Motorola 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

2011 Charges

During 2011, the Company continued to implement various productivity improvement plans aimed at

achieving long-term, sustainable profitability by driving efficiencies and reducing operating costs. Both of the

Company’s segments were impacted by these plans. The employees affected were located in all geographic regions.

During 2011, the Company recorded net reorganization of business charges of $58 million, including

$6 million of charges in Costs of sales and $52 million of charges under Other charges in the Company’s

consolidated statements of operations. Included in the aggregate $58 million are charges of $41 million for

employee separation costs, $19 million for exit costs, partially offset by $2 million of reversals for accruals no

longer needed.

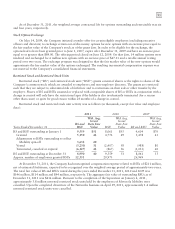

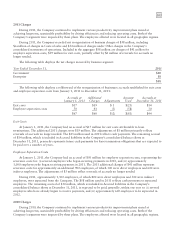

The following table displays the net charges incurred by business segment:

Year Ended December 31, 2011

Government $40

Enterprise 18

$58

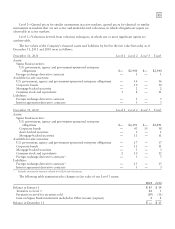

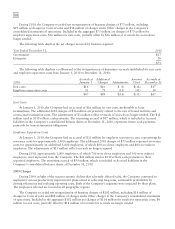

The following table displays a rollforward of the reorganization of businesses accruals established for exit costs

and employee separation costs from January 1, 2011 to December 31, 2011:

Accruals at

January 1, 2011

Additional

Charges Adjustments

Amount

Used

Accruals at

December 31, 2011

Exit costs $17 $19 $ 1 $(23) $14

Employee separation costs 50 41 (3) (58) 30

$67 $60 $(2) $(81) $44

Exit Costs

At January 1, 2011, the Company had an accrual of $17 million for exit costs attributable to lease

terminations. The additional 2011 charges were $19 million. The adjustments of $1 million primarily reflects

reversals of accruals no longer needed. The $23 million used in 2011 reflects cash payments. The remaining accrual

of $14 million, which is included in Accrued liabilities in the Company’s consolidated balance sheets at

December 31, 2011, primarily represents future cash payments for lease termination obligations that are expected to

be paid over a number of years.

Employee Separation Costs

At January 1, 2011, the Company had an accrual of $50 million for employee separation costs, representing the

severance costs for: (i) severed employees who began receiving payments in 2010, and (ii) approximately

1,000 employees who began receiving payments in 2011. The 2011 additional charges of $41 million represent

severance costs for approximately an additional 900 employees, of which 300 were direct employees and 600 were

indirect employees. The adjustments of $3 million reflect reversals of accruals no longer needed.

During 2011, approximately 1,300 employees, of which 800 were direct employees and 500 were indirect

employees, were separated from the Company. The $58 million used in 2011 reflects cash payments to separated

employees. The remaining accrual of $30 million, which is included in Accrued liabilities in the Company’s

consolidated balance sheets at December 31, 2011, is expected to be paid, generally, within one year to: (i) severed

employees who have already begun to receive payments, and (ii) approximately 600 employees to be separated in

2012.

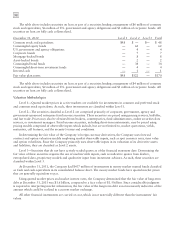

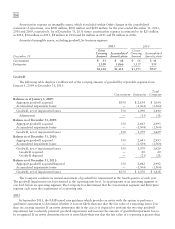

2010 Charges

During 2010, the Company continued to implement various productivity improvement plans aimed at

achieving long-term, sustainable profitability by driving efficiencies and reducing operating costs. Both of the

Company’s segments were impacted by these plans. The employees affected were located in all geographic regions.