Mondelez 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Mondelez annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MONDELEZ INTERNATIONAL, INC.

FORM 10-K

(Annual Report)

Filed 02/25/13 for the Period Ending 12/31/12

Address THREE PARKWAY NORTH

DEERFIELD, IL 60015

Telephone 847-943-4000

CIK 0001103982

Symbol MDLZ

SIC Code 2000 - Food and kindred products

Industry Food Processing

Sector Consumer/Non-Cyclical

Fiscal Year 12/31

http://www.edgar-online.com

© Copyright 2013, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

MONDELEZ INTERNATIONAL, INC. FORM 10-K (Annual Report) Filed 02/25/13 for the Period Ending 12/31/12 Address Telephone CIK Symbol SIC Code Industry Sector Fiscal Year THREE PARKWAY NORTH DEERFIELD, IL 60015 847-943-4000 0001103982 MDLZ 2000 - Food and kindred products Food Processing Consumer/Non-... -

Page 2

... shares of the registrant's Class A Common Stock outstanding. Documents Incorporated by Reference Portions of the registrant's definitive proxy statement to be filed with the Securities and Exchange Commission in connection with its annual meeting of shareholders expected to be held on May 21, 2013... -

Page 3

... Qualitative Disclosures about Market Risk Financial Statements and Supplementary Data: Report of Management on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm Consolidated Statements of Earnings for the Years Ended December 31, 2012, 2011 and 2010... -

Page 4

... hold leading market shares in every category and every region of the world in which we compete. We hold the No. 1 position globally in biscuits, chocolate, candy and powdered beverages as well as the No. 2 position in gum and coffee. Our portfolio includes nine brands with annual revenues exceeding... -

Page 5

...2012, we announced a reorganization of our business and reporting structure following the Spin-Off. Effective January 1, 2013, our operations, management and segments will be reorganized into five operating segments: Asia Pacific; Eastern Europe, Middle East & Africa ("EEMEA"); Europe; Latin America... -

Page 6

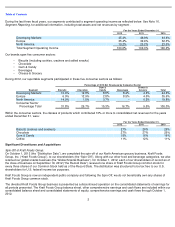

... and net revenues by segment . 2012 For the Years Ended December 31, 2011 2010 Developing Markets Europe North America Total Segment Operating Income Our brands span five consumer sectors Biscuits (including cookies, crackers and salted snacks) Chocolate Gum & Candy Beverages Cheese & Grocery 45... -

Page 7

... 31, 2012, we also have a $55 million receivable from Kraft Foods Group related to the cash settlement of stock awards held by our respective employees at the time of the Spin-Off as further described in Note 11, Stock Plans , to the consolidated financial statements. Our results from continuing... -

Page 8

... we purchase on world markets as well as from local grower cooperatives. Green coffee bean prices are affected by the quality and availability of supply, changes in the value of the U.S. dollar in relation to certain other currencies and consumer demand for coffee products. Significant cost items in... -

Page 9

... are continually adopting new laws and implementing new regulations that affect our business and operations, such as the European Commission's EU Health Claim Regulation, effective December 14, 2012, that limits the number of health claims that may be made by food companies about their products and... -

Page 10

... Executive Vice President, Integrated Supply Chain Executive Vice President and President, Asia Pacific and EEMEA Executive Vice President and General Counsel Executive Vice President, Research, Development and Quality Executive Vice President and Chief Category and Marketing Officer Ms. Rosenfeld... -

Page 11

...Inc., a financial services provider. Mr. Myers is Executive Vice President, Integrated Supply Chain, a position he has held since he joined Kraft Foods Inc., the predecessor to MondelÄ"z International, in September 2011. Prior to that, he worked for Procter & Gamble, a consumer products company, for... -

Page 12

...new product innovation to protect or increase market share. These expenditures are subject to risks, including uncertainties about trade and consumer acceptance of our efforts. If we reduce prices or our costs increase, but we cannot increase sales volumes to offset those changes, then our financial... -

Page 13

...retailers have the scale to develop supply chains that permit them to operate with reduced inventories or to develop and market their own retailer brands. Further retail consolidation and increasing retail power could materially and adversely affect our product sales, financial condition and results... -

Page 14

... could increase our costs. Our activities throughout the world are highly regulated and subject to government oversight. Various laws and regulations govern food production and marketing, as well as licensing, trade, tax and environmental matters. Governing bodies regularly adopt new laws and... -

Page 15

... competitors grow their global operations and low cost local manufacturers expand their production capacities. Our success in emerging markets, is critical to our growth strategy. If we cannot successfully increase our business in emerging markets, our product sales, financial condition and results... -

Page 16

... to complete acquisitions or to successfully integrate and develop acquired businesses we could fail to achieve anticipated synergies and cost savings, including the expected increases in revenues and operating results, any of which could materially and adversely affect our financial results. In... -

Page 17

... costs in 2012 related primarily to certain pension plan obligations transferred to Kraft Foods Group in the Spin-Off and other 2012 one-time costs, partially offset by increased pension plan expenses in 2013 related to lower discount rates. Volatility in the global capital markets has increased... -

Page 18

...employer and our costs might increase as a result. (See Note 10, Benefit Plans , to the consolidated financial statements for more information). Further, if we withdraw from a multi-employer pension plan, we may be required to pay those plans an amount based on our allocable share of the underfunded... -

Page 19

...in the fast moving consumer goods ("FMCG") sector, which includes products such as chocolate and coffee. On January 31, 2012, the German Federal Cartel Office ("FCO") issued a press release stating that it had discontinued proceedings against our wholly owned subsidiary, Kraft Foods Deutschland GmbH... -

Page 20

... account the value of Kraft Foods Group shares distributed in the Spin-Off). A vertical line below indicates the October 1, 2012 Spin-Off date and is intended to facilitate comparisons of performance against peers and the stock market before and following the Spin-Off. Date MondelÄ"z International... -

Page 21

... activity represents shares tendered by our employees who used shares to exercise options, and who used shares to pay the related taxes for grants of restricted and deferred stock that vested. Accordingly, these are non-cash transactions. Total Number of Shares Average Price Paid per Share October... -

Page 22

... continuing operations include: Spin-Off Costs in 2012, Restructuring Programs in 2012 and 2008, Cost Savings Initiatives in all years; divestitures and sales of property in 2012 and 2010, the acquisition of Cadbury in 2010 and related Integration Program in 2010-2012; accounting calendar changes... -

Page 23

...other sections of this Annual Report on Form 10-K, including the consolidated financial statements and related notes contained in Item 8. Description of the Company We manufacture and market primarily snack food and beverage products, including biscuits, chocolate, gum & candy, beverages and various... -

Page 24

... and business unit costs which were allocated to Kraft Foods Group historically and are expected to continue at MondelÄ"z International after the Spin-Off. These costs include primarily corporate overheads, information systems and sales force support. On a pre-tax basis, through the date of the Spin... -

Page 25

... 31, 2012, we also have a $55 million receivable from Kraft Foods Group related to the cash settlement of stock awards held by our respective employees at the time of the Spin-Off as further described in Note 11, Stock Plans , to the consolidated financial statements. Our results from continuing... -

Page 26

... for exposures related to taxes of approximately $70 million was established within our Developing Markets segment. The cumulative exposure was approximately $150 million at December 31, 2010. Other Divestitures and Sales of Property During the three months ended December 31, 2012, we completed... -

Page 27

... within our Europe and Developing Markets segments, as well as within general corporate expenses. At December 31, 2012, we had an accrual of $202 million related to the Integration Program. See Note 7, Integration Program and Cost Savings Initiatives , to the consolidated financial statements for... -

Page 28

...("53 rd week") than 2012 or 2010, which each had 52 weeks. In 2011, we changed the consolidation date for certain operations of our Europe segment and in the Latin America, Central and Eastern Europe ("CEE") and Middle East and Africa ("MEA") regions within our Developing Markets segment. Previously... -

Page 29

... volume/mix. Higher net pricing, including the impact of pricing actions from the prior year, was realized across all reportable segments as we increased pricing to offset higher input costs. Favorable volume/mix was driven by higher shipments in Developing Markets and Europe, mostly offset by... -

