LensCrafters 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7978

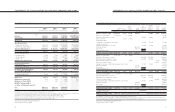

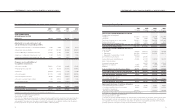

Lire 46,275,000,000. The ADS ratio remained unchanged, with each ADS continuing to represent one ordinary

share.

• At the Extraordinary Shareholders’ Meeting held in Milan on June 26, 2001, shareholders approved the conversion

of the Luxottica Group’s authorized and issued share capital into Euro. As a result of the conversion, the per share

par value of the Group’s ordinary shares is 0.06, from Italian Lire 100.

• On December 31, 2003, Luxottica Group’s authorized share capital was 27,268,621.98, equivalent to

454,477,033 ordinary shares.

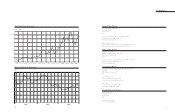

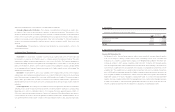

1990-2003:FOURTEEN YEARS ON THE NYSE

2001-2003:THREE YEARS ON THE MTA

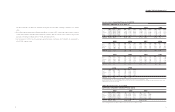

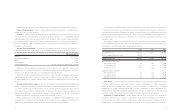

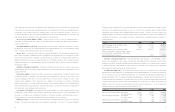

QUARTERLY ORDINARY SHARES PRICES (Euro)

QUARTERLY ADS PRICES (U.S. Dollars) (1)

1996

High Low Close

7.83 5.63 7.81

8.10 6.91 7.34

7.64 6.51 7.28

7.23 5.21 5.21

8.10 5.21

1997

High Low Close

6.64 5.13 5.31

6.99 5.30 6.78

6.98 5.63 5.69

6.51 5.68 6.25

6.99 5.13

1998

High Low Close

9.41 6.28 9.37

9.49 7.75 7.75

8.66 4.97 5.19

6.00 3.88 6.00

9.49 3.88

First

Second

Third

Fourth

Full Year

1999

High Low Close

6.66 5.00 6.44

8.63 6.19 7.78

9.53 7.00 9.53

10.31 7.81 8.78

10.31 5.00

First

Second

Third

Fourth

Full Year

2001

High Low Close

16.09 13.13 15.17

16.00 13.25 16.00

17.99 12.15 13.99

17.21 13.45 16.48

17.99 12.15

2003

High Low Close

14.05 10.23 10.95

14.11 10.69 13.90

15.48 13.73 14.29

18.15 14.40 17.40

18.15 10.23

2002

High Low Close

19.82 15.90 19.38

20.85 17.85 19.00

18.70 11.82 12.88

15.51 12.00 13.65

20.85 11.82

2000

High Low Close

12.34 7.97 12.25

12.97 11.19 12.19

17.00 12.38 16.13

16.44 13.00 13.75

17.00 7.97

1992

High Low Close

3.23 2.74 2.90

3.28 2.63 2.71

3.11 2.66 2.95

2.93 2.25 2.51

3.28 2.25

1991

High Low Close

1.41 0.99 1.38

1.71 1.39 1.51

2.28 1.51 2.26

2.75 2.25 2.75

2.75 0.99

1995

High Low Close

3.96 3.13 3.60

3.83 3.43 3.71

4.92 3.70 4.89

5.95 4.54 5.85

5.95 3.13

1994

High Low Close

3.38 2.79 3.04

3.50 2.98 3.41

3.58 3.28 3.39

3.65 3.23 3.41

3.65 2.79

1993

High Low Close

2.49 2.03 2.38

2.56 2.18 2.18

2.38 2.09 2.09

2.95 2.06 2.93

2.95 2.03

First

Second

Third

Fourth

Full Year

• Fourteen-year high: US$ 20.85 on April 26, 2002 • Fourteen years low: US$ 0.79 on November 7, 1990

(1) These figures have been retroactively adjusted to reflect the five-for-one stock split which was effective April 16, 1998, and the two-for-one stock

split which was effective June 26, 2000

1990

High Low Close

1.06 0.95 0.98

1.38 0.96 1.32

1.46 0.99 1.01

1.11 0.79 1.02

1.46 0.79

First

Second

Third

Fourth

Full Year

2003

High Low Close

13.48 9.25 9.81

12.37 9.85 11.92

13.96 11.67 12.23

14.82 12.35 13.70

14.82 9.25

First

Second

Third

Fourth

Full Year

2002

High Low Close

22.95 18.34 22.43

22.88 18.54 19.69

19.05 11.75 13.22

15.52 12.00 12.58

22.95 11.75

2001

High Low Close

17.20 14.37 16.80

19.11 15.04 19.11

20.62 13.41 15.74

19.59 14.88 18.43

20.62 13.41

• Three-year high: 22.95 on March 27, 2002 • Three-year low: 9.25 on March 12, 2003

SHARE PERFORMANCE