LensCrafters 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101100

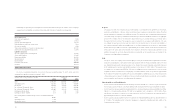

First American Health Concepts, Inc.

During 2001, Luxottica Group acquired all outstanding shares of First American Health Concepts, Inc. (“FAHC”), a

publicly traded company on the American Stock Exchange, for approximately 27.7 million (US$ 23.5 million), net

of cash acquired (3.6 million or US$ 3 million). FAHC markets and administers vision care plans throughout the

U.S.. FAHC tangible assets and liabilities assumed were insignificant individually and in aggregate and, accordingly,

substantially the entire purchase price was allocated to goodwill. No pro-forma financial information is presented,

as the acquisition was not material to the Company’s consolidated financial statements.

OPSM Group Limited

In May 2003, Luxottica Group formed an indirect wholly-owned subsidiary in Australia, Luxottica South Pacific Pty

Limited, for the purpose of making a cash offer for all outstanding shares, options and performance rights of

OPSM Group Limited (“OPSM”), a publicly traded company on the Australian Stock Exchange. The cash offer

commenced on June 16, 2003, has received acceptances which increased Luxottica’s relevant interest in OPSM

shares to 50.68 percent on August 8, 2003, and was completed on September 3, 2003. At the close of the offer,

Luxottica South Pacific held 82.57 percent of OPSM’s ordinary shares. As consequence of the acquisition, all

options and performance rights were cancelled. As a result of Luxottica South Pacific Pty Limited acquiring the

majority of OPSM’s shares on August 8, 2003, OPSM’s financial position and results of operations are

consolidated into the Company’s financial statements as of August 1, 2003. Results of operations for the seven

day period ended August 7, 2003, were immaterial. The acquisition was accounted for in accordance with SFAS

No.141, and accordingly, the purchase price of 253.7 million or Australian Dollar (“A$”) 442.7 million (including

approximately A$ 7.2 million of acquisition-related expenses) was allocated to the assets acquired and liabilities

assumed based on their fair value at the date of the acquisition. This included an independent valuation of the

value of intangibles, including trade names which have been appraised in 141 million (A$ 246 million). The

valuation of OPSM’s acquired assets and assumed liabilities is preliminary and, as a result, the allocation of the

purchase price is subject to modification. Management believes that the valuation will be finalized by June 2004.

The acquisition of OPSM was made as result of the Company’s strategy to expand its retail business in Australia

and New Zealand and become a leading player in the Australian prescription segment.

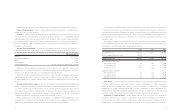

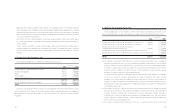

The purchase price and expenses have been allocated based upon the valuation of the Company’s acquired

assets and liabilities assumed as follows:

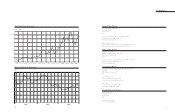

Thousands of Euro

Assets purchased:

Cash and cash equivalents 17,023

Inventories 90,034

Property, plant and equipment 113,212

Prepaid expenses and other current assets 14,717

Accounts receivable 2,161

Trade name (useful life of 25 years, no residual value) 340,858

Other assets including deferred tax assets 34,657

Liabilities assumed:

Accounts payable and accrued expenses (101,020)

Other current liabilities (52,200)

Deferred tax liabilities (135,340)

Long-term debt (128,691)

Bank overdraft (104,155)

Fair Value of Net Assets 91,256

Goodwill 466,790

TOTAL PURCHASE PRICE 558,046

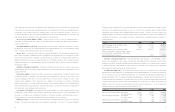

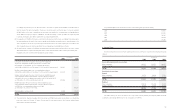

Pro-forma consolidated statements of income for the year ended December 31, 2001, assuming the acquisition

took place on January 1, 2001:

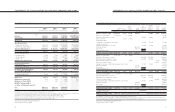

Thousands of Euro, except per share data - Unaudited December 31,

2001

Sales 3,211,063

Operating Income 490,998

Net Income 297,851

No. of Shares (Thousands) - Basic 451,037

No. of Shares (Thousands) - Diluted 453,965

Earnings per Share (Euro) - Basic 0.66

Earnings per Share (Euro) - Diluted 0.66