Motorola 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

We may from time to time seek to retire certain of our outstanding debt through open market cash purchases,

privately-negotiated transactions or otherwise. Such repurchases, if any, will depend on prevailing market

conditions, our liquidity requirements, contractual restrictions and other factors.

Payment of Dividends: During the year ended December 31, 2011, we announced that our Board of Directors

approved the initiation of a regular cash dividend on our outstanding common stock. We paid $72 million in cash

dividends to holders of our common stock in 2011. During the year ended December 31, 2010, we did not pay cash

dividends to holders of our common stock. During the year ended December 31, 2009, we paid $114 million in cash

dividends to holders of our common stock, all of which was paid during the first quarter of 2009, related to the

payment of a dividend declared in November 2008. In February 2009, we announced that our Board of Directors

suspended the declaration of quarterly cash dividends on our common stock.

During the year ended December 31, 2010, we paid $23 million of dividends to a minority shareholder in

connection with a subsidiary’s common stock.

Share Repurchase Program: During the year ended December 31, 2011, we announced that our Board of

Directors approved a share repurchase program that allows us to purchase up to $2.0 billion of outstanding

common stock through December 31, 2012, of which we repurchased $1.1 billion of our outstanding common

stock during 2011. On January 30, 2012, we announced that our Board of Directors authorized up to $1.0 billion

in additional funds for use under the existing share repurchase program through the end of 2012.

Credit Facilities

As of December 31, 2011, we had a $1.5 billion unsecured syndicated revolving credit facility (the “2011

Motorola Solutions Credit Agreement”) that is scheduled to expire on June 30, 2014. The 2011 Motorola Solutions

Credit Agreement includes a provision pursuant to which we can increase the aggregate credit facility size up to a

maximum of $2.0 billion by adding lenders or having existing lenders increase their commitments. We must comply

with certain customary covenants, including maintaining maximum leverage and minimum interest coverage ratios

as defined in the 2011 Motorola Solutions Credit Agreement. We were in compliance with our financial covenants

as of December 31, 2011. We did not borrow under the 2011 Motorola Solutions Credit Agreement during 2011.

Contractual Obligations and Other Purchase Commitments

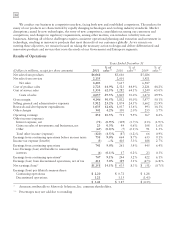

Summarized in the table below are our obligations and commitments to make future payments under long-term

debt obligations (assuming earliest possible exercise of put rights by holders), lease obligations, purchase

obligations, tax obligations and other obligations as of December 31, 2011.

Payments Due by Period

(in millions) Total 2012 2013 2014 2015 2016

Uncertain

Timeframe Thereafter

Long-Term Debt Obligations $1,519 $405 $ 5 $ 4 $ 4 $ 5 $ — $1,096

Lease Obligations 304 81 55 41 25 21 — 81

Purchase Obligations 78 49 27 2 — — — —

Tax Obligations 191 25 ———— 166 —

Other Obligations 75 — ———— 75 —

Total Contractual Obligations $2,167 $560 $87 $47 $29 $26 $241 $1,177

Amounts included represent firm, non-cancelable commitments.

Long-Term Debt Obligations: Our long-term debt obligation, including the current portion of long-term

debt, totaled $1.5 billion at December 31, 2011, compared to $2.7 billion at December 31, 2010.

Lease Obligations: We own most of our major facilities, but do lease certain office, factory and warehouse

space, land, information technology and other equipment, principally under non-cancelable operating leases. Our

future minimum lease obligations, net of minimum sublease rentals, totaled $304 million. Rental expense, net of

sublease income, was $92 million in 2011, $123 million in 2010, and $140 million in 2009.