Motorola 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

The net periodic pension cost for these split-dollar life insurance arrangements was $5 million for the years

ended December 31, 2011 and 2010. The Company has recorded a liability representing the actuarial present value

of the future death benefits as of the employees’ expected retirement date of $56 million and $51 million as of

December 31, 2011 and December 31, 2010, respectively.

Defined Contribution Plan

The Company and certain subsidiaries have various defined contribution plans, in which all eligible employees

participate. In the U.S., the 401(k) plan is a contributory plan. Matching contributions are based upon the amount

of the employees’ contributions. Effective January 1, 2005, newly hired employees have a higher maximum

matching contribution at 4% on the first 5% of employee contributions, compared to 3% on the first 6% of

employee contributions for employees hired prior to January 2005. Effective January 1, 2009, the Company

temporarily suspended all matching contributions to the Motorola Solutions 401(k) plan. Matching contributions

were reinstated as of July 1, 2010 at a rate of 4% on the first 4% of employee contributions. The maximum

matching contribution for 2010 was pro-rated to account for the number of months remaining after the

reinstatement. The Company’s expenses for material defined contribution plans, for the years ended December 31,

2011, 2010 and 2009 were $48 million, $23 million and $8 million, respectively.

8. Share-Based Compensation Plans and Other Incentive Plans

Stock Options, Stock Appreciation Rights and Employee Stock Purchase Plan

The Company grants options to acquire shares of common stock to certain employees, and existing option

holders in connection with the merging of option plans following an acquisition. Each option granted and stock

appreciation right has an exercise price of no less than 100% of the fair market value of the common stock on the

date of the grant. The awards have a contractual life of five to ten years and vest over two to four years. Stock

options and stock appreciation rights assumed or replaced with comparable stock options or stock appreciation

rights in conjunction with a change in control only become exercisable if the holder is also involuntarily terminated

(for a reason other than cause) or quits for good reason within 24 months of a change in control.

The employee stock purchase plan allows eligible participants to purchase shares of the Company’s common

stock through payroll deductions of up to 10% of eligible compensation on an after-tax basis. Plan participants

cannot purchase more than $25,000 of stock in any calendar year. The price an employee pays per share is 85% of

the lower of the fair market value of the Company’s stock on the close of the first trading day or last trading day of

the purchase period. The plan has two purchase periods, the first one from October 1 through March 31 and the

second one from April 1 through September 30. For the years ended December 31, 2011, 2010 and 2009, employees

purchased 2.2 million, 2.7 million and 4.2 million shares, respectively, at purchase prices of $30.56 and $35.61,

$41.79 and $42.00, $25.20 and $25.76, respectively.

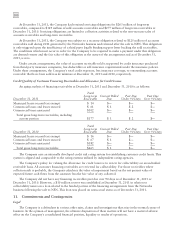

The Company calculates the value of each employee stock option, estimated on the date of grant, using the

Black-Scholes option pricing model. The weighted-average estimated fair value of employee stock options granted

during 2011, 2010 and 2009 was $13.25, $21.43 and $19.43, respectively, using the following weighted-average

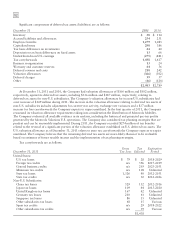

assumptions:

2011 2010 2009

Expected volatility 28.8% 41.7% 57.1%

Risk-free interest rate 2.1% 2.1% 1.9%

Dividend yield 0.0% 0.0% 0.0%

Expected life (years) 6.0 6.1 3.9

During 2011, the majority of the employee stock options were granted prior to the Company re-instituting a

dividend on the Company’s outstanding common stock.

The Company uses the implied volatility for traded options on the Company’s stock as the expected volatility

assumption required in the Black-Scholes model. The selection of the implied volatility approach was based upon

the availability of actively traded options on the Company’s stock and the Company’s assessment that implied

volatility is more representative of future stock price trends than historical volatility.