LensCrafters 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113112

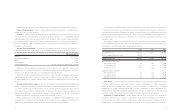

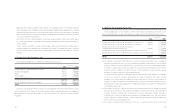

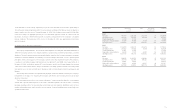

9EMPLOYEE BENEFITS

Liability for Termination Indemnities - The liability for termination indemnities represents amounts accrued for

employees in Australia, Austria, Greece, Israel, Italy and Japan, determined in accordance with labor laws and labor

agreements in each respective country. Each year, the Company adjusts its accrual based upon headcount, changes

in compensation level and inflation. This liability is not funded. Therefore, the accrued liability represents the amount

that would be paid if all employees were to resign or be terminated as of the balance sheet date. This treatment is in

accordance with SFAS No. 112, Employers' Accounting for Post Employment Benefits, which requires employers to

expense the costs of benefit paid before retirement (i.e. severance) over the service lives of employees. The charge to

earnings during the years ended December 31, 2001, 2002, and 2003, aggregated 7.8 million, 5.7 million and

12.5 million, respectively.

Defined Benefit Plans - During 1998, U.S. Holdings merged all of its pension plans into a single plan sponsored

by a U.S. subsidiary. This plan covers substantially all employees of the U.S. subsidiaries and affiliates. This pension

plan was amended effective January 1, 2002, to allow the employees of Sunglass Hut International to participate in

the plan.

The Company’s funding policy is in accordance with minimum funding requirements of the U.S. Employee

Retirement Income Security Act of 1974 as amended. No contributions were made in 2001, and 2002. Net periodic

pension cost for the years ended December 31, 2001, 2002, and 2003, includes the following components

(thousands of Euro):

December 31,

2001 2002 2003

Service cost 9,777 11,670 11,805

Interest cost 12,902 13,501 12,025

Expeted return on plan assets (16,124) (16,279) (13,321)

Amortization of actuarial loss - - 294

Amortization of prior service cost 780 745 623

Net periodic pension cost 7,335 9,637 11,426

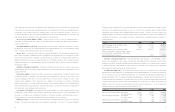

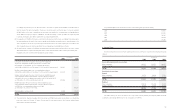

remains under certain defined thresholds and for the U.S. subsidiary to receive an interest payment of the three

months Libor rate as defined in the agreement. This amount is settled net every three months. This derivative

instrument does not qualify for hedge accounting under SFAS No. 133 and as such is marked to market with the

gain or losses from the change in value included in the consolidated income statements. A loss of 2.6 million

and a gain of 635 thousands are included in current operations in 2002, and 2003, respectively.

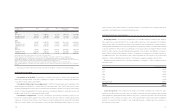

(c) On September 3, 2003, U.S. Holdings closed a private placement of US$ 300 million (238 million) of senior

unsecured guaranteed notes (the “Notes”), issued in three series (Series A, Series B and Series C). Interest on the

Series A Notes accrues at 3.94 percent per annum and interest on Series B and Series C Notes accrues at 4.45

percent per annum. The Series A and Series B Notes mature on September 3, 2008, and the Series C Notes

mature on September 3, 2010. The Series A and Series C Notes require annual prepayments beginning on

September 3, 2006, through the applicable Notes date of maturity. The Notes are guaranteed on a senior

unsecured basis by the Company and Luxottica S.r.l., a wholly-owned subsidiary. The Notes can be prepaid at

U.S. Holdings option under certain circumstances. The proceeds from the Notes were used for the repayment of

outstanding debt and for other working capital needs. The Notes contain certain financial and operating

covenants. The Company is in compliance with those covenants as of December 31, 2003.

In connection with the issuance of the Notes, U.S. Holdings entered into three interest rate swap agreements with

Deutsche Bank AG (the “DB Swap”). The three separate agreements, notional amounts, and interest payment

dates coincide with the Notes. The DB Swap exchanges the fixed rate of the Notes to a floating rate of the six

month Libor rate plus 0.6575 percent for the Series A Notes and to a floating rate of the six month Libor rate plus

0.73 percent for the Series B and Series C Notes. These swaps are treated as fair value hedges of the related

debt and qualify for the shortcut method of hedge accounting (assuming no ineffectiveness in a hedge in an

interest rate swap). Thus the interest income/expense on the swaps is recorded as an adjustment to the interest

expense on the debt effectively changing the debt from a fixed rate of interest to the swap rate.

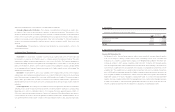

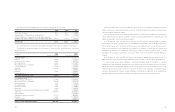

Long-Term debt matures in the years subsequent to December 31, 2004, as follows (thousands of Euro):

Years ending December 31,

2005 404,525

2006 93,791

2007 123,339

2008 209,104

2009 10,510

Subsequent Years 21,223

TOTAL 862,492