LensCrafters 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123122

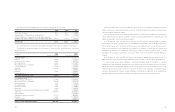

dismiss certain other claims made by Lantis, leaving only the breach of contract claim. The Company in November

2000 filed its answer and counterclaim against Lantis. In December 2002, the parties entered into a mutual release

and settlement agreement and the case was dismissed with prejudice. This settlement did not have a material impact

on the Company’s consolidated financial statements for 2002.

In March 2002, an individual plaintiff commenced an action in the California Superior Court for the County of San

Francisco against LensCrafters, the Company’s subsidiary that operates as a licensed California vision health care

service plan, certain of the Company’s other subsidiaries and Luxottica Group S.p.A., alleging that the relationships

between those companies violate certain California statutes governing optometrists and opticians and constitute

unlawful or unfair business practices. The plaintiffs named in the second amended complaint seek certification of the

case as a class action, and remedies including an injunction against the allegedly unlawful practices, disgorgement

and restitution of allegedly unjustly obtained sums, and unspecified compensatory and punitive damages. The

defendants intend to defend against such claims vigorously.

In May 2001, certain former stockholders of Sunglass Hut International, Inc. commenced an action in the U.S.

District Court for the Eastern District of New York against the Company, its acquisition subsidiary formed to acquire

Sunglass Hut International and certain other defendants, on behalf of a purported class of former Sunglass Hut

International stockholders, alleging in the original and in the amended complaint filed later, among other claims, that

the defendants violated certain provisions of U.S. Securities Law, and the rules thereunder in connection with the

acquisition of Sunglass Hut International in a tender offer and second-step merger, by reason of entering into a

consulting, non-disclosure and non-competition agreement, prior to the commencement of the tender offer, with the

former chairman of Sunglass Hut International, which purportedly involved paying consideration to such person for his

Sunglass Hut International shares and his support of the tender offer that was higher than that paid to Sunglass Hut

International’s stockholders in the tender offer.

The Company and the other defendant filed a motion to dismiss the complaint in its entirety which, on November

26, 2003, the Court granted in part and denied in part. The Court granted the Company’s motion to dismiss plaintiffs'

claim under Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5 thereunder, but denied the

Company’s motion to dismiss the claims under Rule 14d-10 relating to the consulting, non-disclosure and non-

competition agreement with Mr. Hauslein, the former Chairman of Sunglass Hut International, and aiding and abetting

alleged breaches by Sunglass Hut International former directors of their fiduciary duties, noting that it was obligated,

for the purpose of rendering its decision on the motion to dismiss, to treat all of the plaintiffs' allegations in the

complaint as true. The Company continues to believe that the claims that were not dismissed are without merit and

that its defenses are meritorious, and will continue to defend against such claims vigorously. However, the Company

can provide no assurance as to the outcome of the case.

In December 2002, the Company was informed that the Attorney General of the State of New York is conducting

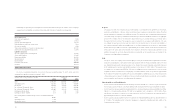

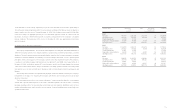

Future minimum annual rental commitments for operating leases are as follows (thousands of Euro):

Years ending December 31,

2004 167,505

2005 130,373

2006 116,855

2007 89,622

2008 67,713

Subsequent Years 107,925

TOTAL 679,993

Total rent expense under operating leases for the years ended December 31, 2001, 2002, and 2003, aggregated

203.7 million, 276.5 million and 260.3 million, respectively.

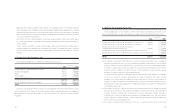

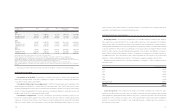

Credit Facilities - As of December 31, 2002, and 2003, Luxottica Group had unused short-term lines of credit of

approximately 308.1 million and 271.8 million, respectively.

These lines of credit are renewed annually and are guaranteed by the Company. At December 31, 2003, there was

no principal amount of borrowings outstanding and 18.5 million in aggregate face amount of standby letters of

credit outstanding under these lines of credit (see below).

Outstanding Stand-by Letters of Credit - A U.S. subsidiary has obtained various stand-by letters of credit from

banks that aggregate 21.2 million as of December 31, 2003. Most of these letters of credit are used for security in

risk management contracts or as security on store leases. Most contain evergreen clauses under which the letter is

automatically renewed unless the bank is notified not to renew.

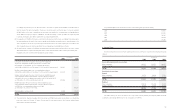

Litigation - On April 22, 2003, the Company entered into a settlement agreement with Oakley, under which two

previously reported patent and intellectual property lawsuits brought by Oakley in 1998 (originally against Bausch &

Lomb Incorporated and certain of its subsidiaries and assumed by the Company in connection with the acquisition

from Bausch & Lomb in 1999 of the Ray-Ban business) and in 2001, against the Company and certain of its

subsidiaries, each in the U.S. District Court for the Central District of California were settled. As part of the settlement,

neither party admitted to any wrongdoing in either case, and all claims and counterclaims were released and

discharged. Further, the preliminary injunction that Oakley had obtained in the second case against certain

subsidiaries of the Company was dissolved.

In November 1999, Lantis Eyewear, Inc. (“Lantis”), a former distributor of Bausch & Lomb, filed a complaint against

Luxottica Group and one of its subsidiaries claiming that, in terminating its distribution agreement with Lantis, the

Company allegedly breached the agreement. In October 2000, the Court granted a motion by Luxottica Group to