Page 30

... for the Year Ended December 31, 2012 (1) Spin-Off Costs Integration Program costs 2012-2014 Restructuring Program costs Spin-Off pension expense adjustment (2) Acquisition-related costs Gains on divestitures, net Operating income from divested businesses Operating Income for the Year Ended December... -

Page 31

...(1) Spin-Off Costs (5) Integration Program costs 2012-2014 Restructuring Program costs Spin-Off interest expense adjustment (2) Spin-Off pension expense adjustment (3) Gains on divestitures, net Net earnings from divested businesses Diluted EPS Attributable to MondelÄ"z International from Continuing... -

Page 32

... ruble. The Cadbury acquisition (due to the incremental January 2011 operating results) added $697 million in net revenues in 2011. Accounting calendar changes (including the 53 rd week of shipments in 2011 and excluding the effects of foreign currency) added $655 million in net revenues in 2011... -

Page 33

...Ended December 31, 2010 Integration Program costs Acquisition-related costs - Cadbury Spin-Off pension expense adjustment (2) Operating income from divested businesses Adjusted Operating Income for the Year Ended December 31, 2010 (1) Higher net pricing Higher input costs Favorable volume/mix Higher... -

Page 34

... to MondelÄ"z International from Continuing Operations for the Year Ended December 31, 2010 Integration Program costs Acquisition-related costs Acquisition-related interest and other expense, net Spin-Off interest expense adjustment (2) Spin-Off pension expense adjustment (3) U.S. health care... -

Page 35

... from continuing operations before income taxes: Operating income: Developing Markets Europe North America Unrealized gains / (losses) on hedging activities Certain U.S. pension plan costs General corporate expenses Amortization of intangibles Gains on divestitures, net Acquisition-related costs... -

Page 36

... within our Europe and Developing Markets segments, as well as within general corporate expenses. The 2012 increase in general corporate expenses was due primarily to $407 million of Spin-Off Costs recorded within general corporate expenses, partially offset by lower Integration Program costs. The... -

Page 37

.../mix. In Middle East and Africa, net revenues increased, driven by higher net pricing across the region, our Cadbury acquisition, favorable volume/mix and the impact of accounting calendar changes, partially offset by unfavorable foreign currency. In Latin America, net revenues increased, driven by... -

Page 38

... the 2012-2014 Restructuring Program. 2011 compared with 2010: Net revenues increased $1,728 million (14.9%), due to favorable foreign currency (5.5 pp), higher net pricing (4.4 pp), the impact of accounting calendar changes (including the 53 rd week of shipments) (3.0 pp), our Cadbury acquisition... -

Page 39

... net pricing, lower other selling, general and administrative expenses, our Cadbury acquisition due to the incremental January 2011 operating results, the impact of the 53 rd week of shipments, favorable foreign currency, lower acquisition-related costs and lower advertising and consumer promotion... -

Page 40

...("53 rd week") than 2012 or 2010, which each had 52 weeks. In 2011, we changed the consolidation date for certain operations of our Europe segment and in the Latin America, Central and Eastern Europe ("CEE") and Middle East and Africa ("MEA") regions within our Developing Markets segment. Previously... -

Page 41

... Developing Markets geographic unit, we used a risk-rated discount rate of 9.3%. Estimating the fair value of individual reporting units requires us to make assumptions and estimates regarding our future plans, industry and economic conditions. Our actual results and conditions may differ over time... -

Page 42

... and assets associated with the Kraft Foods Group active and retired employees and certain of our retired employees that previously participated in our North American benefit plans. At October 1, 2012, we transferred benefit plan liabilities of $12,218 million, pension plan assets of $6,550 million... -

Page 43

... Kraft Foods Group in the SpinOff and other 2012 one-time costs, partially offset by increased benefit plan expenses in 2013 due to lower discount rates. In 2012, other comprehensive losses included $2,266 million of net actuarial pre-tax losses primarily related to the decrease in the discount rate... -

Page 44

... 2013 assumptions for our U.S. and non-U.S. pension and postretirement health care plans, as a sensitivity measure, a fifty-basis point change in our discount rates or the expected rate of return on plan assets would have the following effects, increase / (decrease) in cost, as of December 31, 2012... -

Page 45

... prices, or interest rates. We manage market risk by limiting the types of derivative instruments and derivative strategies we use and the degree of market risk that we plan to hedge through the use of derivative instruments. Income Taxes: We recognize tax benefits in our financial statements... -

Page 46

... we purchase on world markets as well as from local grower cooperatives. Green coffee bean prices are affected by the quality and availability of supply, changes in the value of the U.S. dollar in relation to certain other currencies and consumer demand for coffee products. Significant cost items in... -

Page 47

... to Kraft Foods Group related to the Spin-Off. The decrease in cash used in investing activities in 2011 primarily related to cash payments in 2010 related to the 2010 Cadbury acquisition, partially offset by the proceeds from Kraft Foods Group's sale of the Frozen Pizza business and proceeds... -

Page 48

... over time or for general corporate purposes. This debt and approximately $260 million of related deferred financing costs were retained by Kraft Foods Group in the Spin-Off. On June 1, 2012, $900 million of our 6.25% notes matured. The notes and accrued interest to date were repaid using primarily... -

Page 49

... 2012 related primarily to certain pension plan obligations transferred to Kraft Foods Group in the Spin-Off and other 2012 non-recurring costs, partially offset by increased pension plan expenses in 2013 related to lower discount rates. As of December 31, 2012, our total liability for income taxes... -

Page 50

... 2012. See Note 2, Divestitures and Acquisitions , to the consolidated financial statements for additional information on the Spin-Off of Kraft Foods Group . Stock Plans: In connection with the Spin-Off and divestiture of Kraft Foods Group, under the provisions of our existing plans, employee stock... -

Page 51

... as Diluted EPS attributable to MondelÄ"z International from continuing operations excluding the impact of Spin-Off Costs, the 2012-2014 Restructuring Program, Integration Program, acquisition-related costs, gains / losses on divestitures, pension costs related to the obligations transferred in the... -

Page 52

... acquisitions, divestitures, Integration Program costs, accounting calendar changes (including the 53 rd week in 2011) and foreign currency rate fluctuations. We believe that Organic Net Revenues better reflects the underlying growth from the ongoing activities of our business and provides improved... -

Page 53

...unfavorable foreign currency Adjusted Operating Income Integration Program Gains on divestitures, net Spin-Off pension expense adjustment (1) Spin-Off Costs 2012-2014 Restructuring Program Operating income from divested businesses Acquisition-related costs Operating Income $ $ $ 4,388 (153) 4,235... -

Page 54

... MondelÄ"z International from continuing operations" (the most comparable U.S. GAAP financial measure) were to exclude Spin-Off Costs, Integration Program costs, 2012-2014 Restructuring Program costs, acquisition and related financing costs, gains / (losses) on divestitures, pension costs related to... -

Page 55

Table of Contents Item 7A. Quantitative and Qualitative Disclosures about Market Risk. As we operate globally, we use certain financial instruments to manage our foreign currency exchange rate, commodity price and interest rate risks. We monitor and manage these exposures as part of our overall risk... -

Page 56

... assessment, management determined that, as of December 31, 2012, we maintained effective internal control over financial reporting. PricewaterhouseCoopers LLP, independent registered public accounting firm, who audited and reported on the consolidated financial statements included in this report... -

Page 57

... reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements. Because of its inherent limitations, internal control over financial reporting may not prevent or... -

Page 58

Table of Contents MondelÄ"z International, Inc. and Subsidiaries Consolidated Statements of Earnings For the Years Ended December 31 (in millions of U.S. dollars, except per share data) 2012 2011 2010 Net revenues Cost of sales Gross profit Selling, general and administrative expenses Asset ... -

Page 59

...) / benefit Pension and other benefits: Net actuarial gain / (loss) arising during period Reclassification adjustment for losses / (gains) included in net earnings due to: Amortization of experience losses and prior service costs Settlement losses Tax (expense) / benefit Derivatives accounted for as... -

