LensCrafters 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4342

At the Annual Ordinary Shareholders’ Meeting of Luxottica Group S.p.A. to be held in Milan, Italy on June 17,

2004, on first call, the Group’s Board of Directors will submit to shareholders for approval the distribution of a cash

dividend for fiscal year 2003 of 0.21 per ordinary share, or 0.21 per American Depositary Share (“ADS”) (one ADS

represents one ordinary share). The proposed cash dividend for fiscal year 2003 compares with a cash dividend

payment for fiscal year 2002 of 0.21 per ordinary share, or 0.21 per ADS.

If approved, Luxottica Group will pay the dividend to all holders of ordinary shares of record as of June 18, 2004,

and to all holders of the Group’s American Depositary Receipts (“ADR”) of record as of June 23, 2004. Luxottica

Group’s ADR holders of record as of June 23, 2004, thus entitled to such dividend, will have purchased the ADSs on

or before June 18, 2004. Both the ordinary shares listed on the Mercato Telematico Azionario (“MTA”), and the ADSs

listed on the New York Stock Exchange (“NYSE”), will trade ex-dividend as of June 21, 2004.

The dividend will be paid in Euro on June 24, 2004, by Monte Titoli S.p.A., as authorized intermediary, to all

ordinary shares’ depositary banks. For holders of ADRs, the dividend will be paid to The Bank of New York, depositary

bank of Luxottica Group’s ordinary shares represented by ADSs, through UniCredito Italiano S.p.A., as custodian

under the Depositary Agreement between Luxottica Group and The Bank of New York. The Bank of New York

anticipates that the dividend will be payable to all ADR holders starting on July 1, 2004, upon satisfaction of the

documentation requirements referred to below, at the Euro/U.S. Dollar exchange rate in effect on June 24, 2004.

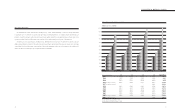

The following table lists the cash dividend amounts paid by Luxottica Group over the past ten years, since 1994.

All dividend amounts are gross. Additionally, data has been retroactively adjusted to reflect the stock splits that took

place in July 1992, April 1998 and June 2000.

PROPOSED DIVIDEND FOR FISCAL YEAR 2003

GROSS DIVIDEND PER ORDINARY SHARE (OR AMERICAN DEPOSITARY SHARE) (1) (4)

Euro (5) U.S. Dollars (2)

2003 0.210 (*)N.A. (3)

2002 0.210 0.242

2001 0.170 0.165

2000 0.140 0.120

1999 0.085 0.081

1998 0.074 0.075

1997 0.063 0.068

1996 0.052 0.059

1995 0.045 0.057

1994 0.041 0.049

(*) Proposed by the Board of Directors and to be submitted for approval to the Annual Shareholders’ Meeting on June 17, 2004

(1) One ADS = one ordinary share

(2) Converted by The Bank of New York at the Lira/U.S. Dollar exchange rate on, respectively, July 8, 1994, July 6, 1995, July 5, 1996, July 7, 1997,

July 6, 1998 and at the Euro/U.S. Dollar exchange rate on July 9, 1999, July 6, 2000, July 12, 2001, July 5, 2002 and July 3, 2003.

(3) If approved, the dividend per share will be converted into U.S. Dollars by The Bank of New York on June 24, 2004

(4) Figures from 1994 to 1999 have been retroactively adjusted to reflect the five-for-one stock split which was effective April 16, 1998, and the two-for-

one stock split which was effective June 26, 2000

(5) Figures through 1999 have been calculated converting the dividend in Italian Lira by the fixed rate of Lire 1,936.27 = 1.00. Beginning with the

2000 financial statements the dividend is declared in Euro.

TAX REGIME - HOLDERS OF ORDINARY SHARES

The gross amount of dividend paid to shareholders of Italian listed companies, whose shares are registered in a

centralized deposit system managed by Monte Titoli S.p.A. and who are individuals and Italian resident for tax

purposes, will be subject to a 12.5 percent final substitute tax, provided the shareholding is not related to the conduct

of a business and that these individuals do not hold a “qualified” shareholding. The 12.5 percent final substitute tax will

not be applied only if they timely declare that they satisfy the relevant requirements (e.g. qualified shareholding or

related to the conduct of a business).

This substitute tax will be levied by the Italian authorized intermediary that participates in the Monte Titoli system

and with which the securities are deposited, as well as by non-Italian centralized deposit system participating in the

Monte Titoli system (directly or through a non-Italian deposit system participating in the Monte Titoli system), through a

fiscal representative to be appointed in Italy.

Individuals who timely declare that they hold a qualified shareholding or related to the conduct of a business, will

receive the gross amounts of dividends paid and include dividends in their worldwide taxable income, subject to the