LensCrafters 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107106

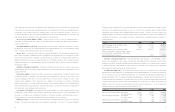

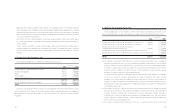

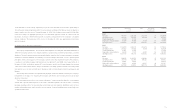

accordingly, the purchase price has been allocated to the assets acquired and the liabilities assumed based on

their fair values at the date of acquisition. The excess of purchase price over the fair value of net assets acquired

(466.8 million at the date of acquisition) was recorded as goodwill in the accompanying consolidated balance

sheets. With the Company’s adoption of SFAS No. 142 effective January 1, 2002, goodwill is no longer subjected

to periodic amortization, but rather is subjected to an annual impairment test.

(d) The acquisition of OPSM in 2003 was accounted for by the purchase method and, accordingly, the purchase price

has been preliminary allocated to the assets acquired and the liabilities assumed based on their fair values at the

date of acquisition. The excess of purchase price over the fair value of net assets acquired (151.4 million at the

date of acquisition) was recorded as goodwill in the accompanying consolidated balance sheets.

(e) Goodwill was also created as the difference between the purchase price paid over the value of net assets of many

additional businesses acquired, resulting from retail locations and wholesales entities over the past several years.

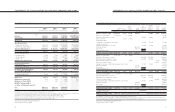

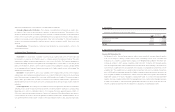

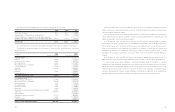

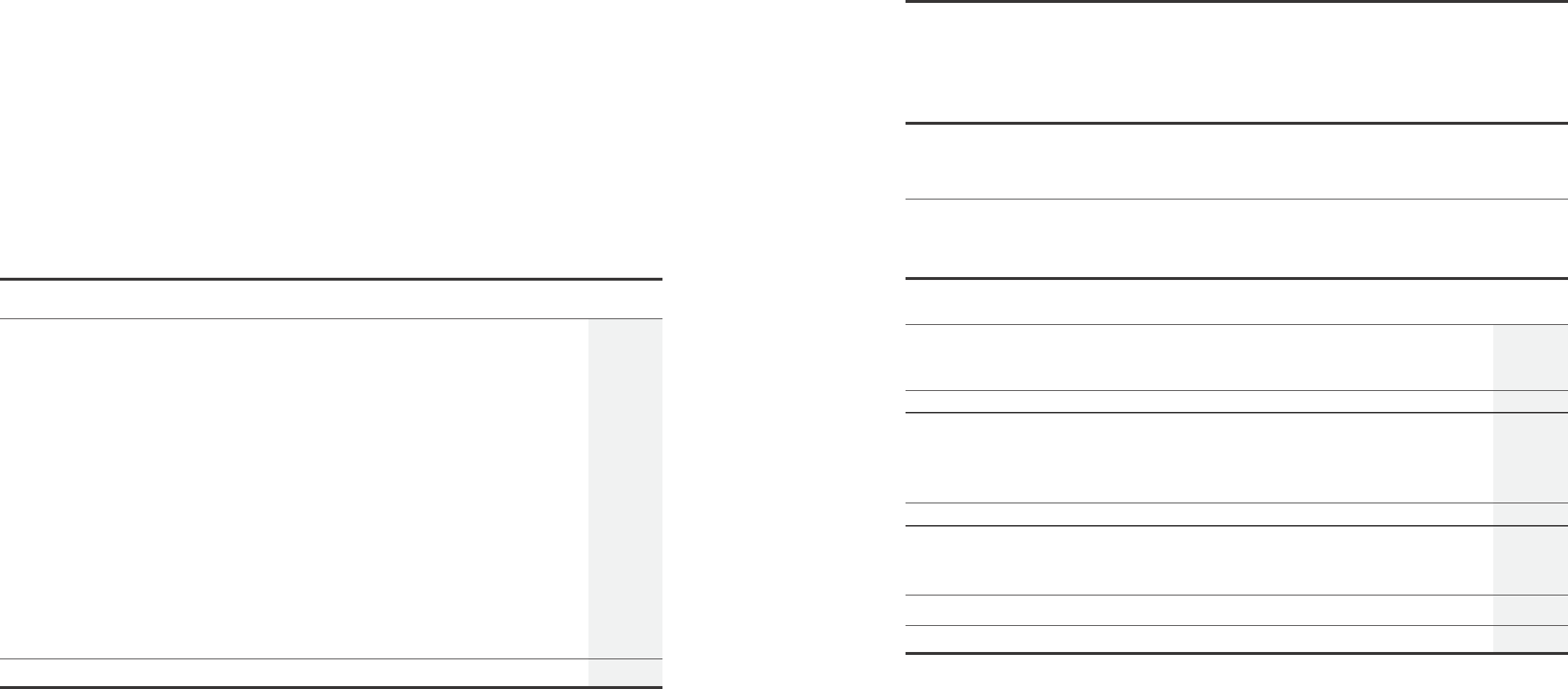

Intangible assets-net consisted of the following (thousands of Euro):

December 31,

2002 2003

LensCrafters trade name, the value of which has been established

as part of an independent valuation performed in connection with

the acquisition of LensCrafters, net of accumulated amortization

of 63,996 and 60,252 as of December 31, 2002, and 2003, respectively (f). 145,827 114,392

Ray-Ban acquired trade names, net of accumulated amortization

of 48,896 and 62,866 as of December 31, 2002, and 2003, respectively (f). 230,305 216,334

Sunglass Hut trade name, the value of which has been established as part

of an independent valuation performed in connection with the acquisition

of Sunglass Hut, net of accumulated amortization of 20,162 and 26,371

as of December 31, 2002, and 2003, (see note 4) (f). 267,868 213,368

OPSM trade name, the value of which has been established as part

of an independent valuation performed in connection with the acquisition

of OPSM, net of accumulated amortization of 2,444

as of December 31, 2003, (see note 4) (f). - 144,205

Other intangibles, net (see note 4). 27,866 76,399

TOTAL 671,866 764,698

(f) The LensCrafters, Ray-Ban, Sunglass Hut International and OPSM trade names are amortized on a straight-line

basis over a period of 25 years, 20 years, 25 years and 25 years, respectively, as the Company believes these

trade names to be finite lived assets.

Projected intangible assets amortization for each of the following years (thousands of Euro):

2004 40,936

2005 40,936

2006 39,136

2007 39,349

2008 39,266

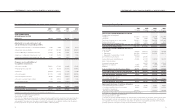

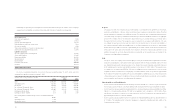

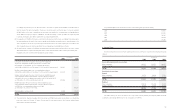

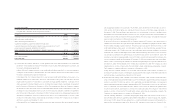

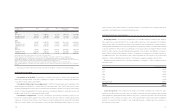

7INCOME TAXES

Income before provision for income taxes and the provision for income taxes consisted of the following (thousands

of Euro):

December 31,

2001 2002 2003

Income before provision for income taxes

Italian companies 336,521 229,527 146,055

Foreign companies 104,790 309,915 243,738

TOTAL 441,311 539,442 389,793

Provision for income taxes

Current

Italian companies 15,079 52,616 17,313

Foreign companies 124,354 117,865 87,150

TOTAL 139,433 170,481 104,463

Deferred

Italian companies (10,619) (14,204) 14,174

Foreign companies (5,364) 6,419 (1,309)

(15,983) (7,785) 12,865

TOTAL 123,450 162,696 117,328

The Italian statutory tax rate is the result of two components: national (“IRPEG”) and regional (“IRAP”) tax. IRAP

could have a substantially different base for its computation as to IRPEG.