Motorola 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

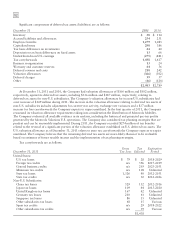

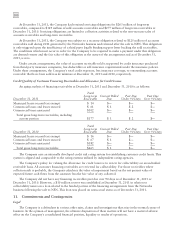

The weighted-average asset allocation for plan assets by asset categories:

Actual Mix

December 31 2011 2010

Equity securities 59% 65%

Fixed income securities 36% 33%

Cash and other investments 5% 2%

Within the equity securities asset class, the investment policy provides for investments in a broad range of

publicly-traded securities including both domestic and international stocks. Within the fixed income securities asset

class, the investment policy provides for investments in a broad range of publicly-traded debt securities ranging from

U.S. Treasury issues, corporate debt securities, mortgages and asset-backed issues, as well as international debt

securities. In the cash asset class, investments may be in cash and cash equivalents.

The Company expects to make no cash contributions to the Postretirement Health Care Benefits Plan in 2012.

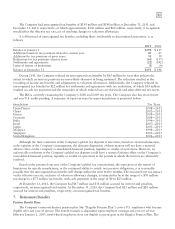

The following benefit payments, which reflect expected future service, as appropriate, are expected to be paid:

Year

2012 $34

2013 33

2014 33

2015 33

2016 32

2017-2021 168

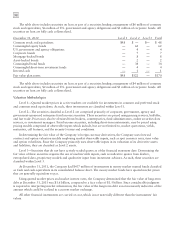

The health care cost trend rate used to determine the December 31, 2011 accumulated postretirement benefit

obligation is 7.25% for 2012, remaining flat at 7.25% through 2015, then grading down to a rate of 5% in 2019.

The health care cost trend rate used to determine the December 31, 2010 accumulated postretirement benefit

obligation was 7.25% for 2011, remaining flat at 7.25% through 2013, then grading down to a rate of 5% in 2016.

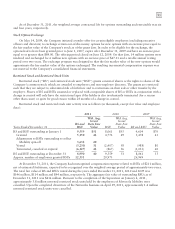

Changing the health care trend rate by one percentage point would change the accumulated postretirement

benefit obligation and the net retiree health care expense as follows:

1% Point

Increase

1% Point

Decrease

Increase (decrease) in:

Accumulated postretirement benefit obligation $17 $(15)

Net retiree health care expense 1 (1)

The Company maintains a lifetime cap on postretirement health care costs, which reduces the liability duration

of the plan. A result of this lower duration is a decreased sensitivity to a change in the discount rate trend

assumption with respect to the liability and related expense.

The Company has no significant Postretirement Health Care Benefit Plans outside the United States.

Other Benefit Plans

The Company maintains a number of endorsement split-dollar life insurance policies that were taken out on

now-retired officers under a plan that was frozen prior to December 31, 2004. The Company had purchased the life

insurance policies to insure the lives of employees and then entered into a separate agreement with the employees

that split the policy benefits between the Company and the employee. Motorola Solutions owns the policies,

controls all rights of ownership, and may terminate the insurance policies. To effect the split-dollar arrangement,

Motorola Solutions endorsed a portion of the death benefits to the employee and upon the death of the employee,

the employee’s beneficiary typically receives the designated portion of the death benefits directly from the insurance

company and the Company receives the remainder of the death benefits. It is currently expected that minimal cash

payments will be required to fund these policies.