LensCrafters 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115114

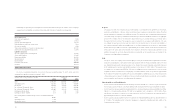

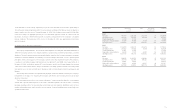

Plan assets were invested in equity securities, U.S. Government obligations, other fixed income securities and

money market funds.

Supplemental Retirement Plan - A U.S. subsidiary of the Company maintains an unfunded supplemental

retirement plan for participants of its pension plan to provide benefits in excess of amounts permitted under the

provisions of prevailing tax law. The pension liability associated with this plan is accrued using the same actuarial

methods and assumptions as those used for the subsidiary’s pension plan noted above, and such amounts are not

material to the consolidated financial statements.

Health Benefit Plans - A U.S. subsidiary of the Company partially subsidizes health care benefits for eligible

retirees. Included in other long-term liabilities on December 31, 2002, and 2003, is approximately 1.6 million and

1.5 million of accrued benefits, respectively.

Other Benefits - A U.S. subsidiary of the Company provides certain post-employment medical and life insurance

benefits. The Company’s accrued liability related to this obligation as of December 31, 2002, and 2003, was 1.3

million and 0.9 million, respectively.

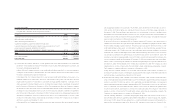

Savings Plan - The Company also sponsors a tax incentive savings plan covering all employees. U.S. Holdings

makes quarterly contributions in cash to the plan based on a percentage of employee contributions. Additionally, the

Company may make an annual discretionary contribution to the plan, which may be made in the Company’s American

Depositary Receipts (ADRs) or cash. Aggregate contributions made to the tax incentive savings plan by the Company

for the years ended December 31, 2001, 2002, and 2003, were 9.1 million, 6.4 million and 5.3 million,

respectively.

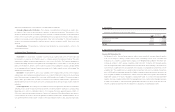

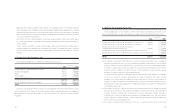

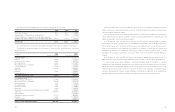

10 STOCK OPTION AND INCENTIVE PLANS

Stock Option Plan - Beginning in April 1998, certain officers and other key employee of the Company and its

subsidiaries were granted stock options of Luxottica Group under the Company’s stock option plan. The stock

options were granted at a price equal to the market value of the shares at the date of grant. These options become

exercisable in three equal annual installments from the date of grant and expire on or before January 31, 2012.

As Luxottica Group has elected to apply APB Opinion No. 25, no compensation expense was recognized

because the option exercise price was equal to the fair market value on the date of grant.

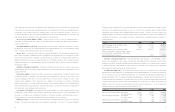

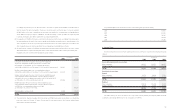

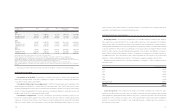

The following table summarizes key information pertaining to the Company’s defined benefit plan as of September

30, 2002, and 2003, the plan’s measurement date (thousands of Euro):

2002 2003

Change in benefits obligation:

•Benefit obligation, beginning of year 194,634 201,572

•Translation differences (29,365) (33,795)

•Service cost 10,518 10,599

•Interest cost 12,168 10,796

• Actuarial loss 20,219 9,025

•Benefits paid (6,602) (6,365)

Benefit obligation, end of year 201,572 191,832

Change in plan assets

•Fair value of plan assets, beginning of year 180,860 132,550

•Translation differences (27,323) (22,223)

•Actual return (loss) in plan assets (14,385) 16,730

•Employer contribution - 2,382

•Benefits paid (6,602) (6,365)

Fair value of plan assets, end of year 132,550 123,074

Funded status (69,022) (68,758)

Unrecognized net actuarial gain 56,644 51,138

Unrecognized prior service cost 3,439 2,303

Accrued benefit costs (8,939) (15,317)

Amounts recognized in the consolidated

balance sheets consist of the following:

Liabilities:

• Accrued pension cost 8,939 15,317

• Additional minimum liability 41,565 35,160

Liabilities - Other long-term liabilities 50,504 50,477

Asset - Intangible Asset 3,439 2,303

Equity - Other comprehensive income 38,126 32,587

Weighted average assumptions as of September 30:

• Discount rate 6.50% 6.00%

• Expected return on assets 9.00% 8.75%

• Rate of compensation increase 5.50% 4.75%