LensCrafters 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3130

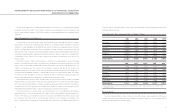

On June 26, 1999, Luxottica Group acquired the Ray-Ban business for a purchase price of approximately

US$ 655 million (635 million based on the exchange rate in effect at such time), subject to post-closing

adjustments. The acquisition was accounted for under the purchase method. As such, the results of the Ray-Ban

business have been accounted for in the Company’s consolidated financial statements since the date of acquisition.

Since the acquisition, Luxottica Group has closed Ray-Ban’s frame manufacturing facilities outside Italy and integrated

these operations into its existing manufacturing structure. This integration was substantially completed by the second

quarter of 2000. In January 2002, Luxottica Group settled a purchase price dispute with Bausch & Lomb

Incorporated, along with certain other litigation between the two companies. The settlement resulted in a reduction in

the purchase price of approximately US$ 42 million and, accordingly, goodwill and a liability to Bausch & Lomb

previously recorded were reduced at December 31, 2001. A receivable was recorded at December 31, 2001, for the

final settlement amount. Luxottica Group received a payment of US$ 23 million in January 2002 as the final settlement

payment.

On March 31, 2001, through the completion of a tender offer and subsequent merger, Luxottica Group acquired

all of the outstanding common stock of Sunglass Hut International for a purchase price of approximately 558 million

(including approximately 33.9 million of acquisition-related expenses). The acquisition was accounted for under the

purchase method and the results of Sunglass Hut International have been included in Luxottica Group’s consolidated

financial statements since the date of acquisition

In September 2003, through the completion of a tender offer and subsequent merger, Luxottica South Pacific Pty

Limited, an Australian subsidiary of Luxottica Group, acquired 82.57 percent of OPSM Group’s (“OPSM”) ordinary

shares, and more than 90 percent of OPSM’s options and performance rights, which entitled Luxottica Group to

require the cancellation of all the options and performance rights still outstanding. The aggregate purchase price for

the OPSM shares, performance rights and options was A$ 442.7 million (253.7 million based on the exchange rate

in effect at such time). The acquisition was accounted for under the purchase method and the financial condition and

results of operations of OPSM have been included in Luxottica Group’s consolidated financial statements since

August 1, 2003.

On January 26, 2004, Luxottica Group and Cole National Corporation jointly announced that they have entered

into a definitive merger agreement as of January 23, 2004, with the unanimous approval of the Boards of Directors of

both companies. Under the agreement, Luxottica Group will acquire all of the outstanding shares of Cole National for

a cash purchase price of US$ 22.50 per share, together with the purchase of all outstanding options and similar

equity rights at the same price per share, less their respective exercise prices, for a total purchase price of

approximately US$ 401 million. The merger is subject to the approval of Cole National's stockholders and the

satisfaction of other customary conditions, including compliance with applicable antitrust clearance requirements. The

transaction is expected to close in the second half of 2004.

For additional information regarding this transaction, please see the section “Subsequent Events” in the notes to

the consolidated financial statements attached to this Annual Report.

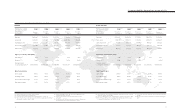

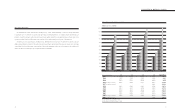

REVIEW OF RESULTS FOR FISCAL YEAR 2003,COMPARATED WITH RESULTS FOR FISCAL YEAR 2002

Consistent financial measures (Non-GAAP) - Luxottica Group uses certain measures of financial performance

that exclude the impact of fluctuations in currency exchange rates in the translation of operating results into Euro,

exclude the results of operations for the 53rd week in the U.S. retail calendar(1) for the fiscal year, when applicable, and

include the results of operations of OPSM for the five-month period ended December 31, 2002.

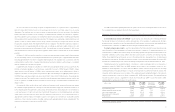

Constant exchange rates results - Luxottica Group believes that these adjusted financial measures provide

useful information to both management and investors by allowing a comparison of operating performance on a

consistent basis. In addition, since Luxottica Group has historically reported such adjusted financial measures to the

investment community, Luxottica Group believes that their inclusion provides consistency in its financial reporting.

Further, these adjusted financial measures are one of the primary indicators management uses for planning and

forecasting for future periods. Operating measures that assume constant exchange rates between fiscal years 2003

and 2002 are calculated using for each currency the average exchange rate for the year ended December 31, 2002.

Operating measures that exclude the impact of fluctuation in currency exchange rates are not measures of

performance under U.S. GAAP. These non-GAAP measures are not meant to be considered in isolation or as a

substitute for results prepared in accordance with U.S. GAAP. In addition, Luxottica Group’s method of calculating

operating performance excluding the impact of changes in exchange rates may differ from methods used by other

companies. See the table below for a reconciliation of the operating measures excluding the impact of fluctuations in

currency exchange rates to their most directly comparable U.S. GAAP financial measures. The adjusted financial

measures should be used as a supplement to results reported under U.S. GAAP to assist the reader in better

understanding the operational performance of Luxottica Group.

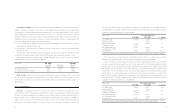

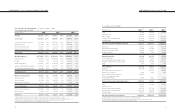

(Millions of Euro) FY 2002 FY 2003 Adjustment FY 2003

U.S. GAAP U.S. GAAP for constant Adjusted

Results Results exchange rates results

Consolidated net sales 3,178.6 2,824.6 400.2 3,224.8

Manufacturing/Wholesale net sales 1,128.7 995.1 77.9 1,073.0

Less: intercompany sales (154.9) (172.7) (29.6) (202.3)

Wholesale sales to third parties 973.8 822.4 48.3 870.7

Retail net sales 2,204.8 2,002.3 351.8 2,354.1

(1) Luxottica Group’s fiscal year for its retail operations ends on the Saturday closest to December 31 and, as a result, a 53rd week may be added every

five to six years. Fiscal 2003 was such a year.