Motorola 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

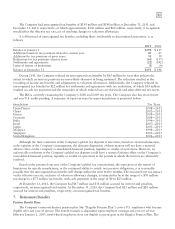

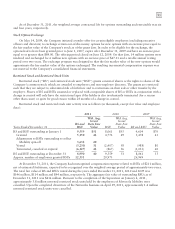

The Company had unrecognized tax benefits of $191 million and $198 million at December 31, 2011 and

December 31, 2010, respectively, of which approximately $150 million and $20 million, respectively, if recognized,

would affect the effective tax rate, net of resulting changes to valuation allowances.

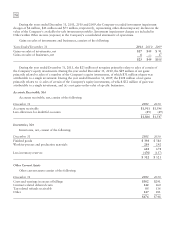

A roll-forward of unrecognized tax benefits, including those attributable to discontinued operations, is as

follows:

2011 2010

Balance at January 1 $198 $ 417

Additions based on tax positions related to current year 45 25

Additions for tax positions of prior years 38 59

Reductions for tax positions of prior years (63) (157)

Settlements and agreements (22) (142)

Lapse of statute of limitations (5) (4)

Balance at December 31 $191 $ 198

During 2011, the Company reduced its unrecognized tax benefits by $63 million for facts that indicate the

extent to which certain tax positions are more-likely-than-not of being sustained. The reduction resulted in the

recording of income tax benefits and adjustments to valuation allowances. Additionally, the Company reduced its

unrecognized tax benefits by $22 million for settlements and agreements with tax authorities, of which $14 million

resulted in cash tax payments and the remainder of which reduced tax carryforwards and other deferred tax assets.

The IRS is currently examining the Company’s 2008 and 2009 tax years. The Company also has several state

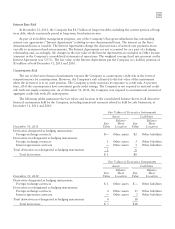

and non-U.S. audits pending. A summary of open tax years by major jurisdiction is presented below:

Jurisdiction Tax Years

United States 2008—2011

China 2002—2011

France 2004—2011

Germany 2008—2011

India 1996—2011

Israel 2007—2011

Japan 2005—2011

Malaysia 1998—2011

Singapore 2005—2011

United Kingdom 2004—2011

Although the final resolution of the Company’s global tax disputes is uncertain, based on current information,

in the opinion of the Company’s management, the ultimate disposition of these matters will not have a material

adverse effect on the Company’s consolidated financial position, liquidity or results of operations. However, an

unfavorable resolution of the Company’s global tax disputes could have a material adverse effect on the Company’s

consolidated financial position, liquidity or results of operations in the periods in which the matters are ultimately

resolved.

Based on the potential outcome of the Company’s global tax examinations, the expiration of the statute of

limitations for specific jurisdictions, or the continued ability to satisfy tax incentive obligations, it is reasonably

possible that the unrecognized tax benefits will change within the next twelve months. The associated net tax impact

on the effective tax rate, exclusive of valuation allowance changes, is estimated to be in the range of a $50 million

tax charge to a $75 million tax benefit, with cash payments in the range of $0 to $25 million.

At December 31, 2011, the Company had $17 million and $32 million accrued for interest and penalties,

respectively, on unrecognized tax benefits. At December 31, 2010, the Company had $25 million and $20 million

accrued for interest and penalties, respectively, on unrecognized tax benefits.

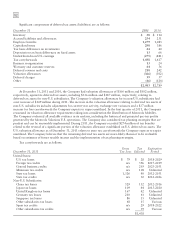

7. Retirement Benefits

Pension Benefit Plans

The Company’s noncontributory pension plan (the “Regular Pension Plan”) covers U.S. employees who became

eligible after one year of service. The benefit formula is dependent upon employee earnings and years of service.

Effective January 1, 2005, newly-hired employees were not eligible to participate in the Regular Pension Plan. The