LensCrafters 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

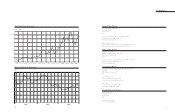

77

CAPITAL STOCK INFORMATION

the Meeting, must be accompanied by a detailed report concerning the personal and professional background of the

candidates.

The Board of Statutory Auditors appointed by the Shareholders’ Meeting on June 25, 2003, which will remain in

office until it has approved Luxottica Group’s financial statements for fiscal year 2005, consists of the following

individuals:

• Giancarlo Tomasin (Chairman)

• Walter Pison (Statutory Auditor)

• Mario Medici (Statutory Auditor)

• Giuseppe Luigi Tacca (alternate Statutory Auditor)

• Mario Bampo (alternate Statutory Auditor).

For the appointment of the Board of Statutory Auditors the minority submitted no list.

A complete version of Luxottica Group’s Corporate Governance is available from the Company’s corporate

website at www.luxottica.com.

76

SNAPSHOT

• Listed on the NYSE and Milan, Italy-MTA since 1990 and 2000, respectively.

• Luxottica Group’s ordinary shares and ADSs trade on both exchanges under the stock symbol LUX

• One NYSE-listed ADS represents one MTA-listed ordinary share

• As of December 31, 2003, Luxottica Group’s authorized share capital was 27,268,621.98, equivalent to

454,477,033 ordinary shares.

• The per share par value of Luxottica Group’s ordinary shares is 0.06

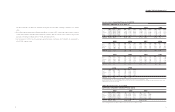

DETAILS OF LUXOTTICA GROUP’SCAPITAL STOCK INFORMATION

• Luxottica Group S.p.A listed on the New York Stock Exchange (NYSE) on January 23, 1990. At the time of the

Initial Public Offering, 10,350,000 ordinary shares were sold, equivalent to 5,175,000 American Depositary Shares

(ADS) (one ADS equals two ordinary shares). The issue price was US$ 19 per ADS.

• For over ten years, Luxottica Group’s ordinary shares did not trade and were listed on Milan’s Mercato Telematico

Azionario (MTA) on December 4, 2000. In conjunction with the listing, 10,385,000 additional ordinary shares were

sold. The issue price was 16.83 per ordinary share.

• The Group’s shares trade on both exchanges under the stock symbol LUX.

• In June 1992, the Group’s Board of Directors approved a change in the conversion ratio of the ADS to 1:1, from

2:1. The change in the conversion ratio, effective from July 10, 1992, did not affect the number of ordinary shares

outstanding, which remained 45,050,000, while holders of the Group’s ADRs received one additional ADR per each

ADR held.

• At the Extraordinary Shareholders’ Meeting held in Milan on March 10, 1998, shareholders approved a five-for-one

split of the Group’s ordinary shares. The stock split resulted in an increase in the number of the Group’s authorized

ordinary shares to 225,250,000, from 45,050,000, and a consequent reduction in par value to Italian Lire 200 per

ordinary share, from Italian Lire 1,000 per ordinary share. The stock split, effective on April 16, 1998, had no effect

on the Group’s authorized share capital, which remained valued at Italian Lire 45,050,000,000. Each ADS

continued to represent one Luxottica Group’s ordinary share.

• At the Extraordinary Shareholders’ Meeting held in Milan on May 3, 2000, shareholders approved a two-for-one

stock split of the Group’s ordinary shares. The stock split, effective on June 26, 2000, resulted in an increase in the

number of the Group’s authorized ordinary shares to 462,750,000, from 231,375,000, and a consequent reduction

in par value to Italian Lire 100 per ordinary share, from Italian Lire 200 per ordinary share. Therefore, the stock split,

effective on June 26, 2000, had no effect on the Group’s authorized share capital, which remained valued at Italian