LensCrafters 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109108

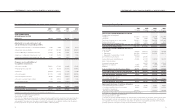

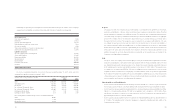

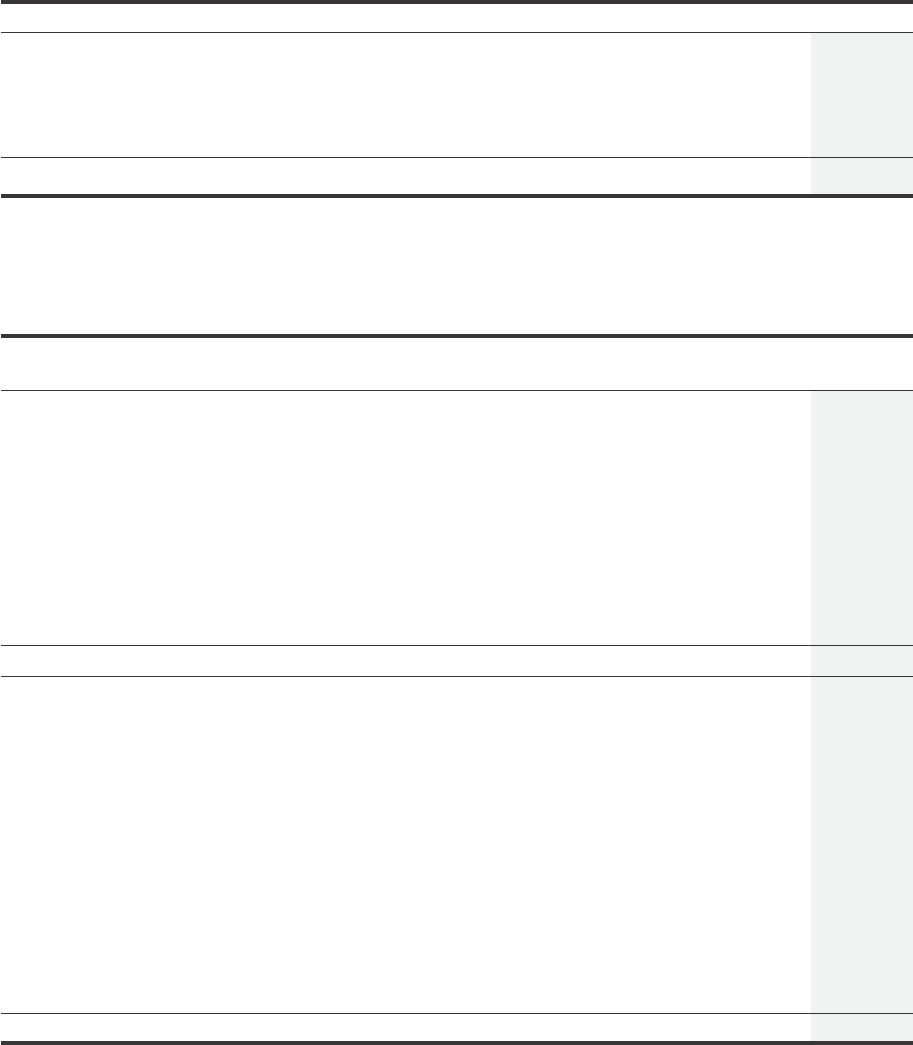

Reconciliation between the Italian statutory tax rate and the effective tax rate is as follows:

December 31, 2001 2002 2003

Italian statutory tax rate 40.3% 40.3% 38.3%

Aggregate effect of different rates in foreign jurisdictions (1.6%) (2.3%) (1.9%)

Permanent differences, principally losses in subsidiary companies

funded through capital contributions, net of non-deductible goodwill (10.7%) (7.8%) (6.3%)

Effective rate 28.0% 30.2% 30.1%

For income tax purposes, the Company and its Italian subsidiaries file tax returns on a separate company basis.

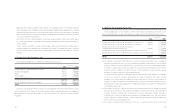

The deferred tax assets and liabilities as of December 31, 2002, and 2003, respectively were comprised of

(thousands of Euro):

December 31, 2002 2003

Deferred Tax Asset/(Liability) Deferred Tax Asset/(Liability)

Current portion:

Inventory 43,459 29,733

Insurance and other reserves 16,993 13,551

Recorded reserves 24,080 17,340

Net operating losses – carryforward 48,120 71,429

Loss on investments 14,128 5,452

Dividends (5,616) (13,112)

Trade name - (5,506)

Other, net 6,924 15,914

Valuation allowance - (10,350)

Net current deferred tax assets 148,088 124,451

Non-current portion:

Difference in basis of fixed assets (53,486) (53,003)

Net operating losses – carryforward 128,016 81,724

Sale of businesses 2,023 1,711

Recorded reserves 5,265 5,142

Occupancy reserves 5,473 4,040

Depreciation (3,042) (3,529)

Employee-related reserves (including minimum pension liability) 21,845 19,042

Trade name (104,643) (121,108)

Other intangibles - (10,734)

Trade mark accelerated amortization (55,777) (68,255)

Other, net 8,806 9,947

Valuation allowance (76,285) (26,079)

Net non-current deferred tax liabilities (121,805) (161,102)

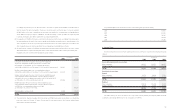

In 2003, the Italian statutory tax rate was reduced to 38.25 percent. As a consequence, deferred tax assets and

liabilities have been recomputed in line with the new tax rate. The immaterial result of the change in the Italian tax rate

has been included in deferred tax expense.

Tax years for Italian companies are open from 1998 and subject to review pursuant to Italian law. Certain Luxottica

Group companies have been subject to tax reviews for previous years. Management believes no significant unaccrued

liabilities are expected to arise from the related tax reviews.

As of December 31, 2003, the taxes that would be due on the distribution of retained earnings to the related

parent company, including net earnings of the year, of subsidiaries for 2003 and prior years would approximate 31.6

million. Luxottica Group has not provided an accrual for taxes on such distributions, nor has it provided an accrual for

taxes on its investments in such subsidiaries as the likelihood of distribution is remote and such earnings and

investments are deemed to be permanently reinvested. In connection with the earnings for 2003 of certain

subsidiaries, the Company has provided for an accrual for Italian income taxes related to declared dividends of

earnings.

As of December 31, 2002, and 2003, the Company has recorded an aggregate valuation allowance of 76.3

million and 36.4 million, respectively, against deferred tax assets recorded in connection with net operating losses.

In connection with various capital contributions, certain Italian subsidiaries, which file tax returns on a separate

company basis, have incurred net operating losses, which expire in five years from the period in which the tax loss

was incurred. Since it is management’s belief that since such net operating losses are not more likely than not to be

realized in future periods, valuation allowances have been recorded in the Company’s consolidated financial

statements. Management will continue to evaluate the likelihood of realizing such deferred tax assets and will reverse

the related valuation allowance when the realization of the deferred tax assets become more likely than not.