LensCrafters 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

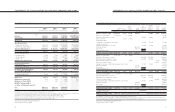

103102

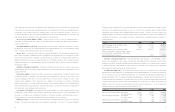

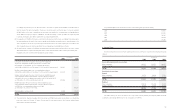

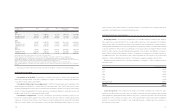

Preliminarily, the purchase price and expenses have been allocated based upon the valuation of the Company’s

acquired assets and liabilities, assumed as follows (reported at the date of acquisition exchange rate):

Thousands of Euro

Assets purchased:

Cash and cash equivalents 5,990

Inventories 23,623

Property, plant and equipment 49,781

Prepaid expenses and other current assets 7,433

Accounts receivable 1,064

Trade name (useful life of 25 years, no residual value) 141,195

Other assets including deferred tax assets 12,616

Liabilities assumed:

Accounts payable and accrued expenses (31,434)

Other current liabilities (11,426)

Deferred tax liabilities (42,359)

Minority interests (11,246)

Bank overdraft (42,914)

Fair Value of Net Assets 102,323

Goodwill 151,353

TOTAL PURCHASE PRICE 253,676

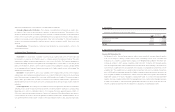

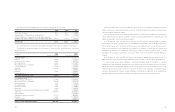

Pro-forma consolidated statements of income for the years ended December 31, 2001, 2002, and 2003,

assuming the acquisition took place at January 1, 2001:

Thousands of Euro, except per share data - Unaudited December 31,

2001 2002 2003

Sales 3,389,289 3,426,624 2,991,112

Operating Income 523,400 615,764 439,676

Net Income 319,686 372,987 266,188

No. of Shares (Thousands) - Basic 451,037 453,174 448,664

No. of Shares (Thousands) - Diluted 453,965 455,353 450,202

Earnings per Share - Basic 0.71 0.82 0.59

Earnings per Share - Diluted 0.70 0.82 0.59

Non recurring items included in the pro-forma consolidated statements:

Sales 82,667 - -

Operating Income 2,750 - -

Net Income / (Loss) (7,238) - -

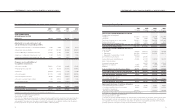

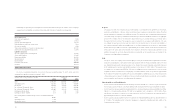

IC Optics

On January 15, 2003, the Company announced the signing of a worldwide license agreement for the design,

production and distribution of Versace, Versus and Versace Sport sunglasses and prescription frames. The initial

ten-year agreement is renewable for an additional ten years. The transaction was completed through the purchase

of IC Optics Group (“IC Optics”), an Italian-based Group that produced and distributes eyewear, for an aggregate

amount of 5.4 million. Prior to this transaction, Gianni Versace S.p.A. and Italocremona S.p.A. held IC Optics

through a 50/50 joint venture. The acquisition was accounted for in accordance with SFAS No. 141 and,

accordingly, the purchase price has been allocated to the fair market value of the assets and liabilities of

the company acquired including an intangible asset for the license agreement for an amount of approximately

28.8 million and goodwill for an amount of approximately 10.7 million. Further, an amount of 25 million has

been paid for the option right, which enables the Company to extend the original royalty agreement for an

additional ten-years. No pro-forma financial information is presented, as the acquisition was not material to the

Company’s consolidated financial statements.

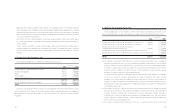

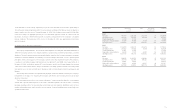

E.I.D.

On July 23, 2003, the Company announced the signing of a ten-year worldwide license agreement for exclusive

production and distribution of prescription frames and sunglasses with the Prada and Miu Miu names. The deal

was finalized through Luxottica Group’s purchase of two Prada’s fully-owned companies named E.I.D. Italia and

E.I.D. Luxembourg, that produce and distribute eyewear, for the amount of 26.5 million. The acquisition was

accounted for in accordance with SFAS No. 141 and, accordingly, the excess of purchase price over net assets

acquired has been recorded in the accompanying consolidated balance sheets as goodwill of approximately

29.7 million. The valuation of acquired assets and assumed liabilities is preliminary and, as a result, the allocation

of the purchase price is subject to modification. No pro-forma financial information is presented, as the acquisition

was not material to the Company’s consolidated financial statements.

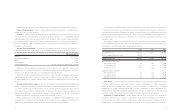

Other Acquisitions and Establishments:

- In 2001, Luxottica Group established a new subsidiary, Luxottica Poland Sp. Z.o.o, which is 75 percent owned by

the Company. Luxottica Poland is a wholesale distributor with an initial investment of approximately 0.1 million.

- In 2001, Luxottica Group acquired the remaining interest in some manufacturing and wholesale distributors (Tristar

Optical Co., Ltd and Luxottica Australia PTY, Ltd) for an aggregate cash consideration of 8.5 million. These

subsidiaries have been accounted for as step acquisitions and the Company has recorded goodwill of

approximately 4.8 million in connection therewith.

- In 2001, Luxottica Group acquired 51 percent of capital stock of Mirarian Marketing Ltd for an initial investment of

1.9 million. The subsidiary, which is based in Singapore, is engaged in marketing and sales activity of the

Company’s products in Asia.