LensCrafters 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

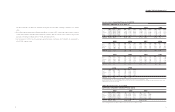

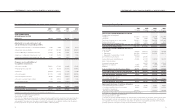

9998

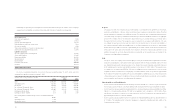

3INVENTORIES

Inventories consisted of the following (thousands of Euro):

December 31,

2002 2003

Raw materials and packaging 64,581 62,209

Work-in process 22,624 25,363

Finished goods 318,827 316,644

TOTAL 406,032 404,216

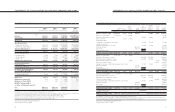

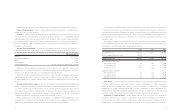

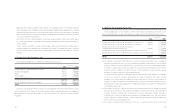

4ACQUISITIONS AND INVESTMENTS

Sunglass Hut International, Inc.

On February 20, 2001, Luxottica Group formed an indirect wholly-owned U.S. subsidiary, Shade Acquisition

Corp., for the purpose of making a tender offer for all the outstanding common stock of Sunglass Hut

International, Inc. (“SGHI”), a publicly traded company on the NASDAQ National Market. The tender offer

commenced on March 5, 2001, and was completed on March 30, 2001. On April 4, 2001, Shade Acquisition

Corp. was merged with and into SGHI and SGHI became an indirect wholly-owned subsidiary of the Company. As

such, the results of SGHI have been consolidated into the Company’s consolidated financial statements as of the

acquisition date. The acquisition was accounted by using the purchase method and, accordingly, the purchase

price of 558 million (including approximately 33.9 million of acquisition-related expenses) was allocated to the

assets acquired and liabilities assumed based on their fair value at the date of the acquisition. This included an

independent valuation of the value of intangibles, including trade names. As a result of the final independent

valuation, which was completed in March 2002, the aggregate balance of goodwill and other intangibles previously

recorded as of December 31, 2001, increased by approximately 147 million. The excess of purchase price over

net assets acquired ("goodwill") has been recorded in the accompanying consolidated balance sheet.

did not have a material impact on the Company’s consolidated financial statements.

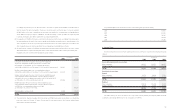

Information Expressed in U.S. Dollars - The Company’s consolidated financial statements are stated in Euro,

the currency of the country in which the parent company is incorporated and operates. The translation of Euro

amounts into U.S.Dollar amounts is included solely for the convenience of international readers and has been made at

the rate of 1 to U.S.$ 1.2597. Such rate was determined by the noon buying rate of the Euro to the U.S. Dollar as

certified for custom purposes by the Federal Reserve Bank of New York as of December 31, 2003. Such translations

should not be construed as representations that Euro amounts could be converted into the U.S. Dollar at that or any

other rate.

Reclassifications - The presentation of certain prior year information has been reclassified to conform to the

current year presentation.

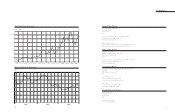

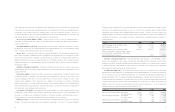

2RELATED PARTY TRANSACTIONS

Fixed Assets - In January 2002, a subsidiary of Luxottica Group acquired certain assets for 28.5 million and

the assumption of a bank loan from “Partimmo S.a.S.”, a company owned by the Company’s Chairman. The assets

acquired were a building, including all improvements for a total cost of 42.0 million. The Company’s headquarter is

located in this building. The bank loan acquired had an outstanding balance of 20.6 million on such date (19.0

million as of December 31, 2003). In connection with the acquisition of this building the Company’s subsidiary entered

into an agreement with the Company’s Chairman who leases for 0.5 million annually a portion of this building. The

expiration date of this lease is 2010.

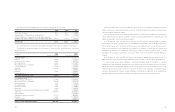

Investment - On December 31, 2001, a U.S. subsidiary of the Company held 1,205,000 of the Company’s

ordinary shares, which had been previously purchased at a cost of US$ 3.1 million (2.4 million at historical exchange

rates). These shares were sold during 2002, for proceeds of US$ 8.8 million (9.3 million). The after-tax net gain of

US$ 6.5 million (6.9 million) was recorded as an increase to the Company’s additional paid-in capital balance.

Approximately 63 percent of these shares were sold to a related party with an after-tax net gain of US$ 4.3 million (

4.4 million).

License Agreement - The Company has a worldwide exclusive license agreement to manufacture and distribute

opthalmic products under the brand name Brooks Brothers. The Brooks Brothers tradename is owned by Retail

Brand Alliance, Inc., which is controlled by a Director of the Company. The license agreement expired on March 31,

2003, and is currently under renewal negotiations. Currently, the Company and Retail Brand Alliance have agreed to

continue under the old conditions until the new agreement is finalized. Royalties paid to Retail Brand Alliance, Inc. for

such agreement were 1.4 million and 1.1 million for the years ended December 31, 2002, and 2003, respectively.