Motorola 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

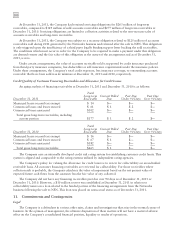

Level 2—Quoted prices for similar instruments in active markets, quoted prices for identical or similar

instruments in markets that are not active and model-derived valuations, in which all significant inputs are

observable in active markets.

Level 3—Valuations derived from valuation techniques, in which one or more significant inputs are

unobservable.

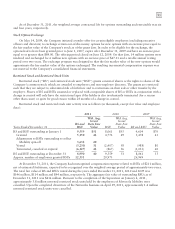

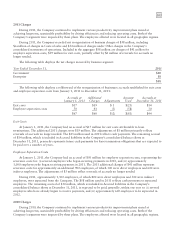

The fair values of the Company’s financial assets and liabilities by level in the fair value hierarchy as of

December 31, 2011 and 2010 were as follows:

December 31, 2011 Level 1 Level 2 Level 3 Total

Assets:

Sigma Fund securities:

U.S. government, agency and government-sponsored enterprise

obligations $— $2,944 $— $2,944

Foreign exchange derivative contracts — 1 — 1

Available-for-sale securities:

U.S. government, agency and government-sponsored enterprise obligations — 16 — 16

Corporate bonds — 10 — 10

Mortgage-backed securities — 2 — 2

Common stock and equivalents 3 8 — 11

Liabilities:

Foreign exchange derivative contracts — 5 — 5

Interest agreement derivative contracts — 3 — 3

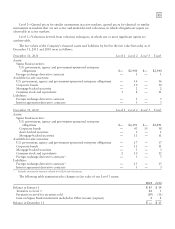

December 31, 2010 Level 1 Level 2 Level 3 Total

Assets:

Sigma Fund securities:

U.S. government, agency and government-sponsored enterprise

obligations $— $2,291 $— $2,291

Corporate bonds — 43 15 58

Asset-backed securities — 1 — 1

Mortgage-backed securities — 11 — 11

Available-for-sale securities:

U.S. government, agency and government-sponsored enterprise obligations — 17 — 17

Corporate bonds — 11 — 11

Mortgage-backed securities — 3 — 3

Common stock and equivalents 2 10 — 12

Foreign exchange derivative contracts* — 5 — 5

Liabilities:

Foreign exchange derivative contracts* — 15 — 15

Interest agreement derivative contracts — 3 — 3

*Includes immaterial amounts related to held for sale businesses.

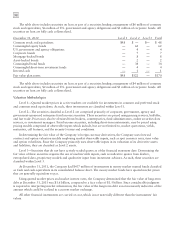

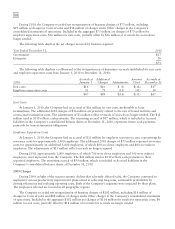

The following table summarizes the changes in fair value of our Level 3 assets:

2011 2010

Balance at January 1 $15 $19

Transfers to Level 3 21 3

Payments received for securities sold (39) (11)

Gain on Sigma Fund investments included in Other income (expense) 34

Balance at December 31 $— $15