Motorola 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

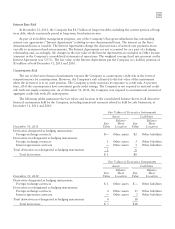

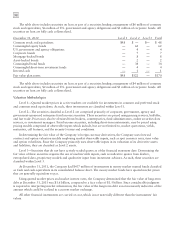

The funded status of the plan is as follows:

2011 2010

Change in benefit obligation:

Benefit obligation at January 1 $ 447 $ 461

Service cost 46

Interest cost 22 23

Actuarial gain —(17)

Benefit payments (23) (26)

Benefit obligation at December 31 450 447

Change in plan assets:

Fair value at January 1 170 174

Return on plan assets 720

Company contributions ——

Benefit payments made with plan assets (22) (24)

Fair value at December 31 155 170

Funded status of the plan (295) (277)

Unrecognized net loss 202 204

Unrecognized prior service cost —(1)

Accrued postretirement health care costs $ (93) $ (74)

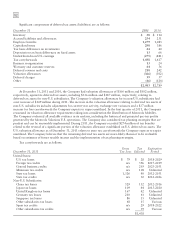

Components of accrued postretirement health care cost:

Years Ended December 31 2011 2010

Non-current liability $(295) $(277)

Tax impact of Medicare Part D subsidy law change —18

Deferred income taxes 92 72

Accumulated other comprehensive income 110 113

Accrued postretirement health care cost $ (93) $ (74)

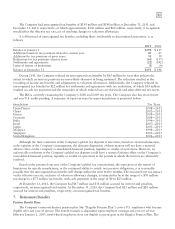

During the first quarter of 2010, the Patient Protection and Affordable Care Act and the Health Care and

Education Reconciliation Act of 2010 were signed into law, which eliminated the favorable income tax treatment of

Medicare Part D Subsidy receipts effective for tax years starting in 2013. As a result of the tax law change, the

Company recorded an $18 million non-cash tax charge to reduce its deferred tax asset associated with Medicare

Part D subsidies currently estimated to be received after 2012.

It is estimated that the net periodic cost for the Postretirement Health Care Benefits Plan in 2012 will include

amortization of the unrecognized net loss and prior service costs, currently included in Accumulated other

comprehensive loss, of $12 million.

The Company has adopted an investment policy for plan assets designed to meet or exceed the expected rate of

return on plan assets assumption. To achieve this, the plan retains professional investment managers that invest plan

assets in equity and fixed income securities and cash. The Company uses long-term historical actual return

experience with consideration of the expected investment mix of the plans’ assets, as well as future estimates of

long-term investment returns, to develop its expected rate of return assumption used in calculating the net periodic

cost and the net retirement healthcare expense. The Company has the following target mixes for these asset classes,

which are readjusted at least periodically, when an asset class weighting deviates from the target mix, with the goal

of achieving the required return at a reasonable risk level:

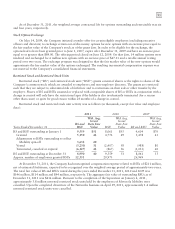

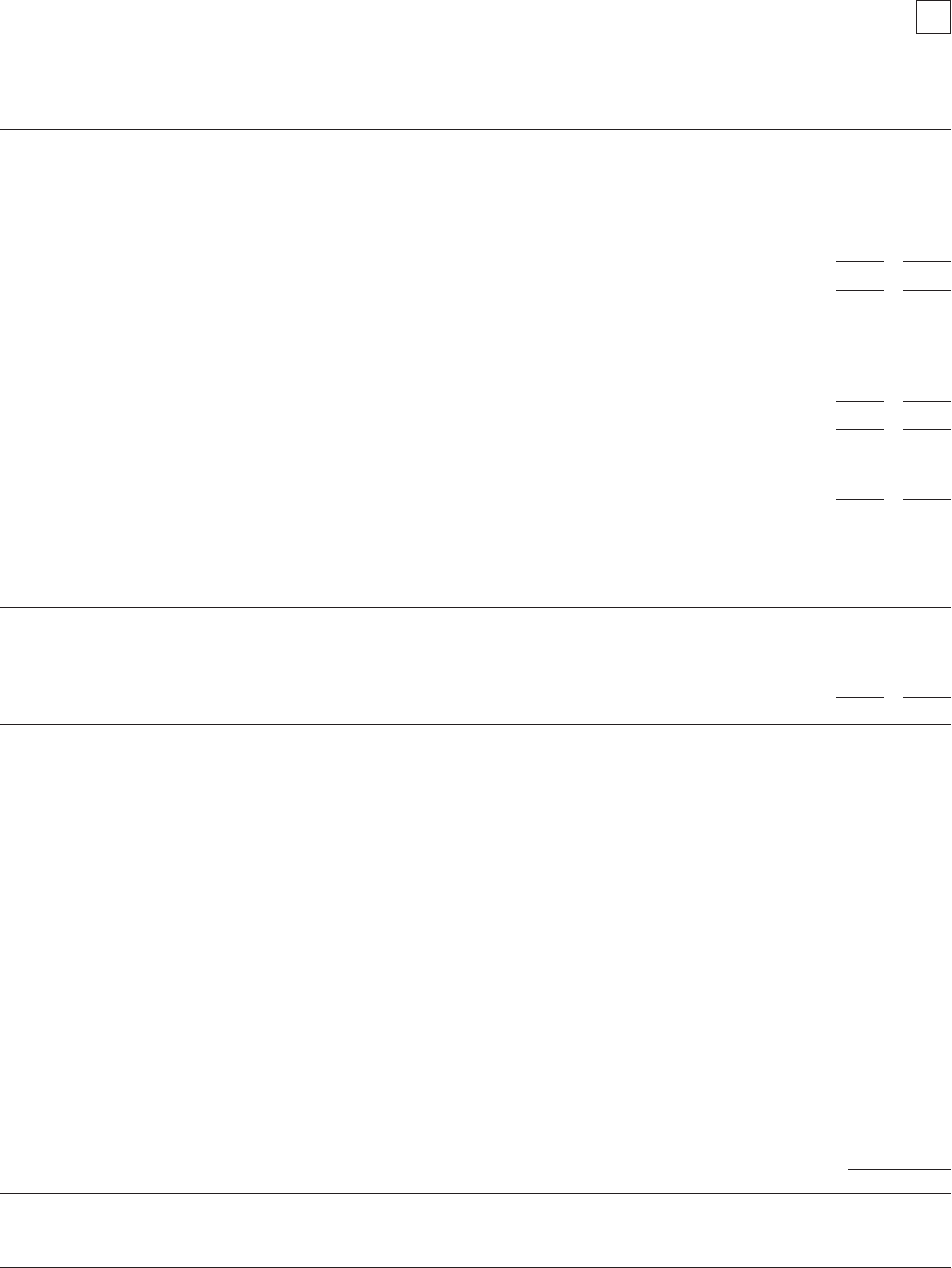

Target Mix

Asset Category 2011 2010

Equity securities 65% 65%

Fixed income securities 34% 34%

Cash and other investments 1% 1%