Page 60

... issued in 2012 and 2011) Additional paid-in capital Retained earnings Accumulated other comprehensive losses Treasury stock, at cost Total MondelÄ"z International Shareholders' Equity Noncontrolling interest TOTAL EQUITY TOTAL LIABILITIES AND EQUITY See notes to consolidated financial statements... -

Page 61

... income taxes Exercise of stock options and issuance of other stock awards Cash dividends declared ($1.00 per share) Spin-Off of Kraft Foods Group, Inc. Dividends paid on noncontrolling interest and other activities Balances at December 31, 2012 $ See notes to consolidated financial statements. 58 -

Page 62

... by operating activities CASH PROVIDED BY / (USED IN) INVESTING ACTIVITIES Capital expenditures Acquisitions, net of cash received Proceeds from divestitures, net of disbursements Cash transferred to Kraft Foods Group related to the Spin-Off Proceeds from sale of property, plant and equipment and... -

Page 63

...("53 rd week") than 2012 or 2010, which each had 52 weeks. In 2011, we changed the consolidation date for certain operations of our Europe segment and in the Latin America, Central and Eastern Europe ("CEE") and Middle East and Africa ("MEA") regions within our Developing Markets segment. Previously... -

Page 64

... in our consolidated financial statements. Significant accounting policy elections, estimates and assumptions include, among others, pension and benefit plan assumptions, valuation assumptions of goodwill and intangible assets, useful lives of long-lived assets, marketing program accruals, insurance... -

Page 65

...flows of those operations. For reporting units within our Developing Markets geographic unit, we used a risk-rated discount rate of 9.3%. Estimating the fair value of individual reporting units requires us to make assumptions and estimates regarding our future plans, industry and economic conditions... -

Page 66

..., and continuing pay and service will be used to calculate the pension benefits through December 31, 2019. Our U.S., Canadian, and United Kingdom subsidiaries provide health care and other benefits to most retired employees. Local government plans generally cover health care benefits for retirees... -

Page 67

...financial instrument might be adversely affected by changes in market conditions and foreign currency exchange rates, commodity prices, or interest rates. We manage market risk by limiting the types of derivative instruments and derivative strategies we use and the degree of market risk that we plan... -

Page 68

... accounting and disclosure requirements related to subsequent events in our consolidated financial statements. Note 2. Divestitures and Acquisitions Spin-off Kraft Foods Group On October 1, 2012 (the "Distribution Date"), we completed the spin-off of our North American grocery business, Kraft Foods... -

Page 69

... table above. As of December 31, 2012, we also have a $55 million receivable from Kraft Foods Group related to the cash settlement of stock awards held by our respective employees at the time of the Spin-Off as further described in Note 11, Stock Plans , to the consolidated financial statements. 66 -

Page 70

... and related costs ("Spin-Off Costs") we have incurred to date. We recorded Spin-Off Costs of $1,053 million in 2012 and $46 million of Spin-Off Costs in 2011. We expect to reflect all one-time Spin-Off Costs within our reported results. We incurred the following Spin-Off Costs within our pre-tax... -

Page 71

...our Developing Markets segment. The cumulative exposure was approximately $150 million at December 31, 2010. Other Divestitures: In 2012, we received $200 million in proceeds and recorded pre-tax gains of $107 million primarily related to the divestitures of a dinners and sauces grocery business in... -

Page 72

... of brand names purchased through our acquisitions of Nabisco Holdings Corp., the Spanish and Portuguese operations of United Biscuits, the global LU Biscuit business of Groupe Danone S.A. and Cadbury. Amortizable intangible assets consist primarily of trademarks, customer-related intangibles... -

Page 73

...implementation costs ("2012-2014 Restructuring Program") reflecting primarily severance, asset disposals and other manufacturing-related one-time costs. The primary objective of the restructuring and implementation activities was to ensure that both Kraft Foods Group and MondelÄ"z International were... -

Page 74

... financial statements greater transparency to the total costs of our 2012-2014 Restructuring Program. Within our continuing results of operations, to date, we recorded implementation costs of $8 million in 2012 within cost of sales and selling, general and administrative expense in our North America... -

Page 75

...project costs outside of our Integration Program and 2012-2014 Restructuring Program and consist of the following specific initiatives: • In 2012, we recorded a $21 million charge primarily within the segment operating income of Europe related to severance benefits provided to terminated employees... -

Page 76

... over time or for general corporate purposes. This debt and approximately $260 million of related deferred financing costs were retained by Kraft Foods Group in the Spin-Off. On June 1, 2012, $900 million of our 6.25% notes matured. The notes and accrued interest to date were repaid using primarily... -

Page 77

...770 Except for one-time Spin-Off related financing fees, interest expense associated with debt incurred by or migrated to Kraft Foods Group in connection with the Spin-Off is reflected within earnings from discontinued operations, net of income taxes. In 2012, SpinOff related financing fees include... -

Page 78

...- Level 2 financial assets and liabilities consist of commodity forwards and options, foreign exchange forwards and options, currency swaps and interest rate swaps. Commodity derivatives are valued using an income approach based on the observable market commodity index prices less the contract rate... -

Page 79

... - - In 2012, we recognized a loss of $556 million in interest and other expenses, net related to certain forward-starting interest rate swaps for which the planned timing of the related forecasted debt was changed in connection with our Spin-Off plans and related debt capitalization plans. In 2011... -

Page 80

...of Kraft Foods Group and certain of our retired employees participated in our North American benefit plans. Following the Spin-Off, their benefits will be provided directly by Kraft Foods Group. The related plan obligations and plan assets (to the extent that the benefit plans were previously funded... -

Page 81

... Obligations and Funded Status: The projected benefit obligations, plan assets and funded status of our pension plans at December 31, 2012 and 2011 were: U.S. Plans 2012 2011 (in millions) 2012 Non-U.S. Plans 2011 Benefit obligation at January 1 Service cost Interest cost Benefits paid Settlements... -

Page 82

... Plans 2011 2010 (in millions) 2012 Non-U.S. Plans 2011 2010 Service cost Interest cost Expected return on plan assets Amortization: Net loss from experience differences Prior service cost Other expenses Net pension costs related to discontinued operations Net pension cost included in continuing... -

Page 83

...million of prior service cost. We used the following weighted-average assumptions to determine our net pension cost for the years ended December 31: 2012 U.S. Plans 2011 2010 2012 Non-U.S. Plans 2011 2010 Discount rate Expected rate of return on plan assets Rate of compensation increase 4.56% 8.00... -

Page 84

... in hedge fund-of-funds are calculated by the investment managers using the net asset value per share of the investment as reported by the money managers of the underlying funds. • Fair value estimates for insurance contracts are calculated based on the future stream of benefit payments discounted... -

Page 85

... 1,516 $ The increases in Level 3 pension plan investments during 2012 were due to the net realized gains recorded on the investments, partially offset by net transfers out, primarily related to assets divested with the Spin-Off of Kraft Foods Group. Changes in our Level 3 plan assets, which are... -

Page 86

...including changes in tax and other benefit laws; significant differences between expected and actual pension asset performance or interest rates; or other factors. Future Benefit Payments: The estimated future benefit payments from our pension plans at December 31, 2012 were (in millions): 2013 2014... -

Page 87

... include contributions related to Kraft Foods Group employees who participated in our multiemployer pension plans through October 1, 2012 of $2 million in 2012, $5 million 2011 and $3 million in 2010. Other Costs: We sponsor and contribute to employee savings plans. These plans cover eligible... -

Page 88

... amounts reported for the health care plans. A onepercentage-point change in assumed health care cost trend rates would have the following effects as of December 31, 2012: One-Percentage-Point Increase Decrease Effect on total of service and interest cost Effect on postretirement benefit obligation... -

Page 89

... 2010 2012 Non-U.S. Plans 2011 2010 Discount rate Health care cost trend rate 4.47% 7.00% 5.30% 7.50% 5.70% 7.00% 4.14% 7.42% 5.02% 8.83% 5.28% 8.79% Future Benefit Payments: Our estimated future benefit payments for our postretirement health care plans at December 31, 2012 were: 2013 2014... -

