Motorola 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

Wireless Broadband businesses sold have not been reclassified as held for disposition for all periods presented as the

balances are not material to the Company’s consolidated balance sheets.

On April 29, 2011 the Company completed the sale of certain assets and liabilities of its Networks business to

NSN. The results of operations of the portions of the Networks business included in the Transaction are reported as

discontinued operations for all periods presented. Certain corporate and general costs which have historically been

allocated to the Networks business remain with the Company after the sale.

Based on the terms and conditions of the Transaction, the sale was subject to a purchase price adjustment that

was contingent upon the review of final assets and liabilities transferred to NSN and was based on the change in net

assets from the original agreed upon sale date. During the year ended December 31, 2011, the Company received

approximately $1.0 billion of net proceeds and recorded a pre-tax gain related to the completion of the Transaction

of $434 million, net of closing costs and an agreed upon purchase price adjustment of $120 million in our results

from discontinued operations. The Company paid $24 million of this settlement to NSN as of December 31, 2011.

On January 4, 2011, the stockholders of record as of the close of business on December 21, 2010 received one

(1) share of Motorola Mobility common stock for each eight (8) shares of the Company’s common stock held as of

the record date (“the Distribution”), completing the separation of Motorola Mobility from Motorola Solutions (the

“Separation”). The Distribution was structured to be tax-free to Motorola Solutions and its stockholders for U.S.

tax purposes (other than with respect to any cash received in lieu of fractional shares). The historical financial

results of Motorola Mobility are reflected in the Company’s consolidated financial statements and footnotes as

discontinued operations for all periods presented.

During the three months ended July 3, 2010, the Company completed the sale of its Israel-based wireless

network operator business formerly included as part of the Government segment. The Company received

$170 million in net cash and recorded a gain on sale of the business of $20 million before income taxes, which is

included in Earnings from discontinued operations, net of tax, in the Company’s consolidated statements of

operations.

During the three months ended April 4, 2009, the Company completed the sale of: (i) Good Technology, and

(ii) the biometrics business, which includes its Printrak trademark. Collectively, the Company received $163 million

in net cash and recorded a net gain on sale of the businesses of $175 million before income taxes, which is included

in Earnings from discontinued operations, net of tax, in the Company’s consolidated statements of operations.

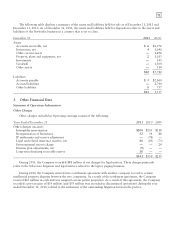

The following table displays summarized activity in the Company’s consolidated statements of operations for

discontinued operations during the years ended December 31, 2011, 2010 and 2009.

Years Ended December 31 2011 2010 2009

Net sales $1,346 $15,256 $15,200

Operating earnings (loss) 201 601 (726)

Gains (losses) on sales of investments and businesses, net 474 20 156

Earnings before income taxes 667 600 (636)

Income tax expense (benefit) 256 211 (163)

Earnings (loss) from discontinued operations, net of tax 411 389 (473)