LensCrafters 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

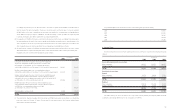

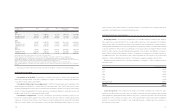

105104

- During 2002, the Company acquired six retail companies for an aggregate amount of 35.0 million (US$ 33.5

million). All tangible assets and liabilities assumed were insignificant individually and in aggregate and, accordingly,

substantially the entire purchase price was allocated to goodwill. No pro-forma financial information is presented,

as the acquisitions were not material to the Company’s consolidated financial statements. One of these companies

is accounted for under the equity method.

- At the end of 2002, the Company established a new wholly-owned subsidiary in China, Luxottica Tristar Optical

Co., with an initial investment of 3.8 million. The subsidiary is engaged in the manufacturing and distribution of

frames worldwide.

- In 2003, Luxottica Holland B.V., a wholly-owned subsidiary, acquired the remaining interest in Mirari Japan, a

wholesale distributor for an aggregate cash consideration of 18 million. The subsidiary has been accounted for

as step acquisition and the Company has recorded goodwill of approximately 16.9 million in connection

therewith.

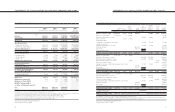

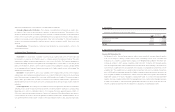

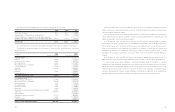

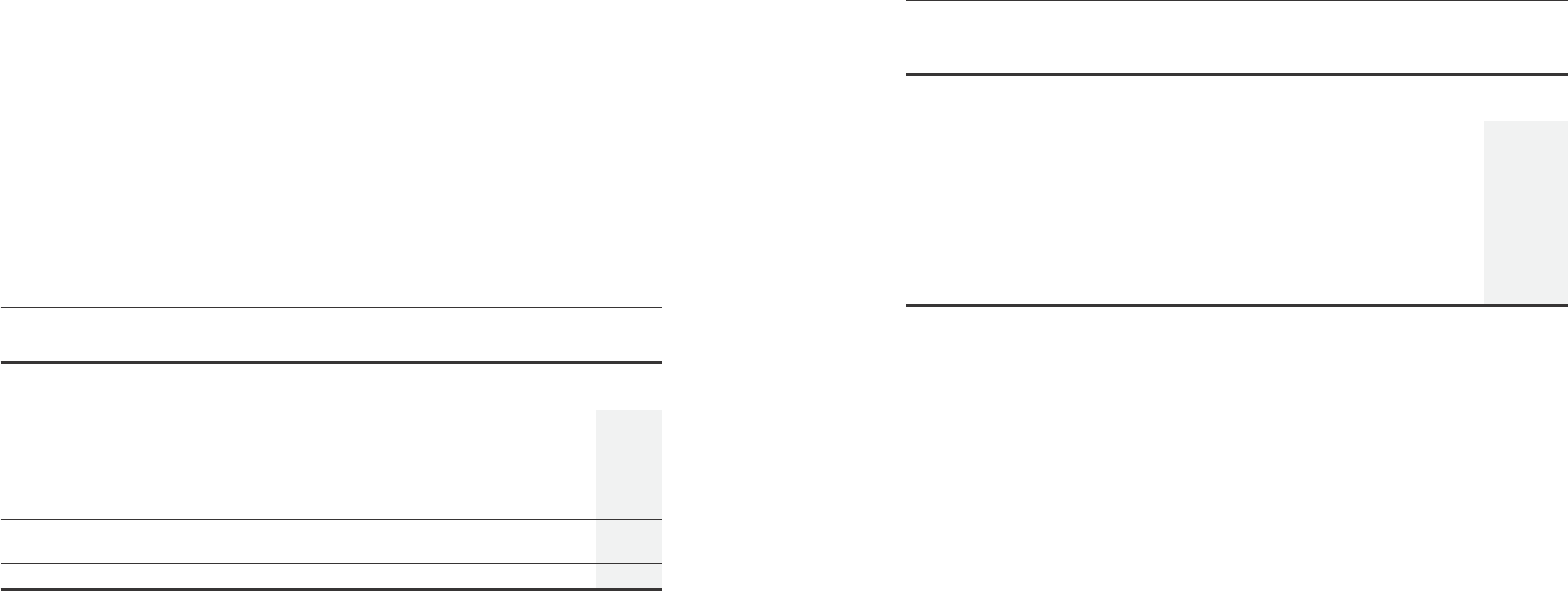

5PROPERTY,PLANT AND EQUIPMENT - NET

Property, plant and equipment-net consisted of the following (thousands of Euro):

