LensCrafters 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9796

by a guarantor in its financial statements about its obligation under certain guarantees it has issued. The initial

recognition and measurement provisions of this Interpretation are applicable on a prospective basis to guarantees

issued or modified after December 31, 2002, and the disclosure requirements are effective for financial statements

ending after December 15, 2002. The adoption of this Interpretation did not have a material impact on the Company’s

consolidated financial statements.

In December 2003, the FASB issued FIN No. 46 (revised December 2003), Consolidation of Variable Interest

Entities (“FIN 46-R”), to address certain FIN No. 46 implementation issues. This interpretation clarifies the application

of Accounting Research Bulletin No. 51, Consolidated Financial Statements, for companies that have interests in

entities that are Variable Interest Entities (VIE) as defined under FIN No. 46. According to this interpretation, if a

company has an interest in a VIE and is at risk for the majority of the VIE’s expected losses, or receives a majority of

the VIE’s expected gains, it shall consolidate the VIE. FIN No. 46-R also requires additional disclosures by primary

beneficiaries and other significant variable interest holders. For entities acquired or created before February 1, 2003,

this interpretation is effective no later than the end of the first interim or reporting period ending after March 15, 2004,

except for those VIE’s that are considered to be special purpose entities for which the effective date is no later than

the end of the first interim or annual reporting period ending after December 15, 2003. The Company does not hold

any significant interests in VIE’s that would require consolidation or additional disclosure.

In December 2003, the FASB issued SFAS No. 132 (revised December 2003), Employer's Disclosures about

Pensions and Other Postretirement Benefits ("SFAS No. 132-R"). SFAS No. 132-R amends the disclosure

requirements contained in SFAS No. 132 to require additional disclosures about assets, obligations, cash flows, and

net periodic benefit cost of the defined benefit pension plans and other post-retirement benefit plans. SFAS No. 132-R

is effective for the Company’s domestic plans beginning with fiscal years ending after December 15, 2003, and the

foreign plans beginning with fiscal years ending after June 15, 2004. The adoption of SFAS No. 132-R did not have a

material impact on the Company's consolidated financial statements.

In April 2003, the FASB issued SFAS No. 149, Amendment of Statement 133 on Derivative Instruments and

Hedging Activities. SFAS No. 149 amends and clarifies SFAS No. 133 for the financial accounting and reporting of

derivative instruments and hedging activities and requires that contracts with similar characteristics be accounted for

on a comparable basis. The provisions of SFAS No. 149 are effective for contracts entered into or modified after June

30, 2003, and for hedging relationships designed after June 30, 2003. The adoption of SFAS No.149 did not have a

material impact on the Company’s consolidated financial statements.

In May 2003, the FASB issued SFAS No. 150, Accounting for Certain Financial Instruments with Characteristics of

both Liabilities and Equity. SFAS No.150 establishes standards on the classification and measurement of certain

financial instruments with characteristics of both liabilities and equity. The provisions of SFAS No.150 are effective for

financial instruments entered into or modified after May 31, 2003, and to all other instruments that exist as of

beginning of the first interim financial reporting period beginning after June 15, 2003. The adoption of SFAS No. 150

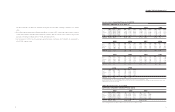

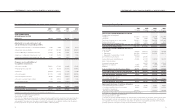

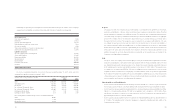

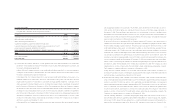

The fair value of options granted was estimated on the date of grant using the Black-Scholes option-pricing model

with the following weighted average assumptions:

2001 2002 2003

Dividend yield 0.53% 0.70% 1.06%

Risk-free interest rate 5.74% 4.48% 3.65%

Expected option life (years) 5 5 5

Expected volatility 53.58% 47.04% 36.00%

Weighted average fair value (Euro) 8.00 7.37 5.45

The Company recognizes forfeitures as they occur.

Derivative Financial Instruments - Effective January 1, 2001, Luxottica Group adopted SFAS No. 133,

Accounting for Derivative Instruments and Hedging Activities. SFAS No. 133, as amended and interpreted,

establishes accounting and reporting standards for derivative instruments, including certain derivative instruments

embedded in other contracts, and for hedging activities.

SFAS No. 133 requires that all derivatives, whether designed in hedging relationship or not, be recorded on the

balance sheet at fair value regardless of the purpose or intent for holding them. If a derivative is designated as a fair-

value hedge, changes in the fair value of the derivative and the related change in the hedge item are recognized in

operations. If a derivative is designated as cash-flow hedge, changes in the fair value of the derivative are recorded in

other comprehensive income (“OCI”) in the consolidated statement of shareholders’ equity and are recognized in the

consolidated statements of income when the hedged item affects operations. For a derivative that does not qualify as

a cash flow hedge, changes in fair value are recognized in operations.

Luxottica Group uses derivative financial instruments, principally interest rate and currency swap agreements as

part of its risk management policy to reduce its exposure to market risks from changes in interest and foreign

exchange rates. Although it has not done in the past, the Company may enter into other derivative financial

instruments when it assesses that the risk can be hedged effectively.

On January 1, 2001, as part of the transition adjustment related to the adoption of SFAS No. 133, the Company

recorded a liability for the fair value of the currency swap and recorded a reduction to OCI of approximately 7.7

million, net of tax (US$ 7 million) as a cumulative transition adjustment for its derivative as a cash flow type hedge

upon adoption SFAS No. 133.

Recent Accounting Pronouncements - In November 2002, the FASB issued FASB Interpretation (“FIN”) No.

45, Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of

Indebtedness of Other, which required that a guarantor recognize, at the inception of a guarantee, a liability for the fair

value of the obligation undertaken in issuing the guarantee. FIN No. 45 also elaborates on the disclosures to be made