Page 90

... stock awards received one share of Kraft Foods Group restricted or deferred shares for every three of our restricted or deferred shares they held as of the Record Date. • Long-term incentive plan : Kraft Foods Inc. awards held by Kraft Foods Group employees were converted to Kraft Foods Group... -

Page 91

...stemming from local laws, taxes or other regulatory matters, certain employees who previously held stock options may no longer hold stock options from Kraft Foods Group. As such, their stock option awards were converted into an equivalent amount of additional MondelÄ"z International stock options in... -

Page 92

... local laws, taxes or other regulatory matters, certain employees who previously held restricted or deferred shares may no longer hold the stock awards from Kraft Foods Group. As such, their stock awards were converted into an equivalent amount of additional MondelÄ"z International stock awards in... -

Page 93

... to laws and industry regulations in all jurisdictions in which we do business, is integral to our success. Accordingly, after we acquired Cadbury in February 2010 we began reviewing and adjusting, as needed, Cadbury's operations in light of U.S. and international standards as well as Kraft Foods... -

Page 94

...Starbucks related to the Starbucks CPG business. The dispute is in arbitration in Chicago, Illinois. We are seeking appropriate remedies, including payment of the fair market value of the supply and license agreement, plus the premium this agreement specifies, prejudgment interest under New York law... -

Page 95

...an independent, publicly traded company. To effect the SpinOff, our shareholders of record as of September 19, 2012 received one share of Kraft Foods Group for every three shares of MondelÄ"z International. The Spin-Off had no effect on the number of shares of MondelÄ"z International common stock in... -

Page 96

... Canadian income taxes for all tax periods prior to the Spin-Off. In addition, we transferred to Kraft Foods Group all of its deferred tax assets and liabilities as of the Distribution Date. See Note 2, Divestitures and Acquisitions. As of January 1, 2012, our unrecognized tax benefits were $1,538... -

Page 97

... 7.4% Our 2012 effective tax rate was favorably impacted by the mix of pre-tax income in various foreign jurisdictions and net tax benefits of $101 million from discrete one-time events, primarily related to the revaluation of U.K. deferred tax assets and liabilities resulting from tax legislation... -

Page 98

... 31, 2012 and 2011: 2012 (in millions) 2011 Deferred income tax assets: Accrued postretirement and postemployment benefits Accrued pension costs Other Total deferred income tax assets Valuation allowance Net deferred income tax assets Deferred income tax liabilities: Trade names Property, plant... -

Page 99

...), chocolate, gum & candy, coffee & powdered beverages and various cheese & grocery products. We manage our global business and report operating results through three geographic units: Developing Markets, Europe and North America. In connection with the divestiture of Kraft Foods Group, we divested... -

Page 100

... within our Europe and Developing Markets segments, as well as within general corporate expenses. The 2012 increase in general corporate expenses was due primarily to $407 million of Spin-Off Costs recorded within general corporate expenses, partially offset by lower Integration Program costs. The... -

Page 101

... Total capital expenditures Net revenues by consumer sector were: $ $ 761 350 217 1,328 282 1,610 $ $ 713 378 279 1,370 401 1,771 $ $ 607 334 272 1,213 448 1,661 For the Year Ended December 31, 2012 Developing Markets Europe North America (in millions) Total Biscuits Chocolate Gum & Candy... -

Page 102

... $ 10,988 9,565 5,692 6,057 3,508 35,810 Developing Markets For the Year Ended December 31, 2010 North Europe America (in millions) Total Biscuits Chocolate Gum & Candy Beverages Cheese & Grocery Total net revenues Geographic data for net revenues and long-lived assets were: $ $ 2,796 3,770... -

Page 103

... 0.36 0.29 42.44 37.15 $ 0.31 (0.01) 0.30 0.13 42.54 24.50 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ The first three quarters of 2012 and the fourth quarter 2012 market price-high in the table above reflect historical stock prices which were not adjusted to reflect the Kraft Foods Group Spin-Off. 100 -

Page 104

...0.47 0.29 37.93 31.88 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Market prices in the table above reflect historical stock prices which were not adjusted to reflect the Kraft Foods Group Spin-Off. The fourth quarter of 2011 benefited from lower than projected taxes on our earnings outside the U.S. and an... -

Page 105

... of Shareholders scheduled to be held on May 21, 2013 ("2013 Proxy Statement"). All of this information is incorporated by reference into this Annual Report. The information on our Web site is not, and shall not be deemed to be, a part of this Annual Report or incorporated into any other filings we... -

Page 106

... Management and Related Stockholder Matters. The number of shares to be issued upon exercise or vesting of awards issued under, and the number of shares remaining available for future issuance under, our equity compensation plans at December 31, 2012 were: Equity Compensation Plan Information Number... -

Page 107

... and between Mondelez Canada Inc. and Kraft Canada Inc., dated as of September 29, 2012 * Master Ownership and License Agreement Regarding Patents, Trade Secrets and Related Intellectual Property, among Kraft Foods Global Brands LLC, Kraft Foods Group Brands LLC, Kraft Foods UK Ltd. and Kraft Foods... -

Page 108

... Stock Option Award Agreement. + MondelÄ"z International, Inc. Long-Term Incentive Plan, effective as of January 1, 2011 and restated as of October 2, 2012. + MondelÄ"z Global LLC Supplemental Benefits Plan I, effective as of September 1, 2012. + MondelÄ"z International, Inc. Supplemental Benefits... -

Page 109

... Officer and Chief Financial Officer pursuant to 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. The following materials from MondelÄ"z International's Annual Report on Form 10-K for the fiscal year ended December 31, 2012, formatted in XBRL (eXtensible Business... -

Page 110

... registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. MONDELÄ'Z INTERNATIONAL, INC. By: / S / DAVID A. BREARTON (David A. Brearton Executive Vice President and Chief Financial Officer) February 25, 2013 Date: Pursuant to the requirements... -

Page 111

... ACCOUNTING FIRM ON FINANCIAL STATEMENT SCHEDULE To the Board of Directors and Shareholders of MondelÄ"z International, Inc.: Our audits of the consolidated financial statements and of the effectiveness of internal control over financial reporting referred to in our report dated February 25, 2013... -

Page 112

... Charged to Charged to Costs and Other Expenses Accounts (a) Col. D Col. E Balance at End of Period Description Deductions (b) 2012: Allowance for trade receivables Allowance for other current receivables Allowance for long-term receivables Allowance for deferred taxes 2011: Allowance for... -

Page 113

Exhibit 2.3 CANADIAN ASSET TRANSFER AGREEMENT BETWEEN MONDELEZ CANADA INC. AND KRAFT CANADA INC. MADE AS OF September 29, 2012 -

Page 114

...Grocery Liabilities Obligations and Liabilities Not Assumed Ancillary Agreements Waiver of Bulk Sales Laws Real Property Matters Intellectual Property Matters Treatment of Personal Information Indemnification Election under Subsection 85(1) of the Tax Act Stated Capital Transfer Taxes Property Taxes... -

Page 115

ARTICLE 6 - PENSIONS AND BENEFITS MATTERS 6.01 6.02 6.03 6.04 6.05 6.06 6.07 Assignment and Assumption of Registered Pension Plans Registered Pension Plan Transfers Group Registered Retirement Savings Plan Non-Registered Savings Plan Accounts Supplemental Top Up Plans Post-Retirement Health and ... -

Page 116

Schedule 5.01(2): Collective Agreements Schedule 5.03(1): Specified Incentive Plans Schedule 6.01(1): Stand-Alone Registered Pension Plans Schedule 6.01(2): Form of Assignment and Assumption Agreement Schedule 6.02(1): Vendor Commingled Registered Pension Plans - iii - -

Page 117

... to the Effective Time and where such performance is to be for the benefit of the Purchaser after the Effective Time. " Business Day " means a day other than a Saturday, Sunday or other day on which commercial banks in New York, New York or Toronto, Ontario are authorized or required by law to close... -

Page 118

... described in Paragraph 89 of the Tax Ruling. " Butterfly Percentage " means the proportion, expressed as a percentage, that the net fair market value of the business property transferred indirectly by the Vendor to Mondelez Canada Holdings ULC (referred to in the Tax Ruling as "TCo"), as described... -

