LensCrafters 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.39

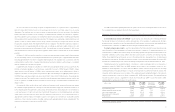

applicable Notes date of maturity. The Notes are guaranteed on a senior unsecured basis by Luxottica Group and

Luxottica S.r.l.. The Notes can be prepaid at U.S. Holdings option under certain circumstances. The proceeds from

the Notes were used for the repayment of outstanding debt and for other working capital needs.

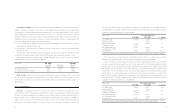

In September 2003, the Company acquired 82.57 percent of the ordinary shares of OPSM and more than 90

percent of performance rights and options of OPSM for an aggregate of A$ 442.7 million (253.7 million). The

purchase price was paid for with the proceeds of a new credit facility with Banca Intesa S.p.A. of 200 million, in

addition to other short-term lines available. The new credit facility includes a 150 million term loan, which will require

equal semiannual installments of principal repayments of 30 million starting September 30, 2006, until the final

maturity date. Interest accrues on the term loan at Euribor (as defined in the agreement) plus 0.55 percent (2.692

percent on December 31, 2003). The revolving loan provides borrowing availability of up to 50 million; amounts

borrowed under the revolving portion can be borrowed and repaid until final maturity. Interest accrues on the revolving

loan at Euribor (as defined in the agreement) plus 0.55 percent (2.683 percent on December 31, 2003). The final

maturity of the credit facility is September 30, 2008. Luxottica Group can select interest periods of one, two or three

months. The credit facility contains certain financial and operating covenants. Under this credit facility, 200 million

was outstanding as of December 31, 2003.

38

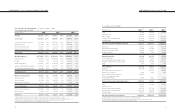

in March 2003. The revolving loan portion of the credit facility allows for maximum borrowings of US$ 150 million.

Interest accrues under the credit facility at Libor (as defined in the agreement) plus 0.5 percent (1.641 percent on

December 31, 2003) and the credit facility allows U.S. Holdings to select interest periods of one, two, or three

months. The credit facility contains certain financial and operating covenants. Under this credit facility, US$ 145 million

was outstanding as of December 31, 2003.

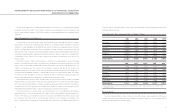

In June 1999, Luxottica Group acquired the Ray-Ban business from Bausch & Lomb Incorporated for a purchase

price of US$ 655 million (635 million), subject to post-closing adjustments. The purchase price was paid with the

proceeds of a US$ 650 million (630 million) credit facility with UniCredito Italiano S.p.A. In June 2000, Luxottica

Group refinanced this short-term credit facility with a new credit facility with several financial institutions under which

the total maximum borrowings was 500 million. All amounts outstanding under this credit facility were repaid, and

the credit facility was terminated in June 2003.

In December 2000, Luxottica Group entered into a credit facility providing for maximum borrowing of 256 million

from San Paolo IMI S.p.A. Bank. This credit facility matured in June 2002, and the amount outstanding at that time

was repaid in full.

In March 2001, Luxottica Group entered into a credit facility with Banca Intesa S.p.A. to finance the acquisition of

Sunglass Hut International. The credit facility was unsecured and scheduled to expire in September 2002. In

September 2002, Luxottica Group agreed with Banca Intesa S.p.A. to extend the credit facility until December 2002,

on the same terms and conditions. On December 27, 2002, the amount outstanding at that time of 500 million was

repaid in full.

In December 2002, Luxottica Group entered into a new unsecured credit facility with Banca Intesa S.p.A. The new

unsecured credit facility provides borrowing availability of up to 650 million. The facility includes a 500 million term

loan, which will require a balloon payment of 200 million in June 2004 and equal quarterly installments of principal

repayments of 50 million subsequent to that date. Interest accrues on the term loan at Euribor (as defined in the

agreement) plus 0.45 percent (2.592 percent on December 31, 2003). The revolving loan provides borrowing

availability of up to 150 million; amounts borrowed under the revolving portion can be borrowed and repaid until

final maturity. Interest accrues on the revolving loan at Euribor (as defined in the agreement) plus 0.45 percent (2.594

percent on December 31, 2003). The final maturity of the credit facility is December 31, 2005. Luxottica Group can

select interest periods of one, two, three or six months. The credit facility contains certain financial and operating

covenants. Under this credit facility, 650 million was outstanding as of December 31, 2003.

On September 3, 2003, U.S. Holdings closed a private placement of US$ 300 million of senior unsecured

guaranteed notes (the “Notes”), issued in three series (Series A, Series B and Series C). Interest on the Series A Notes

accrues at 3.94 percent per annum and interest on Series B and Series C Notes accrues at 4.45 percent per annum.

The Series A and Series B Notes mature on September 3, 2008, and the Series C Notes mature on September 3,

2010. The Series A and Series C Notes require annual prepayments beginning on September 3, 2006, through the