Motorola 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

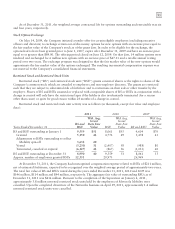

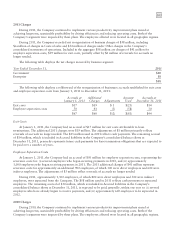

Total Share-Based Compensation Expense

Compensation expense for the Company’s employee stock options, stock appreciation rights, employee stock

purchase plans, RS and RSUs was as follows:

Year Ended December 31 2011 2010 2009

Share-based compensation expense included in:

Costs of sales $20$19$16

Selling, general and administrative expenses 112 82 80

Research and development expenditures 36 43 41

Share-based compensation expense included in Operating earnings 168 144 137

Tax benefit 51 43 43

Share-based compensation expense, net of tax $ 117 $ 101 $ 94

Decrease in basic earnings per share $(0.34) $(0.30) $(0.29)

Decrease in diluted earnings per share $(0.34) $(0.30) $(0.29)

Share-based compensation expense in discontinued operations $13$ 164 $ 159

All RSUs and stock options remaining with Motorola Solutions after the Distribution were adjusted to reflect

the Distribution and the Reverse Stock Split. The number of shares covered by, and the exercise price of, all vested

and unvested stock options was adjusted to reflect the change in the Company’s stock price immediately following

the Distribution and Reverse Stock Split by:

• Multiplying the number of shares subject to each stock option grant by .238089 (“the Motorola Adjustment

Factor”) and rounding down to the next whole share; and

• Dividing the exercise price per share for each such stock option grant by the Motorola Adjustment Factor

and rounding up to the penny.

The number of RSUs immediately following the Distribution and Reverse Stock Split was calculated by

multiplying the number of shares subject to each such grant by the Motorola Adjustment Factor and rounding down

to the next whole share.

Motorola Solutions Annual Incentive Plan

The Company’s annual incentive plan provides eligible employees with an annual payment, calculated as a

percentage of an employee’s eligible earnings, in the year after the close of the current calendar year if specified

business goals and individual performance targets are met. The expense for awards under these incentive plans for

the years ended December 31, 2011, 2010 and 2009 were $203 million, $201 million and $109 million,

respectively.

Long-Range Incentive Plan

The Long-Range Incentive Plan (“LRIP”) rewards participating elected officers for the Company’s achievement

of specified business goals during the period, based on two performance objectives measured over three-year cycles.

The expense for LRIP (net of the reversals of previously recognized reserves) for the years ended December 31,

2011, 2010 and 2009 was $3 million, $11 million and $5 million, respectively.

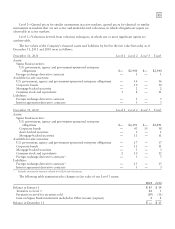

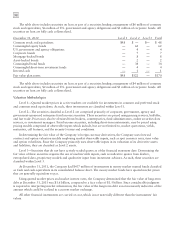

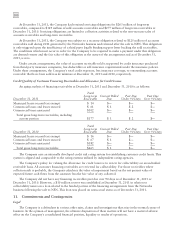

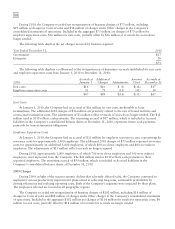

9. Fair Value Measurements

The Company holds certain fixed income securities, equity securities and derivatives, which are recognized and

disclosed at fair value in the financial statements on a recurring basis. Fair value is defined as the price that would

be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants as of

the measurement date. Fair value is measured using the fair value hierarchy and related valuation methodologies as

defined in the authoritative literature. This guidance specifies a hierarchy of valuation techniques based on whether

the inputs to each measurement are observable or unobservable. Observable inputs reflect market data obtained

from independent sources, while unobservable inputs reflect the Company’s assumptions about current market

conditions. The prescribed fair value hierarchy and related valuation methodologies are as follows:

Level 1—Quoted prices for identical instruments in active markets.