Motorola 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

from the extinguishment of a portion of our outstanding long-term debt, partially offset by: (i) a $12 million foreign

currency gain, and (ii) an $11 million gain from Sigma Fund investments. The net income in 2009 was primarily

comprised of: (i) $80 million of gains from Sigma Fund investments, (ii) $67 million gain related to the

extinguishment of our outstanding long-term debt, and (iii) $14 million foreign currency gain, partially offset by

$75 million other-than-temporary investment impairment charges.

Effective Tax Rate

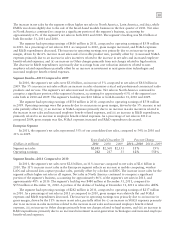

We recorded $403 million of net tax expense in 2010, resulting in an effective tax rate of 61%, compared to

$188 million of net tax expense, resulting in an effective tax rate of 30% in 2009. Our effective tax rate in 2010

was higher than the U.S. statutory rate of 35% primarily due to an increase in the U.S. federal income tax accrual

for repatriation of undistributed foreign earnings and a non-cash tax charge related to the Medicare Part D subsidy

tax law change, partially offset by reductions in unrecognized tax benefits for facts that now indicate the extent to

which certain tax positions are more-likely-than-not of being sustained.

Our effective tax rate will change from period to period based on non-recurring events, such as the settlement

of income tax audits, changes in valuation allowances and the tax impact of significant unusual or extraordinary

items, as well as recurring factors including changes in the geographic mix of income before taxes and effects of

various global income tax strategies.

Earnings from Continuing Operations

After taxes, and excluding Earnings attributable to noncontrolling interests, we had earnings from continuing

operations of $244 million, or $0.72 per diluted share, in 2010, compared to net earnings from continuing

operations of $422 million, or $1.28 per diluted share, in 2009.

The decrease in the earnings from continuing operations after income taxes in 2010 compared to 2009 was

primarily attributed to: (i) $215 million increase in tax expense, (ii) $212 million increase in SG&A expenses, and

(iii) $153 million increase in Total other income (expense), partially offset by (i) $335 million increase in gross

margin, and (ii) $105 million decrease in Other charges.

Earnings (loss) from Discontinued Operations

After taxes, we had earnings from discontinued operations of $389 million, or $1.15 per diluted share, in 2010,

compared to a loss from discontinued operations of $473 million, or $1.43 per diluted share, in 2009. The

improvement in earnings from discontinued operations in 2010 compared to 2009 was primarily attributable to a

significant decrease in the loss from the operations of Motorola Mobility, and an increase in earnings from the

Networks business.

Segment Information

The following commentary should be read in conjunction with the financial results of each operating business

segment as detailed in Note 12, “Information by Segment and Geographic Region,” to our consolidated financial

statements. Net sales and operating results for our two operating business segments for 2011, 2010, and 2009 are

presented below.

Government Segment

In 2011, the segment’s net sales represented 65% of our consolidated net sales, compared to 66% in 2010 and

69% in 2009.

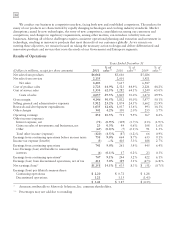

Years Ended December 31 Percent Change

(Dollars in millions) 2011 2010 2009 2011—2010 2010—2009

Segment net sales $5,358 $5,049 $4,796 6% 5%

Operating earnings 616 534 534 15% —

Segment Results—2011 Compared to 2010

In 2011, the segment’s net sales were $5.4 billion, a 6% increase compared to net sales of $5.0 billion in 2010.

The 6% increase in net sales in the Government segment reflects an increase in sales of mission-critical and

professional commercial radio products and services.