December 31,

2002 2003

Land and buildings, including leasehold improvements 451,900 416,752

Machinery and equipment 366,027 428,644

Aircraft 25,185 25,908

Other equipment 263,340 268,138

Building, held under capital lease 2,332 2,332

1,108,784 1,141,774

Less: accumulated depreciation and amortization (602,239) (644,339)

TOTAL 506,545 497,435

Depreciation and amortization expense of property, plant and equipment for the years ended December 31, 2001,

2002, and 2003, was 101.1 million, 103.8 million and 92.2 million, respectively. Included in other equipment is

approximately 25.1 million and 16.5 million of construction in progress as of December 31, 2002, and 2003,

respectively.

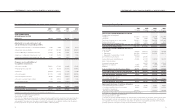

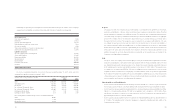

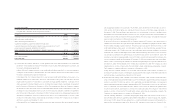

6GOODWILL AND INTANGIBLE ASSETS - NET

Certain goodwill balances are denominated in currencies other than Euro (the reporting currency) and as such,

balances may fluctuate due to changes in exchange rates, Goodwill consisted of the following (thousands of Euro):

December 31,

2002 2003

Goodwill, which arose in connection with the acquisition of LensCrafters, (a). 489,944 407,801

Goodwill, which arose in connection with the acquisition of Ray-Ban, (b). 228,354 228,354

Goodwill, which arose in connection with the acquisition

of Sunglass Hut International, (see Note 4) (c). 409,036 373,216

Goodwill, which arose in connection with the acquisition of OPSM (see Note 4) (d). - 153,976

Goodwill, which arose in connection with other business acquisitions, (see note 4) (e).117,326 165,567

TOTAL 1,244,660 1,328,914

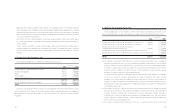

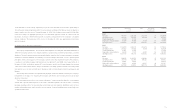

(a) The acquisition of LensCrafters in May 1995 was accounted for by the purchase method and, accordingly, the

purchase price has been allocated to the assets acquired and the liabilities assumed based on their fair values at

the date of acquisition. The excess of purchase price over the fair value of net assets acquired (US$ 698.9 million

at the date of acquisition) was recorded as goodwill in the accompanying consolidated balance sheets. With the

Company’s adoption of SFAS No. 142, effective January 1, 2002, goodwill is no longer subjected to periodic

amortization, but rather is subjected to an annual impairment test.

In connection with the acquisition of LensCrafters, Luxottica Group recorded certain liabilities for commitments

and other costs expected to be paid in future periods. As a result of negotiations with vendors and other

settlements, the Company settled these liabilities at an amount less than the accrual set up at the date of the

acquisition. Accordingly, included in the consolidated statements of income for fiscal 2001, and 2002, is income of

approximately 10.1 million (US$ 9 million) and 3.8 million (US$ 4.0 million), net of taxes, for the final settlement

of these liabilities, respectively.

(b) The acquisition of Ray-Ban in 1999 was accounted for by the purchase method and, accordingly, the purchase

price has been allocated to the assets acquired and the liabilities assumed based on their fair values at the date of

acquisition. The excess of purchase price over the fair value of net assets acquired (272.9 million at the date of

acquisition) was recorded as goodwill in the accompanying consolidated balance sheets. With the Company’s

adoption of SFAS No. 142 effective January 1, 2002, goodwill is no longer subjected to periodic amortization, but

rather is subjected to an annual impairment test.

(c) The acquisition of Sunglass Hut International in 2001, was accounted for by the purchase method and,