension plans retain professional investment managers that invest

plan assets in equity and fixed income securities and cash. In addition, some plans invest in insurance contracts. The

Company’s measurement date of its plan assets and obligations is December 31. The Company has the following

target mixes for these asset classes, which are readjusted periodically, when an asset class weighting deviates from

the target mix, with the goal of achieving the required return at a reasonable risk level:

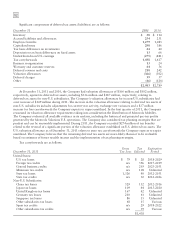

Target Mix

Asset Category 2011 2010

Equity securities 63% 63%

Fixed income securities 35% 35%

Cash and other investments 2% 2%

The weighted-average pension plan asset allocation by asset categories:

Actual Mix

December 31 2011 2010

Equity securities 60% 66%

Fixed income securities 35% 32%

Cash and other investments 5% 2%

Within the equity securities asset class, the investment policy provides for investments in a broad range of

publicly-traded securities including both domestic and international stocks. Within the fixed income securities asset

class, the investment policy provides for investments in a broad range of publicly-traded debt securities ranging from

U.S. Treasury issues, corporate debt securities, mortgage and asset-backed securities, as well as international debt

securities. In the cash and other investments asset class, investments may be in cash, cash equivalents or insurance

contracts.