LensCrafters 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5554

STRATEGY

Based on the above described competitive advantages, management of Luxottica Group has set forth the

following as the main points of the Group’s strategy:

INCREASED MARKET PENETRATION INTHE SUN SEGMENT

Over the coming years, the Group will look to continue to expand its presence in the sun segment because of the

significant growth opportunities that this segment is expected to present.

The acquisitions of Ray-Ban and Sunglass Hut International have positioned Luxottica Group as the world’s

leader in the production and marketing of mid- to premium-priced sunglasses. Luxottica Group believes that, over

the coming years, the sun segment will show growth rates greater than those of the prescription frame market, as a

result of:

• A rise in the number of consumers who perceive sunglasses as a fashion accessory;

• Greater awareness of the potential dangers of exposure to ultraviolet rays;

• More time dedicated to leisure activities that require the use of sunglasses;

• Increased use of sunglasses from individuals who either wears contact lenses or undergo laser surgery.

OPTIMIZED PORTFOLIO OFBRANDS

Luxottica Group does not look to merely increase the number of brands in its portfolio, but rather focus on those

that have the greatest growth potential and a recognized appeal in key markets worldwide. Similarly, it will also

continuously evaluate opportunities to acquire new brands or licenses to substitute to those that, once expired, it is no

longer interested in renewing.

Luxottica Group’s strategy is to optimize a portfolio of brands that, with approximately 2,450 models, is already

one of the largest and best balanced in the sector. The Group continuously works on improving its product mix, to

focus on the mid- to premium-priced segments of the market, while limiting potential cannibalization among

competing lines. Within this context, the agreements with Prada and Versace signed in 2003 were important steps in

the optimization of the Group’s brand portfolio.

FURTHER COMMERCIAL EXPANSION

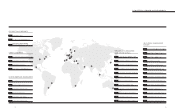

Luxottica Group’s products are distributed in the major markets worldwide through 28 wholly- or partially-owned

wholesale subsidiaries, and through independent distributors in the markets in which the Group does not have a direct

presence.

The Group plans to further expand on an ongoing basis its global wholesale distribution network through the

opening of additional subsidiaries. As part of this plan, Luxottica Group is testing smaller scale, more flexible

wholesale subsidiaries in the markets in which the costs associated with opening a full-scale, traditional wholesale

subsidiary would not be justified. These would still allow the Group to directly control distribution in these markets.

Furthermore, the Group intends to strengthen its retail presence in North America and Australia, where it has

acquired important experience while posting strong results, by launching every year a new store opening plan and

carefully considering relevant opportunities. The acquisition in 2003 of OPSM Group, Australia’s leading optical retailer,

was another important step in this direction, immediately establishing Luxottica Group as a leader in important

markets such as Australia and New Zealand.