Motorola 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

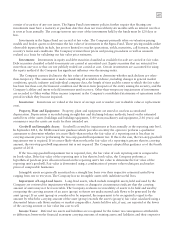

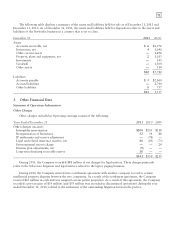

consist of securities of any one issuer. The Sigma Fund’s investment policies further require that floating rate

investments must have a maturity at purchase date that does not exceed thirty-six months with an interest rate that

is reset at least annually. The average interest rate reset of the investments held by the funds must be 120 days or

less.

Investments in the Sigma Fund are carried at fair value. The Company primarily relies on valuation pricing

models and broker quotes to determine the fair value of investments in the Sigma Fund. These pricing models utilize

observable inputs which include, but are not limited to: market quotations, yields, maturities, call features, and the

security’s terms and conditions. The Company reviews these prices and pricing procedures as well as amounts

realized as a basis for validating our fair value price estimates.

Investments: Investments in equity and debt securities classified as available-for-sale are carried at fair value.

Debt securities classified as held-to-maturity are carried at amortized cost. Equity securities that are restricted for

more than one year or that are not publicly traded are carried at cost. Certain investments are accounted for using

the equity method if the Company has significant influence over the issuing entity.

The Company assesses declines in the fair value of investments to determine whether such declines are other-

than-temporary. This assessment is made considering all available evidence, including changes in general market

conditions, specific industry and individual company data, the length of time and the extent to which the fair value

has been less than cost, the financial condition and the near-term prospects of the entity issuing the security, and the

Company’s ability and intent to hold investment until recovery. Other-than-temporary impairments of investments

are recorded to Other within Other income (expense) in the Company’s consolidated statements of operations in the

period in which they become impaired.

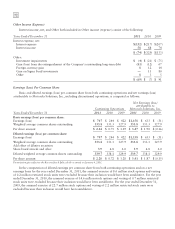

Inventories: Inventories are valued at the lower of average cost or market (net realizable value or replacement

cost).

Property, Plant and Equipment: Property, plant and equipment are stated at cost less accumulated

depreciation. Depreciation is recorded using straight-line and declining-balance methods, based on the estimated

useful lives of the assets (buildings and building equipment, 5-40 years; machinery and equipment, 2-10 years) and

commences once the assets are ready for their intended use.

Goodwill and Intangible Assets: Goodwill is tested for impairment at least annually at the reporting unit level.

In September 2011, the FASB issued new guidance which provides an entity the option to perform a qualitative

assessment to determine whether it is more-likely-than-not that the fair value of a reporting unit is less than its

carrying amount prior to performing the two-step goodwill impairment test. If this is the case, the two-step goodwill

impairment test is required. If it is more-likely-than-not that the fair value of a reporting is greater than its carrying

amount, the two-step goodwill impairment test is not required. The Company adopted this guidance as of the fourth

quarter of 2011.

If the two-step goodwill impairment test is required, first, the fair value of each reporting unit is compared to

its book value. If the fair value of the reporting unit is less than its book value, the Company performs a

hypothetical purchase price allocation based on the reporting unit’s fair value to determine the fair value of the

reporting unit’s goodwill. Fair value is determined using a combination of present value techniques and market

prices of comparable businesses.

Intangible assets are generally amortized on a straight line basis over their respective estimated useful lives

ranging from one to ten years. The Company has no intangible assets with indefinite useful lives.

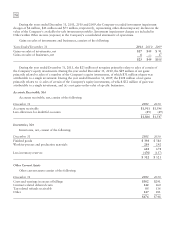

Impairment of Long-Lived Assets: Long-lived assets, which include intangible assets, held and used by the

Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying

amount of assets may not be recoverable. The Company evaluates recoverability of assets to be held and used by

comparing the carrying amount of an asset (group) to future net undiscounted cash flows to be generated by the

asset (group). If an asset (group) is considered to be impaired, the impairment to be recognized is equal to the

amount by which the carrying amount of the asset (group) exceeds the asset’s (group’s) fair value calculated using a

discounted future cash flows analysis or market comparables. Assets held for sale, if any, are reported at the lower

of the carrying amount or fair value less cost to sell.

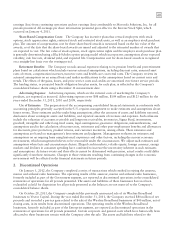

Income Taxes: Deferred tax assets and liabilities are recognized for the future tax consequences attributable

to differences between the financial statement carrying amounts of existing assets and liabilities and their respective