Page 119

... Effective Time that constitute part of the SnackCo Business. " Canadian Snack Liabilities " means all Liabilities of the Vendor that constitute SnackCo Liabilities, including those listed or described in Section 2.10. " Canadian Transaction Tax " has the meaning ascribed thereto in the Tax Sharing... -

Page 120

...) and Trebor Canada Inc. (now Kraft Canada Inc.), as amended pursuant to an amendment agreement dated , 2012, as such loan agreement has been assigned by Greencastle Drinks to Kraft Foods North America and Asia BV, and as subsequently assigned by Kraft Foods North America and Asia BV to Yellowcastle... -

Page 121

...agreement dated Inc., as may be amended or modified from time to time. , 2012 between Kraft Foods Inc. and Kraft Foods Group, " SnackCo Brand IP " has the meaning ascribed thereto in the IP Agreement (Trademark). " SnackCo Canada Cash " means an amount of cash and Cash Equivalents of or standing to... -

Page 122

... in the name of the Vendor and those held by Cadbury Schweppes Overseas Limited in trust for the Vendor), and (iii) all of the liabilities and obligations owed to the Vendor by Kraft Holdings ULC and by Kraft Asia Pacific (Alberta) GP ULC. " Tax " has the meaning ascribed thereto in the Tax Sharing... -

Page 123

...to the extent Related to the Canadian Snack Business and (ii) any other accounts receivable of the Vendor listed or described on Schedule 2.01(a), but in all cases save and except for the Specified GroceryCo Accounts Receivable. " Transferred Employees from Commingled Plans " has the meaning set out... -

Page 124

... Grocery Indebtedness; Sub-leasehold Lands; Specified Liabilities; Employees Transferring to the Purchaser; Collective Agreements; Specified Incentive Plans; Stand-Alone Registered Pension Plans; Form of Assignment and Assumption Agreement; and Vendor Commingled Registered Pension Plans. ARTICLE... -

Page 125

... to the date of the SnackCo Balance Sheet; all approvals, registrations, permits and authorizations issued by any Governmental Authority that relate exclusively to the Canadian Snack Business or the Canadian Snack Assets and are held in the name of the Vendor, including those listed or described... -

Page 126

... pre-paid expenses and deposits Related to the Canadian Snack Business including all pre-paid insurance, rent and royalties, all pre-paid property taxes and water rates, all pre-paid purchases of gas, oil and hydro, all pre-paid lease payments and all pre-paid employee items referred to in Section... -

Page 127

..., the Tax Sharing Agreement or in any other Ancillary Agreement. 2.04 Consideration The consideration (the " Consideration ") payable by the Purchaser to the Vendor for the Canadian Snack Assets will be the aggregate fair market value of the Canadian Snack Assets as at the Effective Time. 2.05... -

Page 128

... use their reasonable best efforts to sustain such allocation. The parties will share information and cooperate to the extent reasonably necessary to permit the transactions contemplated by this Agreement to be properly, timely and consistently reported. 2.07 Cash Transfer From the Effective Time... -

Page 129

..., thereafter amounts owing to the Vendor from persons related to the Vendor, and thereafter other Cash Equivalents, in each case, of or standing to the credit of the Vendor immediately prior to the Effective Time and constituting SnackCo Canada Cash. 2.08 Misdirected Amounts and Misdirected Invoices... -

Page 130

... operation or conduct of the Canadian Snack Business, as conducted at any time prior to the Effective Time (including any Liability relating to, arising out of or resulting from any act or failure to act by any director, officer, employee, agent or representative (whether or not such act or failure... -

Page 131

... Business), arising on or after the Effective Time; the Applicable SnackCo Proportion of any Shared Liability; the Greencastle Obligation; the Vendor's obligations as a subsidiary guarantor under the Cadbury Bonds Guarantee; (j) (k) (l) (m) all employment and registered and unregistered pension... -

Page 132

...; the operation or conduct of the Canadian Grocery Business, as conducted at any time prior to the Effective Time (including any Liability relating to, arising out of or resulting from any act or failure to act by any director, officer, employee, agent or representative (whether or not such act or... -

Page 133

... of each of them have entered into the Ancillary Agreements (other than this Agreement), including the Employee Matters Agreement, the IP Agreement (Non-Trademark), the IP Agreement (Trademark), the Supply Agreement, the Tax Sharing Agreement, the Transition Services Agreements and the Warehouse... -

Page 134

... 6 of the Retail Sales Tax Act (Ontario) and equivalent Laws in other provinces to the extent such Laws would be applicable to the transactions contemplated by this Agreement. 3.02 Real Property Matters (1) (2) At or before the Effective Time the Vendor and the Purchaser will have entered into the... -

Page 135

... Liabilities; the operation or conduct of any business conducted by the Vendor at any time after the Effective Time (including any Liability relating to, arising out of or resulting from any act or failure to act by any director, officer, employee, agent or representative (whether or not such act or... -

Page 136

... class immediately before the disposition" will be interpreted to mean that proportion of the undepreciated capital cost to the Vendor of all of the property of that class immediately before the Effective Time that the fair market value at that time of the asset that is transferred is of the fair... -

Page 137

... will be responsible for accounting for any goods and services tax, harmonized sales tax and/or Quebec sales tax that form part of any receivables acquired by the Purchaser as part of its acquisition of the Canadian Snack Assets, and (ii) the transfer of such receivables will be net of any amount... -

Page 138

... sets out the names of all employees of the Canadian Snack Business as of the Closing Date (" Employees "). No later than the Closing Date, the Vendor will provide the Purchaser with information regarding terms and conditions of employment of the Employees in effect as of the Effective Time and such... -

Page 139

... insurance, Canada Pension Plan, employer health tax, applicable statutory hospitalization insurance, accrued wages, salaries and commissions and employee benefit plan payments will be appropriately adjusted to the close of business on the day immediately preceding the Effective Time. (4) On... -

Page 140

...any payments made by the Vendor after the Effective Time to any workers compensation board in relation to any Employees who become employees of the Purchaser, the Purchaser will fully indemnify and save harmless the Vendor for such payments within 30 days following the end of each quarter-end during... -

Page 141

...Canadian Snack Business as of the Closing Date, and who become employed by the Purchaser effective the Effective Time (the " Transferred Employees from Commingled Plans ") will cease to actively participate in and accrue benefits under the Vendor Commingled Registered Pension Plans and will commence... -

Page 142

... SnackCo Pension Plan in respect of the benefits which Transferred Employees from Commingled Plans have accrued under the Vendor Commingled Registered Pension Plans up to the Effective Time. The asset transfer amounts will be determined in accordance with paragraph 8(b) of the Financial Services... -

Page 143

... Vendor Commingled Registered Pension Plans in respect of the benefits of Transferred Employees from Commingled Plans (adjusted to reflect the applicable rate of return determined under clause (c) below), and increased or decreased, as the case may be, in order to reflect the fund rate of return of... -

Page 144

... to post-retirement health and welfare benefit entitlements of the members of the Stand-Alone Registered Pension Plans whose employment with the Vendor ceased prior to the Effective Time. With respect to Employees who become employed by the Purchaser effective the Effective Time, the Purchaser... -

Page 145

... arising before the Closing Date, regardless of whether such individuals become employed by the Purchaser. ARTICLE 7-CLOSING ARRANGEMENTS AND TERMINATION 7.01 Closing The transactions contemplated by this Agreement will be completed at the Effective Time at the offices of McCarthy Tétrault LLP... -

Page 146

... it is a member of the SnackCo Post-Distribution Group. As such, the Vendor and the Purchaser acknowledge that the Purchaser is entitled to the benefits of Sections 5.03(a) and 5.04 of the Tax Sharing Agreement as they relate to Canadian Transaction Taxes imposed on the Purchaser or for which the... -

Page 147

...08 of the Tax Sharing Agreement), any demand, notice or other communication to be given in connection with this Agreement must be given in writing and will be given by personal delivery or by electronic means of communication addressed to the recipient as follows: To the Vendor: Kraft Canada Inc. 95... -

