LensCrafters 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9190

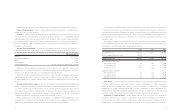

1ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Organization - Luxottica Group S.p.A. and its subsidiaries (collectively "Luxottica Group" or the "Company")

operates in two industry segments: manufacturing and wholesale distribution, and retail distribution. Through its

manufacturing and wholesale distribution operations, Luxottica Group is engaged in the design, manufacturing,

wholesale distribution and marketing of house and designer brand lines of mid- to premium-priced prescription frames

and sunglasses. The Company operates in the retail segment through its Retail Division, consisting of LensCrafters,

Inc. and other affiliated companies (“LensCrafters”), Sunglass Hut International, Inc. and its subsidiaries (“Sunglass

Hut International”) and, since August 2003, OPSM Group Limited and its subsidiaries (“OPSM”). As of December 31,

2003, LensCrafters operated 877 stores throughout the U.S. and Canada; Sunglass Hut International operated 1,905

stores located in North America, Europe and Australia; and, OPSM operated 600 stores trading under three brands

across all states and territories in Australia as well as New Zealand, Hong Kong, Singapore and Malaysia.

Principles of Consolidation and Basis of Presentation - The consolidated financial statements of Luxottica

Group include the financial statements of the parent company and all wholly- or majority-owned Italian and foreign

subsidiaries. The Company's investments in unconsolidated subsidiaries which are at least 20 percent owned and

where the Company exercises significant influence over operating and financial policies are accounted for using the

equity method. Luxottica Group holds a 44 percent interest in an affiliated manufacturing and wholesale distributor,

located in India, and a 50 percent interest in an affiliated company located in the United Kingdom, which are both

accounted for under the equity method. The results of operations of these investments are not material to the results

of the operations of the Company. Investments in other companies with less than a 20 percent interest are carried at

cost. All significant intercompany accounts and transactions are eliminated in consolidation. Luxottica Group prepares

its consolidated financial statements in accordance with accounting principles generally accepted in U.S. (“U.S.

GAAP”).

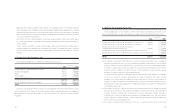

Foreign Currency Translation and Transactions - Luxottica Group accounts for its foreign currency

denominated transactions and foreign operations in accordance with Statement of Financial Accounting Standards

(“SFAS”) No. 52, Foreign Currency Translation. The financial statements of foreign subsidiaries are translated into Euro,

which is the functional currency of the parent company and the reporting currency of the Company. Assets and

liabilities of foreign subsidiaries, which use the local currency as their functional currency, are translated at year-end

exchange rates. Results of operations are translated using the average exchange rates prevailing throughout the year.

The resulting cumulative translation adjustments have been recorded as a separate component of accumulated other

comprehensive income/(loss), net of tax. Transactions in foreign currencies are recorded at the exchange rate in effect

at the transaction date.

The Company has one subsidiary in a highly inflationary country. However, the operations of such subsidiary are

currently not material to the Company’s consolidated financial statements.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS