LensCrafters 2003 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1110

July 24 Luxottica Group extends the OPSM offer for an additional two weeks to provide shareholders with

additional time to accept the offer. The Group also announces that the Australian Foreign

Investment Review Board (FIRB) confirmed that it had no objections to the transaction.

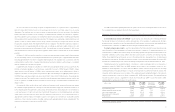

July 28 Luxottica Group reports results for the second quarter with net sales of 707.0 million, operating

income of 111.9 million, and earnings per share or ADS of 0.15 (US$ 0.17). For the six-month

period ended June 30, the Group reports net sales of 1,411.5 million, operating income of

223.2 million, and earnings per share or ADS of 0.30 (US$ 0.33).

August 1 The Group extend the OPSM offer by one additional week, through August 22, and indicates that it

intends to make it unconditional if it acquires by August 12 shares equal to at least 50.1% of the

total number of shares outstanding.

August 8 Luxottica Group announces that it has received acceptances from OPSM holders that increase its

relevant interest in the company to 50.68%. As a result, Luxottica Group declares the offer free from

all conditions.

September 1 The Group announces that India’s Securities Appellate Tribunal (SAT) has upheld the decision of the

Securities and Exchange Board of India (SEBI). The decision would requires a subsidiary of the

Group to make a public offering to acquire up to an additional 20% of the shares of RayBan Sun

Optics India Ltd., a company listed on the local market. Luxottica Group further states that a tender

offer in accordance with SEBI’s decision would have no material financial impact on the Group and

is estimated at approximately 10 million, plus a stipulated interest increment.

September 3 Luxottica Group announces the successful completion of the cash offer for all outstanding shares,

options and performance rights of OPSM. At the close of the offer on September 2, Luxottica South

Pacific Pty Ltd., the wholly-owned subsidiary through which the offer was launched, holds 82.57%

of the shares of OPSM Group, thus gaining the unilateral right to appoint all members of OPSM’s

Board of Directors.

September 22 Luxottica Group is added to the MIB 30, the index of highest market capitalization stocks traded on

the Italian Stock Exchange.

September 29 Luxottica Group’s Board of Directors approves, in accordance with Italian securities law, the

Group’s Italian GAAP financial statements for the six-month period ended June 30.

October 28 Luxottica Group reports results for the third quarter with net sales of 694.5 million, operating

income of 109.4 million, and earnings per share or ADS of 0.17 (US$ 0.19). For the nine-month

period ended September 30, the Group reports net sales of 2,106.0 million, operating income of

332.7 million, and earnings per share or ADS of 0.46 (US$ 0.51).

October 30 Luxottica Group announces that, in compliance with directions issued by India’s SAT, it intends to

launch a public offer to acquire an additional 20% of the outstanding shares of RayBan Sun Optics

India Ltd. The offer would be launched through the Group’s subsidiary Ray Ban Indian Holdings

Inc., with a maximum expected investment of 16 million, including the stipulated interest

increment.

December 31 Luxottica Group’s ordinary shares and ADSs close trading on the MTA at 13.700 and on

the NYSE at US$ 17.40, respectively, reflecting a market capitalization of 6.3 billion and

US$ 7.9 billion, respectively.

Jan. 29, 2004 Luxottica Group reports results for the fourth quarter with net sales of 718.1 million, operating

income of 99.1 million, and earnings per share or ADS of 0.13 (US$ 0.16). For the full year, the

Group reports net sales of 2,824.6 million, operating income of 431.8 million, and earnings per

share or ADS of 0.60 (US$ 0.67).