Page 148

To the Purchaser: Mondelez Canada Inc. 2660 Matheson Boulevard East Mississauga, Ontario L4W 5M2 Fax No.: Attention : President or to such other street address, individual or electronic communication number or address as may be designated by notice given by either party to the other. Any demand, ... -

Page 149

IN WITNESS WHEREOF the parties have executed this Agreement. MONDELEZ CANADA INC. Per: /s/ Rosanne Angotti Name: Rosanne Angotti Title: President and Secretary KRAFT CANADA INC. Per: /s/ Kelly MacGregor Name: Kelly MacGregor Title: Assistant Secretary -

Page 150

... PROFESSIONAL SERVICES AGREEMENT BETWEEN KRAFT FOODS GROUP, INC., AND HP ENTERPRISE SERVICES, L.L.C. As amended and restated pursuant to Amendment 90 KRAFT / HP CONFIDENTIAL CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT... -

Page 151

... value to Kraft's business processes; Continue to deliver year-on-year cost reductions; Design new capabilities and innovations to enable growth; Implement common processes and move toward an integrated enterprise-wide reporting system across Kraft; Provide committed levels of service quality that... -

Page 152

... ability to manage its business to predictable costs; Provide a contract structure that will minimize the occurrence of true-ups after the Effective Date that would result in unplanned changes in the Services, Service performance, pricing or to other costs to Kraft; Leverage the Supplier's scale in... -

Page 153

... this Agreement which sets forth the hosting Services to be provided under this Agreement for Kraft shall also become effective as of the Grocery Start Date. For the avoidance of doubt, the term stated in any Supplement each shall continue without change (e.g., the Term of a novated Supplement will... -

Page 154

...disputes arising under or relating to any Companion Agreement shall be subject to the provisions of Article 19 , and under no circumstances shall 2.4.2 CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY... -

Page 155

... Physical Security Kraft Rules Kraft Internal Controls Kraft Labor Policies Network Services Demarcation Subcontractors Policies and Procedures Manual Content Termination Assistance Services Direct Kraft Competitors Direct Supplier Competitors Approved Benchmarkers Global Personal Data Protection... -

Page 156

... to enter into new commitments (such as refresh of equipment, in order to provide the Services or meet the Service Levels), in which case Termination Charges may be payable with regard to such commitments, provided that Supplier notifies Kraft in advance of such commitments and the associated costs... -

Page 157

... recurring basis as of the Commencement Date, by Kraft Personnel who were displaced or whose functions were displaced as a result of this Agreement, including all Affected Personnel (including, for the avoidance of doubt, those services, functions and responsibilities performed by Directed Employees... -

Page 158

... Supplement, at 12:00:01 a.m., United States Central Time on the Commencement Date (or at such later time as Kraft may specify); in the case of Services comprising Projects, New Services and Termination Assistance Services, on the date determined in accordance with this Agreement or the applicable... -

Page 159

...by Kraft or the Eligible Recipients and (ix) a detailed work plan identifying the specific transition activities to be performed by Supplier Personnel (at the individual or team level, as appropriate) on a weekly basis during the Transition Period. The Transition Plan also shall identify any related... -

Page 160

... and shall use commercially reasonable efforts to assist Kraft with the resolution of any problems that may impede or delay the timely completion of each task in the Transition Plan that is Kraft's responsibility. 4.2.5 Reports . Supplier shall meet at least weekly with Kraft to report on its... -

Page 161

... by the Supplier and the changes in technology and business processes to be implemented by Supplier, (ii) the date(s) by which each such activity 4.3 4.3.1 4.3.2 4.3.3 CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO... -

Page 162

... current or future plans, or altering the timing for implementation of parts of the transformation without any increase in Supplier's Charges, if Kraft reasonably determines that any part of the transformation poses a risk or hazard to Kraft's or an Eligible Recipient's business interests, (v) the... -

Page 163

... of the Term or on such earlier date as Kraft may reasonably request given the nature of the tasks being requested, and continuing for the period of time requested by Kraft in its notice to Supplier, which may be up to 12 months following the effective date of the expiration of the Term (as... -

Page 164

...by Kraft and continuing for the period of time requested by Kraft in its notice to Supplier, which may be up to 12 months following the effective date of such termination. 4.4.1.2 Extension of Termination Assistance Services . Kraft may elect, upon 30 days' prior notice, to extend the effective date... -

Page 165

... assist Kraft, an Eligible Recipient and/or their designee(s) in developing a written transition plan for the transition of the Services to Kraft, such Eligible Recipient, or their designee(s), which plan shall include (as requested by Kraft) capacity planning, business process planning, facilities... -

Page 166

... . Subject to applicable Privacy Laws, such list shall specify each such Supplier Personnel's job title and annual rate of pay. 4.4.2.2.2 CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY REQUEST... -

Page 167

... the Acquired Assets) owned or leased by Supplier that is primarily used by Supplier, Supplier Subcontractors or Supplier Affiliates to perform the Services. Such Equipment shall be transferred in good working condition, reasonable wear and tear excepted, as of the expiration or termination date or... -

Page 168

..., Kraft shall pay Supplier a negotiated fee, which will be [ * * * ] that is [ * * * ] the [ * * * ] reflected in the applicable rates under the applicable Supplement from Supplier's [ * * * ]. To the extent the Termination Assistance Services requested by Kraft can be provided by Supplier using... -

Page 169

...Recipients, then for a period of up to two years following the expiration or termination date, upon Kraft's request Supplier shall continue to provide such proprietary communications network and other Network Services at the rates, and subject to the terms and conditions, set forth in this Agreement... -

Page 170

... on the Services or the Service Levels, and Supplier is not compensated for such additional resources through the charging mechanism in the applicable Supplement, then Kraft will compensate Supplier for such assistance on a time and materials basis provided that (i) Supplier notifies Kraft prior to... -

Page 171

...monthly number of Project proposals and plans typically prepared by Kraft prior to the Effective Date, the Parties agree to meet and develop an equitable solution. Additional Work or Reprioritization . In addition to the FTEs provided for in accordance with Section 4.6.1 , the Kraft Contract Manager... -

Page 172

... technology environments to be acquired, potential integration approaches, and the potential net economic impact of the acquisition in connection with the Services) as reasonably necessary to assist Kraft's assessment of the portion of the acquisition or new Entity to which the Services will relate... -

Page 173

... management for the information technology functions needed to support such Entity, including on-site support at the location of such Entity. Divestitures. From time to time, Kraft may divest business units or Affiliates. In such cases, Supplier will provide transition support services to Kraft... -

Page 174

... all information that Supplier reasonably believes is required for Kraft to determine whether the new location will result in: (A) increased costs to Kraft or the Eligible Recipients, (B) a negative impact to the Services or Service Levels, or (C) increased business (including public relations... -

Page 175

... to office space and office furniture provided by Kraft to other contractors performing information technology or similar services at the same Kraft Facility, except to the extent Supplier provides lesser quality office space and office furniture to its own similarly situated employees. In the case... -

Page 176

..., Supplier shall provide (i) all maintenance, site management, site administration and similar services for the Supplier Facilities, (ii) uninterrupted power supply services for the Supplier Facilities and for the Software, Equipment and Systems in Kraft Facilities as designated in Schedule 7.1 and... -

Page 177

... from which the Services are then being provided by Supplier to another geographic location; provided that, in such event, Kraft will provide Supplier with comparable office space in the new geographic location. In such event, Kraft shall pay the applicable labor rate(s) for additional personnel... -

Page 178

... the Services which have been communicated to Supplier or Supplier Personnel in advance by such means as are generally used by Kraft to disseminate such information to its employees or contractors, including those set forth on Schedule 17.3 and those applicable to specific Kraft Sites (collectively... -

Page 179

... and Supplier Personnel shall observe and comply with all Laws applicable to the use by it and them of each Kraft Facility or Site or the provision of the Services, including environmental Laws and Laws regarding occupational health and safety. Supplier shall be responsible for the compliance... -

