Motorola 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

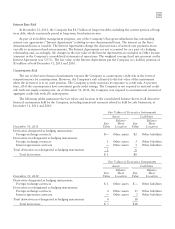

The status of the Company’s plans is as follows:

2011 2010

Regular

Officers’

and

MSPP Non

U.S. Regular

Officers’

and

MSPP

Non

U.S.

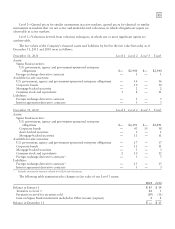

Change in benefit obligation:

Benefit obligation at January 1 $ 6,129 $ 44 $1,423 $ 5,821 $ 52 $1,438

Service cost —— 17 —— 24

Interest cost 341 3 72 341 3 84

Plan amendments —— 20 — — (115)

Settlement/curtailment — — (19) —— 2

Actuarial (gain) loss 702 12 123 173 4 54

Foreign exchange valuation adjustment —— (10) —— (19)

Employee contributions —— — —— 5

Tax payments — (5) — — (3) —

Benefit payments (224) (16) (38) (206) (12) (50)

Benefit obligation at December 31 6,948 38 1,588 6,129 44 1,423

Change in plan assets:

Fair value at January 1 4,308 12 1,214 3,898 17 1,102

Return on plan assets 178 — 23 466 1 125

Company contributions 480 9 38 150 7 41

Settlements/curtailments — — (19) —— —

Employee contributions —— — —— 5

Foreign exchange valuation adjustment —— 1 —— (9)

Tax payments from plan assets —— — — (1) —

Benefit payments from plan assets (224) (16) (38) (206) (12) (50)

Fair value at December 31 4,742 5 1,219 4,308 12 1,214

Funded status of the plan (2,206) (32) (369) (1,821) (32) (209)

Unrecognized net loss 3,527 9 462 2,799 11 311

Unrecognized prior service cost — — (55) — — (99)

Prepaid (accrued) pension cost $ 1,321 $(23) $ 38 $ 978 $(21) $ 3

Components of prepaid (accrued) pension cost:

Non-current benefit liability $(2,206) $(32) $ (369) $(1,821) $(32) $ (209)

Deferred income taxes 1,292 3 26 1,033 4 14

Accumulated other comprehensive loss 2,235 6 381 1,766 7 198

Prepaid (accrued) pension cost $ 1,321 $(23) $ 38 $ 978 $(21) $ 3

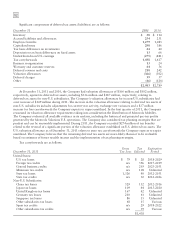

It is estimated that the net periodic cost for 2012 will include amortization of the unrecognized net loss and

prior service costs for the Regular Plan, Officers’ and MSPP Plans, and Non-U.S. Plans, currently included in

Accumulated other comprehensive loss, of $271 million, $2 million, and $19 million, respectively.

The Company uses a five-year, market-related asset value method of recognizing asset-related gains and losses.

Unrecognized gains and losses are being amortized over periods ranging from 5 to 9 years. Prior service costs are

being amortized over periods ranging from 10 to 12 years. Benefits under all pension plans are valued based upon

the projected unit credit cost method.

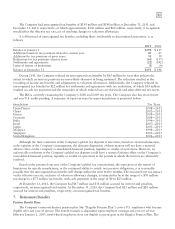

In April 2011, the Company recognized a curtailment gain in its United Kingdom defined benefit plan, and a

settlement loss in its Japanese defined benefit plan, due to the sale of the Networks business. As a result, the

Company recorded a net gain to its statement of operations of $9 million.

Certain actuarial assumptions such as the discount rate and the long-term rate of return on plan assets have a

significant effect on the amounts reported for net periodic cost and benefit obligation. The assumed discount rates

reflect the prevailing market rates of a universe of high-quality, non-callable, corporate bonds currently available

that, if the obligation were settled at the measurement date, would provide the necessary future cash flows to pay