LensCrafters 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9392

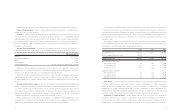

The Company’s goodwill was tested for impairment during the first half of 2002, and, in November 2002, in

connection with the announcement of the termination of the license agreement for the production and distribution of

the Giorgio Armani and Emporio Armani lines, and in 2003, as required by the provisions of SFAS No.142. Such tests

were performed at the reporting unit level. The result of this process was the determination that the carrying value of

each reporting unit of the Company was not impaired and, as a result, the Company has not recorded an asset

impairment charge.

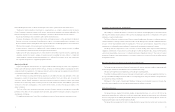

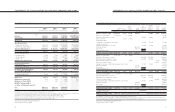

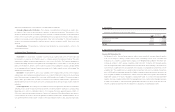

Actual results of operations for the year ended December 31, 2002, and 2003, and pro-forma results of operations

for the year ended December 31, 2001, had the Company applied the non-amortization provisions of SFAS No. 142

in those periods, follows (thousands of Euro, except per share amounts):

2001 2002 2003

Reported net income 316,373 372,077 267,343

Add: Goodwill amortization, net of tax 80,249 - -

Adjusted net income 396,622 372,077 267,343

Basic earnings per share (Euro):

Reported net income 0.70 0.82 0.60

Goodwill Amortisation 0.18 0.00 0.00

Adjusted net income 0.88 0.82 0.60

Diluted earnings per share (Euro):

Reported net income 0.70 0.82 0.59

Goodwill Amortisation 0.17 0.00 0.00

Adjusted net income 0.87 0.82 0.59

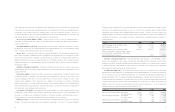

Trade Names - In connection with various acquisitions, Luxottica Group has recorded as intangible assets certain

trade names under the names of “LensCrafters”, “Ray-Ban”, “Sunglass Hut International” and “OPSM.” Trade names,

which the Company has determined have a finite life, continue to be amortized on a straight-line basis over periods

ranging from 20 to 25 years (see Note 6) and are subject to testing for impairment in accordance with SFAS No. 144,

Accounting for the Impairment or Disposal of Long-Lived Assets. Amortization of trade names for the years ended

December 31, 2001, 2002, and 2003, was 23.8 million, 36.1 million and 37.3 million, respectively.

Impairment of Long-Lived Assets - Luxottica Group’s long-lived assets, other than goodwill, are tested for

impairment whenever events or changes in circumstances indicate that the net carrying amount may not be

recoverable. When such events occur, the Company measures impairment by comparing the carrying value of the

long-lived asset to the estimated undiscounted future cash flows expected to result from the use of the assets and

Realized foreign exchange gains or losses during the year are recognized in consolidated income in such year.

Cash and Cash Equivalents - Luxottica Group considers investments purchased with a remaining maturity of

three months or less to be cash equivalents.

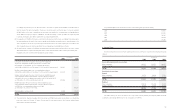

Inventories - Luxottica Group’s manufactured inventories, approximately 82.5 percent and 76.9 percent of total

frame inventory for the years 2002 and 2003, respectively, are stated at the lower of cost, as determined under the

weighted-average method (which approximates the first-in, first-out method, “FIFO”), or market value. Retail inventory

not manufactured by the Company or its subsidiaries are stated at the lower of cost, as determined on a retail last-in,

first-out method (“LIFO”) or FIFO or weighted-average cost, or market value. The LIFO reserve was not material as of

December 31, 2002, and 2003.

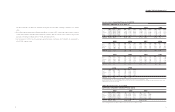

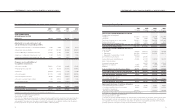

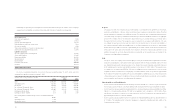

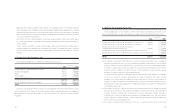

Property, Plant and Equipment - Property, plant and equipment are stated at historical cost. Depreciation is

computed principally on the straight-line method over the estimated useful lives of the related assets as follows:

Estimated Useful Life

Buildings 19 to 40 years

Machinery and equipment 3 to 12 years

Aircraft 25 years

Other equipment 5 to 8 years

Leasehold improvements lesser of 10 years or the remaining life of the lease

Maintenance and repair expenses are expensed as incurred. Upon the sale or disposition of property and

equipment, the cost of the asset and the related accumulated depreciation and leasehold amortization are removed

from the accounts and any resulting gain or loss is included in the statements of income.

During 2003, management determined that the useful lives of certain machinery and equipment were longer than

originally expected based upon useful lives of similar fully amortized assets which are still in use. A change in

accounting estimate was recognized to reflect this decision, resulting in an immaterial increase of net income for the

period.

Goodwill and Change in Accounting - In July 2001, the Financial Accounting Standards Board (“FASB”) issued

SFAS No. 141, Business Combinations, which requires all business combinations initiated after June 30, 2001, to be

accounted for under the purchase method. SFAS No. 141 also sets forth guidelines for applying the purchase method

of accounting in the determination of intangible assets, including goodwill acquired in a business combination, and

expands financial disclosures concerning business combinations consummated after June 30, 2001. The application

of SFAS No. 141 did not affect any previously reported amounts included in goodwill.

Effective January 1, 2002, Luxottica Group adopted SFAS No. 142, Goodwill and Other Intangible Assets, which

established new accounting and reporting requirements for goodwill and other intangible assets. SFAS No. 142

requires that goodwill amortization be discontinued and replaced with periodic tests of impairment.