Motorola 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

We maintained all of the U.S. pension liabilities and the majority of the non-U.S. pension liabilities following

the distribution of Motorola Mobility on January 4, 2011, and following the sale of certain assets and liabilities of

the Networks business to NSN on April 29, 2011. Retirement benefits are further discussed in the “Significant

Accounting Policies—Retirement Benefits” section.

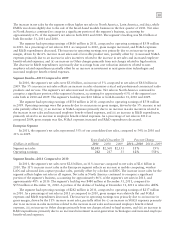

Investing Activities

Net cash provided by investing activities was $2.4 billion in 2011, compared to $523 million in 2010 and net

cash used for investing activities of $531 million in 2009. The $1.9 billion increase in net cash provided by investing

activities from 2010 to 2011 was primarily due to: (i) a $1.1 billion increase in cash received from net sales of Sigma

Fund investments, and (ii) $860 million increase in cash received from sales of investments and businesses primarily

relating to the sale of certain assets and liabilities of the Networks business.

Sigma Fund: We and our wholly-owned subsidiaries invest most of our U.S. dollar-denominated cash in a

fund (the “Sigma Fund”) that allows us to efficiently invest our cash around the world. We had net proceeds of $1.5

billion from sales of Sigma Fund investments in 2011, compared to $453 million in net proceeds from sales of Sigma

Fund investments in 2010 and $922 million of net purchases of Sigma Fund investments in 2009. The aggregate fair

value of Sigma Fund investments was $3.2 billion at December 31, 2011 (including $1.3 billion held by us outside

the U.S.), compared to $4.7 billion at December 31, 2010 (including $1.9 billion held by us outside the U.S.).

The Sigma Fund portfolio is managed by four independent investment management firms. The investment

guidelines of the Sigma Fund require that purchased investments must be in high-quality, investment grade (rated at

least A/A-1 by Standard & Poor’s or A2/P-1 by Moody’s Investors Service), U.S. dollar-denominated fixed income

obligations, including certificates of deposit, commercial paper, government bonds, corporate bonds and asset- and

mortgage-backed securities. Under the Sigma Fund’s investment policies, except for obligations of the U.S.

government, agencies and government-sponsored enterprises, no more than 5% of the Sigma Fund portfolio is to

consist of securities of any one issuer. The Sigma Fund’s investment policies further require that floating rate

investments must have a maturity at purchase date that does not exceed thirty-six months with an interest rate that

is reset at least annually. The average interest rate reset of the investments held by the funds must be 120 days or

less. The actual average effective maturity of the portfolio (excluding cash and defaulted securities) was less than

one month at both December 31, 2011, and December 31, 2010.

Investments in the Sigma Fund were primarily fixed income securities carried at fair value. At December 31,

2011, $3.2 billion of the Sigma Fund investments were classified as current in our consolidated balance sheets,

compared to $4.7 billion at December 31, 2010. The weighted average maturity of the Sigma Fund investments

classified as current was less than one month (excluding cash of $264 million) at December 31, 2011, compared to

1 month (excluding cash of $2.4 billion and defaulted securities) at December 31, 2010. A majority of the Sigma

Fund’s cash balance at December 31, 2010 was reserved for the distribution of Motorola Mobility. At

December 31, 2011, 100% of the Sigma Fund investments were invested in cash and U.S. government, agency and

government-sponsored enterprise obligations. This reflects a strategic decision to prioritize capital preservation

rather than investment income.

In 2011, we recorded a de minimus loss from the Sigma Fund investments in Other income (expense) in the

consolidated statement of operations, compared to a gain from the Sigma Fund investments of $11 million in 2010.

Securities with a maturity greater than twelve months and defaulted securities have been classified as

non-current in our consolidated balance sheets. At December 31, 2011, no Sigma Fund investments were classified

as non-current due to the sales of the non-current securities during 2011. At December 31, 2010, $70 million of the

Sigma Fund investments were classified as non-current.

We continuously assess our cash needs and continue to believe that the balance of cash and cash equivalents,

short-term investments and investments in the Sigma Fund classified as current are more than adequate to meet our

current operating requirements over the next twelve months.

Strategic Acquisitions and Investments: We used $32 million cash for acquisitions and new investment

activities in 2011, compared to $23 million in 2010 and $17 million in 2009. The cash used in 2011, 2010, and

2009 was for small strategic investments.