LensCrafters 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

121120

vendor would not cause a significant impact on the future operations of the Company as it could replace this vendor

quickly with other third party and Company-manufactured products.

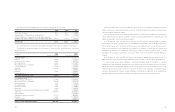

14 COMMITTMENTS AND CONTINGENCIES

Royalty Agreements - The Company is obligated under non-cancelable distribution agreements with designers,

which expire at various dates through 2013. In accordance with the provisions of such agreements, the Company is

required to pay royalties and advertising fees based on a percentage of sales (as defined) with, in certain agreements,

minimum guaranteed payments in each year of the agreements. In the first half of 2003, the Company has terminated

its license agreement for the production and distribution of the Giorgio Armani and Emporio Armani eyewear

collections and has signed a ten-year worldwide license agreement for the production and distribution of eyewear of

Versace, Versus and Versace Sport eyewear collections. The agreement is renewable at the Company’s discretion for

an additional ten years. In the second part of 2003 a license agreement has been signed for the production and

distribution of Prada and Miu Miu eyewear collections. The Prada license agreement expiration date is in 2013.

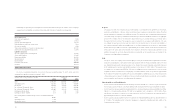

Minimum payments required in each of the years subsequent to December 31, 2003, are detailed as follows

(thousands of Euro):

Years ending December 31,

2004 29,225

2005 19,279

2006 19,680

2007 16,980

2008 23,283

Subsequent Years 156,800

TOTAL 265,247

Leases and Licenses - The Company leases through its world-wide subsidiaries various retail store, plant,

warehouse and office facilities, as well as certain of its data processing and automotive equipment under operating

lease arrangements expiring between 2004 and 2015, with options to renew at varying terms. The lease and license

arrangements for the Company's U.S. retail locations often include escalation clauses and provisions requiring the

payment of incremental rentals, in addition to any established minimums, contingent upon the achievement of

specified levels of sales volume.

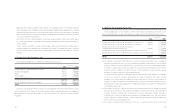

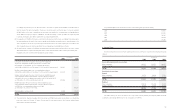

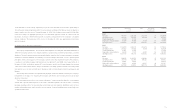

(Thousands of Euro) Italy (6) North Other (6) Adjustments and Consolidated

December 31, America (6) Eliminations

2003

Net sales (5) 753,772 1,939,505 731,080 (599,721) 2,824,636

Operating income 184,929 226,226 63,813 (43,181) 431,787

Identifiable assets 1,087,097 2,077,855 802,918 (55,194) 3,912,676

2002

Net sales (5) 795,287 2,320,791 675,941 (613,417) 3,178,602

Operating income 207,250 323,038 82,187 (10,967) 601,508

Identifiable assets 974,412 2,405,462 374,933 (168,475) 3,586,332

2001

Net sales (5) 792,901 2,320,161 622,331 (634,264) 3,101,129

Operating income 240,581 328,518 68,752 (128,359) 509,492

Identifiable assets 1,161,117 2,794,149 375,191 (382,095) 3,948,362

(5) No single customer represents five percent or more of sales in any year presented

(6) Sales, operating income and identifiable assets are the result of combination of legal entities located in the same geographical area

(7) Inter-segment elimination of net sales relates to intercompany sales from the manufacturing and wholesale segment to the retail segment

(8) Inter-segment elimination of operating income mainly relates to depreciation and amortization of corporate identifiable assets and profit-in-stock

elimination for frames manufactured by the wholesale business and included in the retail segment inventory

(9) Inter-segment elimination of depreciation and amortization relates to depreciation and amortization of corporate identifiable assets

(10) Inter-segment elimination of identifiable assets includes mainly the net value of goodwill and trade names of acquired retail businesses attributed to

corporate

Certain amounts for the years 2001 and 2002, have been reclassified to conform to the 2003 presentation.

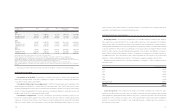

13 FINANCIAL INSTRUMENTS

Concentration of Credit Risk - Concentrations of credit risk with respect to trade accounts receivable are

limited due to the large number of customers comprising the Company's customer base. Ongoing credit evaluations

of customer's financial condition are performed.

Concentration of Sales under License Agreement - In 1999, the Company signed a license agreement for the

design production and distribution of frames under the Chanel trade name. Since 1999 Chanel sales have been

increasing representing about four percent of total sales in 2003. On February 18, 2004, the Company announced the

renewal of the licensing agreement for the design, production and worldwide distribution of prescription frames and

sunglasses with Chanel. The license agreement expires in 2008.

Concentration of Supplier Risk - As result of the Sunglass Hut International acquisition, Oakley Inc. has

become the Company’s largest supplier. For fiscal years 2001, 2002 and 2003, Oakley accounted for approximately

9.1 percent, 11.8 percent and 8.7 percent of the Company’s total merchandise purchases, respectively. In December

2001, the Company signed a three year purchase contract with Oakley. Management believes that the loss of this