Motorola 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

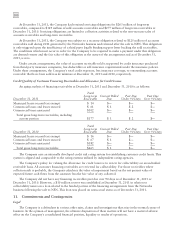

At December 31, 2011, the Company had retained servicing obligations for $263 million of long-term

receivables, compared to $329 million of sold accounts receivables and $277 million of long-term receivables at

December 31, 2010. Servicing obligations are limited to collection activities related to the non-recourse sales of

accounts receivables and long-term receivables.

At December 31, 2011, the Company was subject to a recourse obligation related to $125 million of accounts

receivables sold during 2011 generated by the Networks business and retained after the sale to NSN. This obligation

is only triggered upon the insufficiency of a third party legally binding support letter backing the sold receivables.

The conditions which must occur in order for the Company to be required to make a payment under this obligation

are deemed remote and the fair value of this obligation at the outset of the arrangement and as of December 31,

2011, is zero.

Under certain arrangements, the value of accounts receivable sold is supported by credit insurance purchased

from third-party insurance companies, less deductibles or self-insurance requirements under the insurance policies.

Under these arrangements, the Company’s total credit exposure, less insurance coverage, to outstanding accounts

receivable that have been sold was de minimus at December 31, 2011 and 2010, respectively.

Credit Quality of Customer Financing Receivables and Allowance for Credit Losses

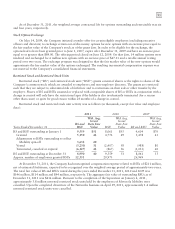

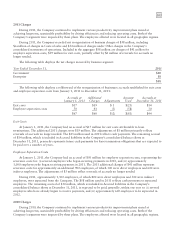

An aging analysis of financing receivables at December 31, 2011 and December 31, 2010 is as follows:

December 31, 2011

Total

Long-term

Receivable

Current Billed

Due

Past Due

Under 90 Days

Past Due

Over 90 Days

Municipal leases secured tax exempt $ 14 $— $— $—

Commercial loans and leases secured $ 61 $ 1 $ 2 $—

Commercial loans unsecured $102 $— $— $—

Total gross long-term receivables, including

current portion $177 $ 1 $ 2 $—

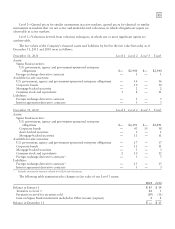

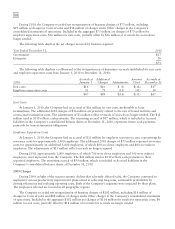

December 31, 2010

Total

Long-term

Receivable

Current Billed

Due

Past Due

Under 90 Days

Past Due

Over 90 Days

Municipal leases secured tax exempt $ 16 $— $— $—

Commercial loans and leases secured $ 67 $ 1 $— $—

Commercial loans unsecured $182 $— $— $—

Total gross long-term receivables $265 $ 1 $— $—

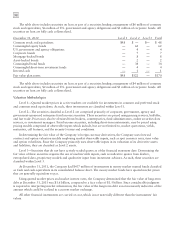

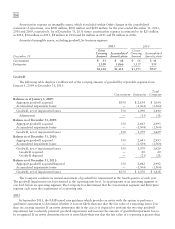

The Company uses an internally developed credit risk rating system for establishing customer credit limits. This

system is aligned and comparable to the rating systems utilized by independent rating agencies.

The Company’s policy for valuing the allowance for credit losses is to review for collectability on an individual

receivable basis. All customer financing receivables are reviewed for collectability. For those receivables where

collection risk is probable, the Company calculates the value of impairment based on the net present value of

expected future cash flows from the customer less the fair value of any collateral.

The Company did not have any financing receivables past due over 90 days as of December 31, 2011 or

December 31, 2010. However, a $10 million reserve was established at December 31, 2011 in relation to

collectability issues on a loan related to the funded portion of the financing arrangements from the Networks

business following the sale to NSN. This loan was placed on nonaccrual status as of December 31, 2011.

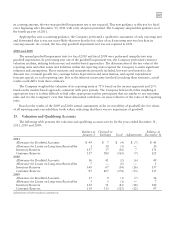

11. Commitments and Contingencies

Legal

The Company is a defendant in various other suits, claims and investigations that arise in the normal course of

business. In the opinion of management, the ultimate disposition of these matters will not have a material adverse

effect on the Company’s consolidated financial position, liquidity or results of operations.