Motorola 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

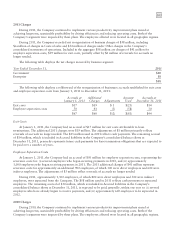

Amortization expense on intangible assets, which is included within Other charges in the consolidated

statement of operations, was $200 million, $203 million and $218 million for the years ended December 31, 2011,

2010 and 2009, respectively. As of December 31, 2011 future amortization expense is estimated to be $25 million

in 2012, $10 million in 2013, $8 million in 2014 and $3 million in 2015 and $2 million in 2016.

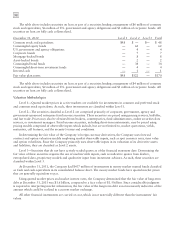

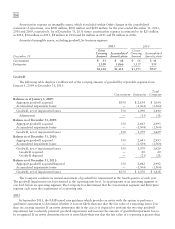

Amortized intangible assets, excluding goodwill, by business segment:

2011 2010

December 31

Gross

Carrying

Amount Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Government $53 $48 $56 $48

Enterprise 1,109 1,066 1,137 899

$1,162 $1,114 $1,193 $947

Goodwill

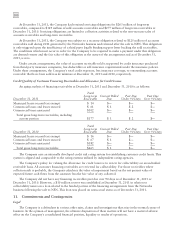

The following table displays a rollforward of the carrying amount of goodwill by reportable segment from

January 1, 2009 to December 31, 2011:

Government Enterprise

Total

Company

Balances as of January 1, 2009:

Aggregate goodwill acquired $350 $ 2,654 $ 3,004

Accumulated impairment losses — (1,564) (1,564)

Goodwill, net of impairment losses 350 1,090 1,440

Adjustments — (11) (11)

Balance as of December 31, 2009:

Aggregate goodwill acquired 350 2,643 2,993

Accumulated impairment losses — (1,564) (1,564)

Goodwill, net of impairment losses 350 1,079 1,429

Balance as of December 31, 2010:

Aggregate goodwill acquired 350 2,643 2,993

Accumulated impairment losses — (1,564) (1,564)

Goodwill, net of impairment losses 350 1,079 1,429

Goodwill acquired — 20 20

Goodwill disposed — (21) (21)

Balance as of December 31, 2011:

Aggregate goodwill acquired/disposed 350 2,642 2,992

Accumulated impairment losses — (1,564) (1,564)

Goodwill, net of impairment losses $350 $ 1,078 $ 1,428

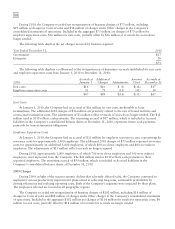

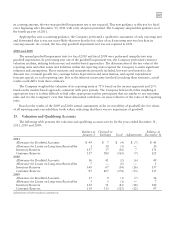

The Company conducts its annual assessment of goodwill for impairment in the fourth quarter of each year.

The goodwill impairment test is performed at the reporting unit level. A reporting unit is an operating segment or

one level below an operating segment. The Company has determined that the Government segment and Enterprise

segment each meet the requirement of a reporting unit.

2011

In September 2011, the FASB issued new guidance which provides an entity with the option to perform a

qualitative assessment to determine whether it is more-likely-than-not that the fair value of a reporting unit is less

than its carrying amount. If an entity determines this is the case, it is required to perform the two-step goodwill

impairment test to identify potential goodwill impairment and measure the amount of goodwill impairment loss to

be recognized. If an entity determines that it is more-likely-than-not that the fair value of a reporting is greater than