Page 180

... Supplier is financially responsible under this Agreement, except for (a) product vendor specialists who Supplier engages on a temporary basis to address urgent problems and (b) contracts for Supplier Overhead Materials, Supplier shall use commercially reasonable efforts to (i) obtain for Kraft, the... -

Page 181

... Supplement or the completion of Termination Assistance Services to permit Kraft, the Eligible Recipients and/or their designee(s) to assume prospectively the license, lease or contract in question or to enter into a new license, lease or contract with Kraft, the Eligible Recipients and/or their... -

Page 182

...Date on which Supplier assumes responsibility for the Services in question, Kraft shall assign to Supplier, and Supplier shall assume and agree to perform all obligations arising on or after the applicable Commencement Date that are related.... THE COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A... -

Page 183

... for which Supplier is financially responsible under the applicable Supplement and, subject to Section 9.12 , may substitute or change vendors relating to goods or services covered thereby; provided that, except as otherwise disclosed by Supplier and agreed to by Kraft, such change(s) (i) shall not... -

Page 184

... the continued performance of the Services in accordance with this Agreement and shall either provide such Services itself or enter into an agreement for such Services with a replacement Managed Third Party. In that event, if and to the extent Kraft is financially responsible for that Managed Third... -

Page 185

..., Supplier agrees to pay Kraft on the Commencement Date the Acquired Assets Credit specified in the applicable Supplement. In addition, Supplier shall be responsible for, and shall pay, or provide evidence of exemption from, all sales, use, goods and services and other similar taxes arising out of... -

Page 186

..., all sales, use, goods and services and other similar taxes arising out of the conveyance of the Acquired Assets. Kraft and Supplier intend that Article 5 of the Sixth Council Directive 77/388/EEC of May 17, 1977, as implemented in the relevant jurisdiction, and similar applicable Laws will apply... -

Page 187

... remedies available to Kraft, Supplier shall pay or credit to Kraft the Deliverable Credits specified in the applicable Supplement or established by Kraft as part of the Project approval process on a case by case basis in recognition of the diminished value of the Services resulting from Supplier... -

Page 188

..., timeliness, responsiveness, cost-effectiveness, or productivity of the Services; (iii) modify or increase the Service Levels to reflect changes in the processes, architecture, standards, strategies, needs or objectives defined by Kraft; and (iv) modify or increase the Service Levels to reflect... -

Page 189

...or any Eligible Recipient's financial integrity or internal controls, the accuracy of Kraft's or any Eligible Recipient's financial, accounting, quality, inventory, procurement or human resources records and reports or compliance with Kraft Rules, Kraft Standards or applicable Laws, or (ii) that has... -

Page 190

... as otherwise provided with respect to employees in Deferred Countries and Directed Employees, Supplier shall extend offers of at-will employment to all Affected Kraft Foods Global Personnel (other than contractors) at least 30 days before the Commencement Date, on a schedule and in a manner that... -

Page 191

... after the Effective Date except to the extent earlier communication is required by applicable Law. Supplier shall not disclose information relating to the transfer of employment, including internal employee communications or external communications, without the prior consent of Kraft or another... -

Page 192

... of such relocation is expressly disclosed in the Transitioned Employee's offer letter and agreed to by him or her at the time of hiring or thereafter. For a period of 12 months following the Effective Date, the Supplier will inform Kraft each month of Transitioned Personnel terminated by Supplier... -

Page 193

..., who obtains information about Affected Personnel who did not receive or accept an offer from Supplier or its Subcontractors, to directly or indirectly offer employment to any such Affected Kraft Foods Global Personnel. Employee Benefit Plans. General . Except as otherwise provided in this Article... -

Page 194

...'s applicable savings plan. Flexible Spending Account Plans . Each Transitioned Employee shall be eligible as of his or her Employment Effective Date to participate in Supplier's applicable health care and dependent care reimbursement accounts . Tuition Assistance . Transitioned Employees shall be... -

Page 195

... that are relevant to the Affected Kraft Foods Global Personnel and any employees who transfer pursuant to the EU Acquired Rights Directive or similar applicable Laws, including, without limitation, those referred to in Regulation 55(2) Income Tax (Employment) Regulations 1993 and paragraph 32... -

Page 196

... be responsible for funding and distributing benefits under the Kraft benefit plans in which Transitioned Employees participated prior to the Employment Effective Date and for paying any compensation and remitting any income, disability, withholding and other employment taxes for such Transitioned... -

Page 197

... reasonably requested by Kraft. If Kraft in good faith objects to the proposed assignment, the Parties shall attempt to resolve Kraft's concerns on a mutually agreeable basis. If the Parties have not been able to resolve Kraft's concerns within five business days of Kraft communicating its concerns... -

Page 198

... this Agreement. If Kraft in good faith objects to the proposed transfer, or reassignment, the Parties shall attempt to resolve Kraft's concerns on a mutually agreeable basis. If the Parties have not been able to resolve Kraft's concerns within five business days of Kraft communicating its concerns... -

Page 199

... designate a Supplier Account Executive for the Services who, unless otherwise agreed by Kraft, shall maintain his or her office at Three Parkway North, Deerfield, Illinois 60015. The Supplier Account Executive shall (i) be one of the Key Supplier Personnel; (ii) be a full time employee of Supplier... -

Page 200

... or a Subcontractor) to perform services directly or indirectly for or market Supplier's services to a Direct Kraft Competitor either while engaged in the provision of Services or during the first [ * * * ] after the Effective Date for the Transitioned Employees and, with respect to: (a) each... -

Page 201

... and professional conduct, including Kraft Labor Policies listed in Schedule 17.5 , generally applicable to personnel at such Kraft Sites (and communicated to Supplier in writing or by any other means generally used by Kraft to disseminate such information to its employees or contractors), (ii... -

Page 202

..., product vendor specialists who Supplier engages on a temporary basis to address urgent problems, and Third Party Contractors under Third Party Contracts assumed by Supplier to the extent such contracts do not comply with this requirement as of the Effective Date) and Affiliates providing Services... -

Page 203

... limitation) its obligations regarding consultation and the giving of information. Reserved. Directed Employees . Kraft shall make available to Supplier for use in Supplier's performance of Services the employees of Kraft and its Affiliates listed on the applicable Supplement (so long as they remain... -

Page 204

... version to Kraft within fifteen (15) business days of its receipt of such comments and suggestions for Kraft's approval. New Supplement Services . In connection with each Supplement for Services not being performed by Supplier immediately preceding the applicable Supplement Effective Date, and at... -

Page 205

... Date for the Snack Business and those that can be provided through ad hoc reporting capabilities in report-generating tools. In addition, from time to time, Kraft may identify additional Reports to be generated by Supplier and delivered to Kraft on an ad hoc or periodic basis. All Reports listed... -

Page 206

... transition and ongoing provision of the Services, quarterly during the first year of the Term and semi-annually thereafter; a quarterly meeting of senior management of both Parties to review relevant contract and performance issues; a periodic meeting of management of both Parties in which Supplier... -

Page 207

... the provision of specific Services on a dayto-day basis) and shall invite the Kraft Contract Manager to attend such meetings or to designate a representative to do so. Quality Assurance and Internal Controls . Supplier shall develop and implement Quality Assurance and internal control processes and... -

Page 208

... in writing by Kraft in order to assist Kraft to meet the requirements of the Sarbanes-Oxley Act of 2002 and implementing regulations promulgated by the United States Securities and Exchange Commission and the Public Company Accounting Oversight Board, as well as similar Laws in other jurisdictions... -

Page 209

... Kraft on an annual basis or otherwise as requested by Kraft in preparing Strategic Plans and short-term implementation plans. The assistance to be provided by Supplier shall include: (i) active participation with Kraft representatives on permanent and ad-hoc committees and working groups addressing... -

Page 210

... that shows how Supplier will provide the Services to enable Kraft to achieve the Strategic Plan objectives and to implement and support Kraft's business, information technology objectives and strategies (" Technology Plan "). The development of the Technology Plan will be an iterative process that... -

Page 211

... for, any impacted business process or associated Software, Equipment, System, Services or Materials, (iii) any increase in the cost to Kraft or the CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE COPY FILED HEREWITH OMITS THE INFORMATION SUBJECT TO A CONFIDENTIALITY... -

