LensCrafters 2003 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125124

On April 19, 2004, the Company stated that it had been made aware of the unsolicited, non-binding offer received

by National Cole from Moulin International Holdings Ltd. to acquire Cole National in a merger. In a press release, the

Company noted that Cole had decided to postpone to a date to be announced the special meeting of stockholders

scheduled for the following day to vote on the Company’s proposal. The postponement was necessary to permit Cole

National to file and distribute to its stockholders updated proxy materials.

In the same press release, the Company also noted that the recommendation by Cole National’s Board of

Directors to vote for the merger agreement executed with the Company last January remained in effect and had not

been modified or changed. In addition, Luxottica Group's Board of Directors did not deem it necessary to take any

action in connection with the matters referred to in the Cole National’s announcement distributed earlier on the same

day and indicated that it would review such matters in due course.

an investigation into the Company’s pricing and distribution practices relating to sunglasses under applicable state

and federal antitrust laws. The Company has been fully cooperating with this investigation and intends to continue to

do so, by providing documents and other information to the New York Attorney General. Although the Company

believes it has not violated any applicable antitrust laws, it is unable at this time to predict the outcome or timing of

this investigation.

On August 29, 2003, the Securities Appellate Tribunal (SAT) in India upheld the decision to require a subsidiary of

the Company to make a public offering to acquire up to an additional 20 percent of the outstanding shares of RayBan

Sun Optics India Ltd. On October 30, 2003, the Company announced that it intended to comply with the SAT’s

decision and that the Company, through its subsidiary, Ray Ban Indian Holdings Inc., would launch a public offer to

purchase an additional 20 percent of the outstanding shares of RayBan Sun Optics India Ltd. The Company expects

the aggregate cost of the offer to be approximately 16 million, including stipulated interest increments. In

accordance with applicable Indian regulation, the Company placed in escrow with the Manager of the Offer Rs. 226

million (4.2 million). On November 17, 2003, the Supreme Court of India stayed the SAT’s order and directed that

the matter be further reviewed at the end of January 2004, provided that the Company issue a letter of credit in favor

of the Indian securities regulatory agency within the following four week period of Rs. 630.6 million (11.9 million).

The Company has complied with such requirement and the review has been delayed until April 1, 2004. The Court

directed the appeal to be listed in the week commencing July 4, 2004.

The Company is defendant in various other lawsuits arising in the ordinary course of business. It is the opinion of

the management of the Company that it has meritorious defenses against all outstanding claims, which the Company

will vigorously pursue, and that the outcome will not have a material adverse effect on either the Company's

consolidated financial position or results of operations.

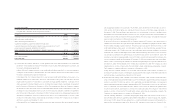

15 SUBSEQUENT EVENTS

On January 26, 2004, the Company and Cole National Corporation (“Cole National”) jointly announced that they

have entered into a definitive merger agreement dated as of January 23, 2004, with the unanimous approval of the

Boards of Directors. Under this agreement, the Company will acquire all of the outstanding shares of Cole National for

a cash purchase price of US$ 22.50 per share, together with the purchase of all outstanding options and similar

equity rights at same price per share, less their respective exercise prices, for a total purchase price of approximately

320 million (US$ 401 million). The merger is subject to the approval of Cole National’s stockholders and satisfaction

of other customary conditions, including compliance with applicable antitrust clearance requirements. The transaction

is expected to close in the second half of 2004. Cole National is a provider of vision care products and services,

including managed vision care programs and personalized gifts, with 2,944 retail locations in the U.S., Canada and

the Carribeans.