Motorola 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

its carrying amount, the two-step goodwill impairment test is not required. This new guidance is effective for fiscal

years beginning after December 15, 2011 with early adoption permitted. The Company adopted this guidance as of

the fourth quarter of 2011.

Applying this new accounting guidance, the Company performed a qualitative assessment of each reporting unit

and determined that is was not more-likely-than-not that the fair value of each reporting unit was less than its

carrying amount. As a result, the two-step goodwill impairment test was not required in 2011.

2010 and 2009

The annual goodwill impairment tests for fiscal 2010 and fiscal 2009 were performed using the two step

goodwill impairment. In performing step one of the goodwill impairment test, the Company performed extensive

valuation analysis, utilizing both income and market-based approaches. The determination of the fair value of the

reporting units and other assets and liabilities within the reporting units required the Company to make significant

estimates and assumptions. These estimates and assumptions primarily included, but were not limited to, the

discount rate, terminal growth rate, earnings before depreciation and amortization, and capital expenditures

forecasts specific to each reporting unit. Due to the inherent uncertainty involved in making these estimates, actual

results could differ from those estimates.

The Company weighted the valuation of its reporting units at 75% based on the income approach and 25%

based on the market-based approach, consistent with prior periods. The Company believes that this weighting is

appropriate since it is often difficult to find other appropriate market participants that are similar to our reporting

units and it is the Company’s view that future discounted cash flows are more reflective of the value of the reporting

units.

Based on the results of the 2009 and 2010 annual assessments of the recoverability of goodwill, the fair values

of all reporting units exceeded their book values, indicating that there was no impairment of goodwill.

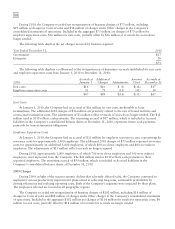

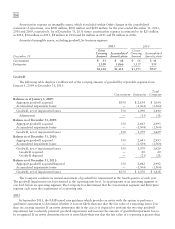

15. Valuation and Qualifying Accounts

The following table presents the valuation and qualifying account activity for the years ended December 31,

2011, 2010 and 2009:

Balance at

January 1

Charged to

Earnings Used Adjustments

Balance at

December 31

2011

Allowance for Doubtful Accounts $ 49 $ 7 $ (4) $ (7) $ 45

Allowance for Losses on Long-term Receivables 1 10 (1) — 10

Inventory Reserves 157 37 (30) 7 171

Customer Reserves 117 580 (565) (7) 125

2010

Allowance for Doubtful Accounts 16 41 (2) (6) 49

Allowance for Losses on Long-term Receivables 7 — (6) — 1

Inventory Reserves 140 67 (34) (16) 157

Customer Reserves 97 427 (374) (33) 117

2009

Allowance for Doubtful Accounts 17 9 (3) (7) 16

Allowance for Losses on Long-term Receivables 3 5 (1) — 7

Inventory Reserves 150 51 (43) (18) 140

Customer Reserves 119 313 (323) (12) 97

Adjustments include translation adjustments.