Page 212

... part of the Services or exercising its right to in-source or use third parties; (viii) have an adverse impact on Kraft's or an Eligible Recipient's environment (including its flexibility to deal with future changes, interoperability and its stability); (ix) introduce new technology to Kraft's or an... -

Page 213

... in accordance with this Agreement and the Kraft Standards and Strategic Plans and that it will not (i) increase Kraft's total cost of receiving the Services; (ii) require material changes to Kraft's or the Eligible Recipient's business, facilities, systems, software or equipment; (iii) adversely... -

Page 214

...to information technology standards, processes and procedures and associated software, equipment and systems on an expedited basis taking into account the relevant circumstances (the " Specialized Services "). The Parties acknowledge that the provision of such Specialized Services may, in some cases... -

Page 215

... for all Charges, all Kraft Data and all transactions, authorizations, changes, implementations, soft document accesses, reports, filings, returns, analyses, procedures, controls, records, data or information created, generated, collected, processed or stored by Supplier in the performance... -

Page 216

... comply with this requirement as of the Effective Date, and vendors of Supplier Overhead Materials) to, provide to Kraft (and internal and external auditors, inspectors, regulators and other representatives that Kraft may designate from time to time, including customers, vendors, licensees and other... -

Page 217

... access to (A) the proprietary information of other Supplier customers, (B) Supplier locations that are not related to Kraft, the Eligible Recipients or the Services, (C) Supplier's internal costs, except to the extent such costs are the basis upon which Kraft is charged (e.g., reimbursable expenses... -

Page 218

... will respond to each exit interview and/or audit report in writing within 30 days, unless a shorter response time is specified in such report. Supplier and Kraft shall develop and agree upon an action plan to promptly address and resolve any deficiencies, concerns and/or recommendations identified... -

Page 219

... events within 60 days of completion. Supplier shall respond to such report in accordance with Section 9.10.7 . 9.10.10 Information-Technology Support . Supplier shall provide all information-technology support reasonably related to the Services and required for Kraft and the Eligible Recipients... -

Page 220

... of this Agreement, and, at Kraft's request, assist Kraft in making those changes. Supplier shall manage each Managed Telecom Transport Provider as a managed third party pursuant to Section 6.6 . Subcontractors . Use of Subcontractors . Prior to entering into a subcontract with a third party... -

Page 221

... shall work in good faith to resolve Kraft's concerns on a mutually acceptable basis and, at Kraft request, replace such Shared Subcontractor at no additional cost to Kraft. 9.12.3 CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR PORTIONS OF THIS EXHIBIT. THE COPY FILED HEREWITH OMITS THE INFORMATION... -

Page 222

... all of the Subcontractors are managed effectively and efficiently. Kraft acknowledges and approves Supplier's use of Kraft assigned contracts notwithstanding that such contracts do not comply with all of the requirements of this Agreement as of the Effective Date. Notwithstanding the terms of the... -

Page 223

... financially and operationally responsible, Supplier agrees to consult with Kraft on request concerning the compatibility of Services with such Equipment including, in the case of Equipment and related software that Kraft proposes to acquire, informing Kraft of the likely effects (if any) of the use... -

Page 224

...) or (ii) newly filed tariffs or regulatory submissions or (iii) public postings by Supplier, Subcontractor or Managed Third Party Telecom Transport Provider of rates and other terms of service. If (x) Supplier is unwilling or unable to develop such proposal within 20 business days of any such event... -

Page 225

... not to, resist same and shall improve or enhance such Service as required. Unauthorized Use. 9.15.5 9.15.6 9.15.7 9.16 Kraft and Supplier shall cooperate fully in efforts to prevent and cure unauthorized use of the Services by expeditiously informing each other of suspected abuse and... -

Page 226

...) improve the efficiency and effectiveness of the information technology services and functions performed by or for Kraft and the Eligible Recipients at or from Kraft Facilities; (iii) result in cost savings or revenue increases to Kraft and the Eligible Recipients in areas of their business outside... -

Page 227

... the business impact, performance improvements and cost savings associated with such Technological Evolutions. Where requested by Kraft, Supplier shall develop and present to Kraft proposals for (i) implementing Technological Evolutions or (ii) changing the direction of Kraft's then current strategy... -

Page 228

... used by Supplier to provide the Services will interface and integrate with the Retained Systems and Business Processes. Keep Informed . Supplier shall inform itself and maintain up to date knowledge about all aspects of the existing and future Retained Systems and Business Processes related... -

Page 229

... business and technology strategy and direction; and (vi) such other things as Kraft may reasonably require related to the Services. 10. 10.1 10.1.1 KRAFT RESPONSIBILITIES Responsibilities . Kraft Contract Manager . Kraft shall designate one individual to whom all Supplier communications concerning... -

Page 230

... Services, Kraft agrees to pay Supplier the applicable Charges that are set forth in the applicable Supplement beginning as of the Commencement Date. Supplier shall continually seek to identify methods of reducing such Charges and will notify Kraft of such methods and the estimated potential savings... -

Page 231

...resources utilized by Kraft hereunder. Charges for Contract Changes . Unless otherwise agreed from time to time, and except as noted in the applicable Supplement, changes in the Services (including changes in Kraft Standards, Strategic Plans, Technology Plans, business processes, Software, Equipment... -

Page 232

...be modified to take account of Supplier's diminished control of the Service Levels and any change in Supplier cost structure for providing the partial set of Services. In such event, Supplier and Kraft will in good faith promptly negotiate any Service Level or pricing adjustments required. Except as... -

Page 233

.... To the extent an authorized Kraft representative specifies the vendor, pricing and/or terms and conditions for procurement of products or services for which Kraft shall pay on a Pass-Through Expense basis or, where agreed upon by the Parties, on a cost-reimbursement basis, Supplier shall 11.3 11... -

Page 234

... equivalent or better terms and conditions for the requested product or service than the master agreements existing as of the Commencement Date that are between Kraft and third party vendors. If, at any time, Kraft determines that the pricing and terms and conditions available through Supplier are... -

Page 235

...consumed by Supplier in providing the Services (including services obtained from Subcontractors) where the tax is imposed on Supplier's acquisition of such goods or services and the amount of tax is measured by Supplier's costs in acquiring or procuring such goods or services and not by Kraft's cost... -

Page 236

... such settled taxes, and Supplier shall reimburse Kraft to the extent Kraft had paid such taxes. Tax Filings. Each Party represents, warrants and covenants that it will file appropriate tax returns, and pay applicable taxes owed arising from or related to the provision of the Services in applicable... -

Page 237

... 10 days, in which case Supplier shall promptly advise Kraft of the time Supplier will require, and shall provide such proposal as soon as reasonably practicable. Kraft shall provide such information as Supplier reasonably requests in order to prepare such New Service proposal. Such New Services... -

Page 238

... replaced over time to keep pace with technological advancements and improvements in the methods of delivering Services and changes in the businesses of Kraft and the Eligible Recipients, provided that the foregoing shall not be interpreted to require Supplier to refresh Equipment at a rate that is... -

Page 239

... Supplier will continually explore and identify opportunities to improve the Services and reduce Kraft's costs, and will advise Kraft management of each opportunity that is identified and estimate the potential savings. From time to time, Kraft may request that the Parties work together to identify... -

Page 240

... the prepayment prior to the Effective Date, Supplier shall only be obligated to refund amounts to Kraft to the extent Supplier received an economic benefit from the prepayment (e.g., if Supplier can demonstrate that it had planned to use a replacement service at a lower cost, Supplier would only be... -

Page 241

...the quality and price of other well-managed outsourcing suppliers (not including companies who self-perform services) performing similar services to ensure that Kraft is receiving from Supplier pricing and levels of service that are competitive with market rates, prices and service levels, given the... -

Page 242

...; (iii) the extent to which supplier pricing includes the cost of acquiring future assets; (iv) the extent to which this Agreement calls for Supplier to provide and comply with unique Kraft requirements; (v) whether Service Taxes are included in such pricing or stated separately in supplier invoices... -

Page 243