Motorola 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

Other

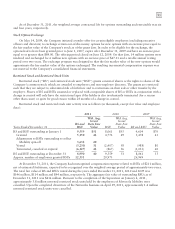

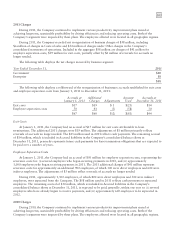

Leases: The Company owns most of its major facilities and leases certain office, factory and warehouse space,

land, and information technology and other equipment under principally non-cancelable operating leases. Rental

expense, net of sublease income, for the years ended December 31, 2011, 2010 and 2009 was $92 million,

$123 million, and $140 million, respectively. At December 31, 2011, future minimum lease obligations, net of

minimum sublease rentals, for the next five years and beyond are as follows: 2012—$81 million; 2013—$55

million; 2014—$41 million; 2015—$25 million; 2016—$21 million and beyond—$81 million.

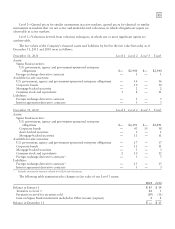

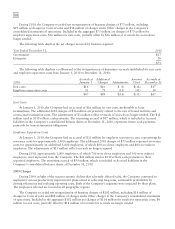

Indemnifications: The Company is a party to a variety of agreements pursuant to which it is obligated to

indemnify the other party with respect to certain matters. Some of these obligations arise as a result of divestitures

of the Company’s assets or businesses and require the Company to hold the other party harmless against losses

arising from the settlement of these pending obligations. The total amount of indemnification under these types of

provisions is $251 million, of which the Company accrued $3 million as of December 31, 2011 for potential claims

under these provisions.

In addition, the Company may provide indemnifications for losses that result from the breach of general

warranties contained in certain commercial and intellectual property agreements. Historically, the Company has not

made significant payments under these agreements. However, there is an increasing risk in relation to patent

indemnities given the current legal climate.

In indemnification cases, payment by the Company is conditioned on the other party making a claim pursuant

to the procedures specified in the particular contract, which procedures typically allow the Company to challenge

the other party’s claims. Further, the Company’s obligations under these agreements for indemnification based on

breach of representations and warranties are generally limited in terms of duration, and for amounts not in excess of

the contract value, and, in some instances, the Company may have recourse against third parties for certain

payments made by the Company.

In addition, pursuant to the Master Separation and Distribution Agreement and certain other agreements with

Motorola Mobility, Motorola Mobility agreed to indemnify the Company for certain liabilities, and the Company

agreed to indemnify Motorola Mobility for certain liabilities, in each case for uncapped amounts.

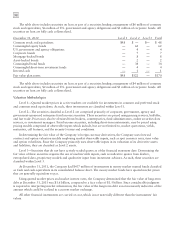

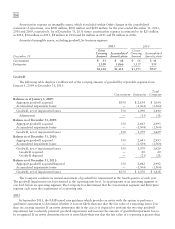

Intellectual Property Matters: During 2010, the Company entered into a settlement agreement with another

company to resolve certain intellectual property disputes between the two companies. As a result of the settlement

agreement, the Company received $65 million in cash and was assigned certain patent properties. As a result of this

agreement, the Company recorded a pre-tax gain of $39 million (and $55 million was allocated to discontinued

operations) during the year ended December 31, 2010, related to the settlement of the outstanding litigation

between the parties.

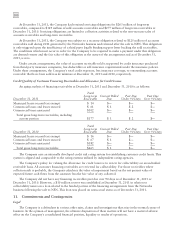

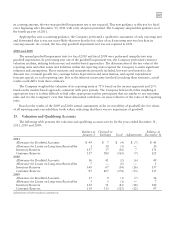

12. Information by Segment and Geographic Region

We report financial results for two operating segments, based on products and services provided:

Government: The Government segment includes sales of public safety mission-critical communication

systems, commercial two-way radio systems and devices, software and services.

Enterprise: The Enterprise segment includes sales of rugged and enterprise-grade mobile computers and

tablets, laser/imaging/RFID-based data capture products, WLAN and iDEN infrastructure, software, and

services.

For the years ended December 31, 2011, 2010 and 2009, no single customer accounted for more than 10% of

net sales.