LensCrafters 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111110

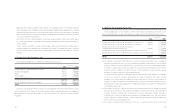

8LONG-TERM DEBT

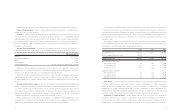

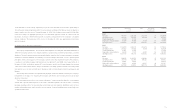

Long-term debt consisted of the following (thousands of Euro):

December 31, 2002 2003

Credit agreement with various financial institutions (a) 675,000 875,000

UniCredito Italiano credit facility (b) 333,810 115,107

Senior unsecured guaranteed notes (c) - 238,152

Capital lease obligations, payable in installments through 2005 1,040 745

Loans with banks and other third parties, interest at various rates (from 2.47 to 4.11

percent per annum), payable in installments through 2017.

Certain subsidiaries' fixed assets are pledged as collateral for such loans 24,139 24,423

Total 1,033,989 1,253,427

Less: current maturities (178,335) (390,935)

Long-term debt 855,654 862,492

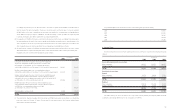

(a) In June 2000, the Company entered into a credit agreement with several financial institutions. The credit facility

provided for a total maximum borrowing of 500 million. This unsecured credit facility expired in June 2003, and

the amount outstanding was repaid in full.

In March 2001, the Company entered into a new credit facility with Banca Intesa S.p.A. to finance the acquisition

of Sunglass Hut International, as described earlier. The credit facility was unsecured and on December 27, 2002,

the amount outstanding at that date was repaid in full.

In December 2002, the Company entered into a new unsecured credit facility with Banca Intesa S.p.A. for a

maximum available line of 650 million. This line of credit includes a term portion of 500 million which will

require a balloon payment of 200 million in June 2004 and equal quarterly installments of principal of 50

million subsequent to that date. Interest accrues on the term portion based on Euribor as defined in the agreement

plus 0.45 percent (2.592 percent on December 31, 2003). The revolving portion allows the Company a maximum

line available of 150 million which can be borrowed and repaid until final maturity. At December 31, 2003, the

revolving portion was totally utilized. Interest accrues on the revolving loan at Euribor as defined in the agreement

plus 0.45 percent (2.594 percent on December 31, 2003). The final maturity of all outstanding principal amounts

and interest is December 27, 2005. The Company has the option to choose interest periods of one, two or three

months. The credit facility contains certain financial and operating covenants. The Company was in compliance

with these covenants as of December 31, 2003.

In December 2002, the Company entered into two interest rate swap transactions (the “Intesa Swaps”) beginning

with an aggregate maximum notional amount of 250 million, which will decrease by 100 million on June 27,

2004, and by 25 million during each subsequent three-month period. The Intesa Swaps will expire on

December 27, 2005. The Intesa Swaps were entered into as a cash flow hedge of a portion of the Banca Intesa

650 million unsecured credit facility disclosed above. As such, changes in the fair value of the Intesa Swaps are

included in OCI until they are realized in the financial statements. The Intesa Swaps exchange the floating rate

based on Euribor to a fixed rate of 2.985 percent per annum.

As disclosed in Note 4(c), in September 2003 the Company acquired 82.57 percent of the ordinary shares of

OPSM and more than 90 percent of performance rights and options of OPSM for an aggregate of A$ 442.7 million

(253.7 million), including acquisition expenses. The purchase price was paid for with the proceeds of a new

credit facility with Banca Intesa S.p.A. of 200 million, in addition to other short-term lines available. The new

credit facility includes a 150 million term loan, which will require equal semiannual installments of principal

repayments of 30 million starting September 30, 2006, until the final maturity date. Interest accrues on the term

loan at Euribor (as defined in the agreement) plus 0.55 percent (2.692 percent on December 31, 2003). The

revolving loan provides borrowing availability of up to 50 million; amounts borrowed under the revolving portion

can be borrowed and repaid until final maturity. At December 31, 2003, the revolving portion was totally utilized.

Interest accrues on the revolving loan at Euribor (as defined in the agreement) plus 0.55 percent (2.683 percent on

December 31, 2003). The final maturity of the credit facility is September 30, 2008. The Company can select

interest periods of one, two or three months. The credit facility contains certain financial and operating covenants.

The Company is in compliance with those covenants as of December 31, 2003.

In May 2003, the Company entered into an unsecured credit facility with Credito Emiliano (“Credem”) for a

borrowing of 25 million. This line of credit requires a ballon payment when it expires on November 2004. Interest

payments are due on a quarterly basis at fixed rate of 2.925 percent.

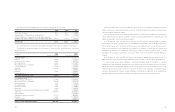

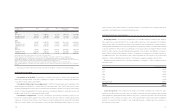

(b) In June 2002, U.S. Holdings, a U.S. subsidiary of the Company, entered into a US$ 350 million credit facility with a

group of four Italian banks led by UniCredito Italiano S.p.A. The credit facility is guaranteed by Luxottica Group and

matures in June 2005. The term loan portion of the credit facility provided US$ 200 million of borrowing and

requires equal quarterly principal installments beginning March 2003. The revolving loan portion of the credit facility

allows for a maximum borrowing of US$ 150 million. Interest accrues at Libor as defined in the agreement plus

0.5 percent (1.641 percent at December 31, 2003) and the credit facility allows the Company to select interest

periods of one, two or three months. The credit facility contains certain financial and operating covenants. The

Company is in compliance with those covenants as of December 31, 2003.

The U.S. subsidiary entered into a Convertible Swap Step-Up (“Swap 2002”) with an initial notional amount of

US$ 275 million which decreases quarterly by US$ 20 million starting March 17, 2003. The Swap 2002, expiration

date is June 17, 2005. Swap 2002, was entered into to convert the UniCredito floating rate credit agreement to a

mixed position rate agreement. Swap 2002, allows the U.S. subsidiary to pay a fixed rate of interest if Libor