LensCrafters 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

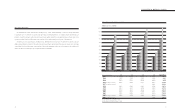

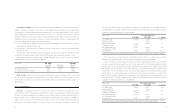

4140

2001(1) (3) 2002(2) (3) 2003(2) (4)

Net sales 3,101,129 100% 3,178,602 100% 2,824,636 100%

Cost of sales (920,183) 29.7% (924,404) 29.1% (878,340) 31.1%

Purchases and inventory variance (527,346) 17.0% (509,725) 16.0% (506,335) 17.9%

Manufacturing cost (112,573) 3.6% (126,247) 4.0% (108,760) 3.9%

Manufacturing depreciation (26,227) 0.8% (27,224) 0.9% (22,320) 0.8%

Manufacturing personnel cost (254,036) 8.2% (261,208) 8.2% (240,925) 8.5%

Gross profit 2,180,946 70.3% 2,254,198 70.9% 1,946,296 68.9%

Operating expenses (1,671,454) 53.9% (1,652,690) 52.0% (1,514,509) 53.6%

Selling expenses (1,034,218) 33.3% (1,078,964) 33.9% (1,008,688) 35.7%

Royalties (54,556) 1.7% (62,274) 2.0% (41,537) 1.5%

Advertising expenses (213,610) 6.9% (213,910) 6.7% (183,252) 6.5%

General and administrative expenses (274,873) 8.9% (261,477) 8.2% (243,717) 8.6%

Goodwill and trademark amortization (94,198) 3.0% (36,065) 1.1% (37,316) 1.3%

Operating income 509,492 16.4% 601,508 18.9% 431,787 15.3%

Other income (expenses) (68,181) 2.2% (62,067) 2.0% (41,994) 1.5%

Financial income 15,060 0.5% 5,036 0.2% 5,922 0.2%

Financial charges (91,978) 2.9% (65,935) 2.1% (47,117) 1.7%

Other income and charges 8,737 0.3% (1,167) 0.0% (799) 0.0%

Income before taxes 441,311 14.2% 539,441 17.0% 389,793 13.8%

Provision for income taxes (123,450) 4.0% 162,695 5.1% (117,328) 4.2%

Minority interests (1,488) 0.0% (4,699) 0.1% (5,122) 0.2%

Net income 316,373 10.2% 372,077 11.7% 267,343 9.5%

(1) 2001and 2002 results include the activity of Sunglass Hut International from the acquisition date (March 31, 2001)

(2) Results for the year ended December 31, 2002, include the effect of adoption of Statement of Financial Accounting Standard No. 142.

(3) Results for fiscal years 2001 and 2002 have been reclassified to allow for a comparison with results for fiscal 2003.

(4) Results for fiscal year 2003 include the activity of OPSM from August 1, 2003

STATEMENTS OF CONSOLIDATED INCOME

FOR THE YEARS ENDED DECEMBER 31,2001,2002, 2003

In accordance with U.S. GAAP

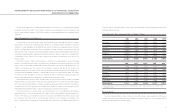

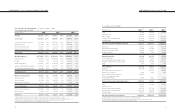

In accordance with U.S. GAAP

(Thousands of Euro) 2001 (1) (2) 2002 (1) 2003 (3)

Cash 85,392 199,202 151,418

Restricted cash 244,994 213,507 -

Bank overdraft (152,111) (411,193) (371,729)

Current portion of long-term debt (580,315) (1,339,131) (178,335)

Long-term debt (506,160) (132,247) (855,654)

Net financial position, beginning of the year (908,200) (1,469,862) (1,254,300)

Net income 316,373 372,077 267,343

Depreciation and amortization 211,906 145,980 134,840

Change in net working capital (82,387) (79,533) (94,923)

Provision and other (9,846) 1,649 20,266

Operating cash flow 436,046 440,173 327,526

Capital expenditure (123,475) (173,330) (81,288)

(Investments)/Disposal in intangible assets (23,714) 28,611 (48,177)

Purchase of business net of cash acquired (571,699) (35,039) (342,933)

Other 7,811 4,646 3,839

Free cash flow (275,031) 265,061 (141,033)

Dividends (63,326) (77,211) (95,405)

(Purchases)/Sale of treasury shares - (15,278) (45,440)

Exercise of stock options 11,465 9,567 1,489

Debt acquired through acquisitions (232,846) - -

Effect of exchange adjustments

to net financial position (1,924) 33,423 64,294

Decrease (increase) in net financial position (561,662) 215,562 (216,095)

Cash 199,202 151,418 299,937

Restricted cash 213,507 - -

Bank overdraft and notes payable (411,193) (371,729) (516,905)

Current portion of long-term debt (1,339,131) (178,335) (390,935)

Long-term debt (132,247) (855,654) (862,492)

Net financial position, end of the year (1,469,862) (1,254,300) (1,470,395)

(1) 2000 and 2001 results have been reclassified to conform to the new 2002 presentation

(2) 2001 and 2002 results include the activity of Sunglass Hut International from the acquisition date (March 31, 2001)

(3) Results for fiscal year 2003 include the activity of OPSM from August 1, 2003

STATEMENTS OF CASH FLOW

(Thousands of Euro)