LensCrafters 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

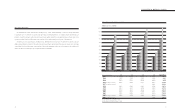

fiscal years; that is for the single quarters of each year, for six-month periods, for nine-month periods and for the full

fiscal years 1994 through 2003.

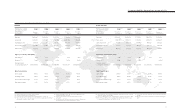

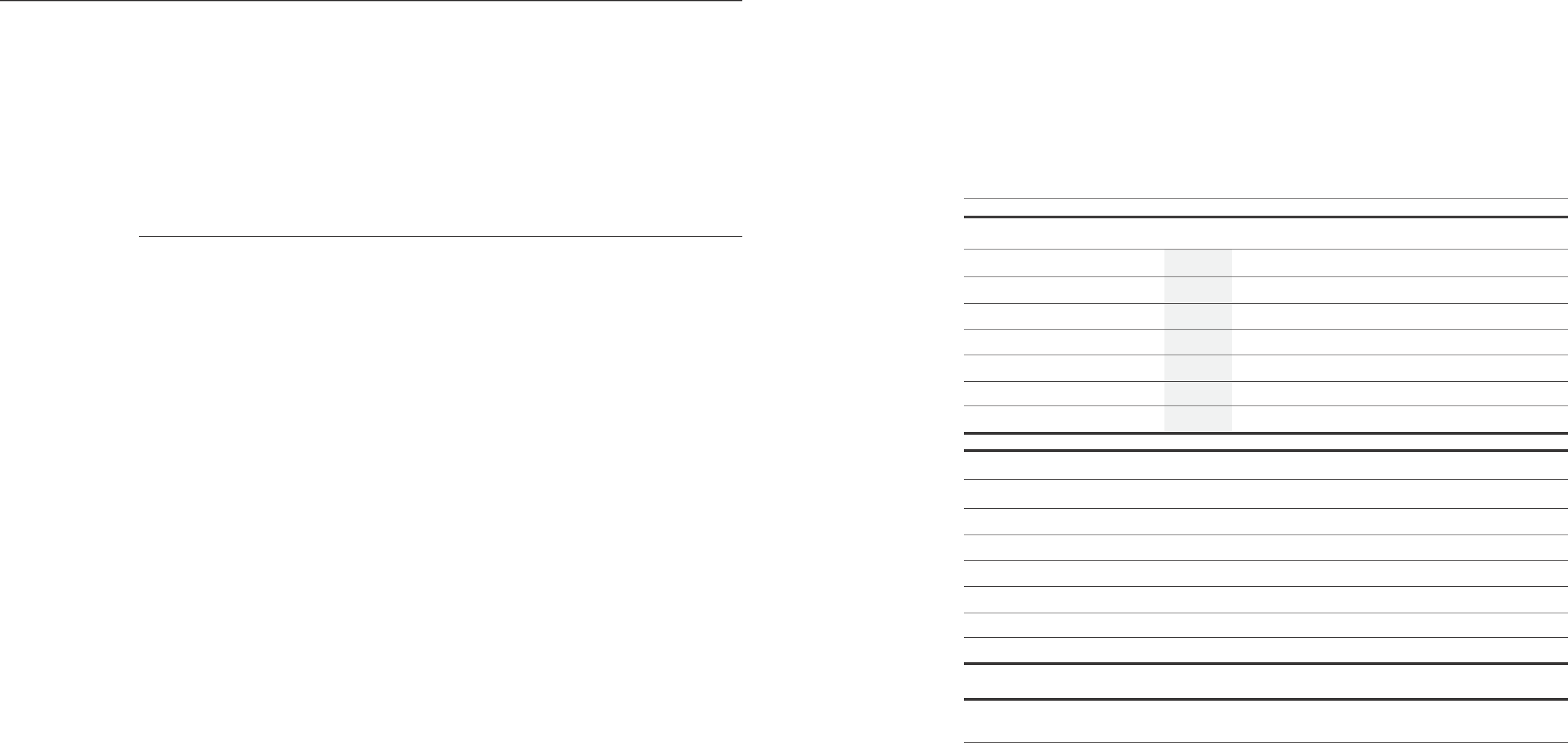

AVERAGE EURO/U.S. DOLLAR EXCHANGE RATE OF RELEVANT PERIOD

2003 2002 2001 2000 1999

First Quarter 1.0730 0.8766 0.9230 0.9859 1.1207

Second Quarter 1.1372 0.9198 0.8721 0.9326 1.0567

Six-month 1.1049 0.8980 0.8990 0.9591 1.0873

Third Quarter 1.1248 0.9838 0.8895 0.9041 1.0483

Nine-Month 1.1117 0.9277 0.8956 0.9400 1.0737

Fourth Quarter 1.1882 0.9982 0.8959 0.8676 1.0370

TWELVE-MONTH 1.1307 0.9450 0.8957 0.9209 1.0642

1998(1) 1997(1) 1996(1) 1995(1) 1994(1)

First Quarter 1.0802 1.1823 1.2307 1.1793 1.1497

Second Quarter 1.0944 1.1457 1.2443 1.1613 1.2063

Six-month 1.0873 1.1634 1.2376 1.1711 1.1778

Third Quarter 1.1130 1.0991 1.2727 1.2081 1.2325

Nine-Month 1.0961 1.1405 1.2493 1.1816 1.1957

Fourth Quarter 1.1765 1.1255 1.2721 1.2160 1.2198

TWELVE-MONTH 1.1152 1.1367 1.2549 1.1887 1.2013

(1) Through 1998 the Euro/U.S. Dollar exchange rate has been calculated through the Lira/U.S. Dollar exchange rate, converted by the fixed rate

Lire 1,936.27 = 1.00

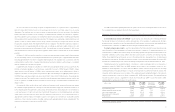

FINANCIAL REVIEW

The section Financial Review contains a discussion of Luxottica Group’s operational results and its financial

condition and should be read together with, and is qualified in its entirety by reference to, the consolidated financial

statements included elsewhere in this Annual Report.

28

Luxottica Group prepares its consolidated financial statements in accordance with accounting principles generally

accepted in the U.S. (“U.S. GAAP”). For the reader’s convenience a more detailed profit and loss statement for the

three fiscal years ending December 31, 2001, 2002 and 2003, is included therewith before the consolidated financial

statements.

FIGURES DENOMINATED IN U.S. DOLLARS

Luxottica Group accounts for its foreign currency denominated transactions and foreign operations in accordance

with Statement of Financial Accounting Standards (“SFAS”) No. 52, Foreign Currency Translation. The financial

statements of foreign subsidiaries are translated into Euro, which is the functional and reporting currency of Luxottica

Group’s consolidated financial statements. Assets and liabilities of foreign subsidiaries are translated at year-end

exchange rates. Results of operations are translated using the average exchange rates prevailing throughout the year.

The resulting cumulative translation adjustments have been recorded as a separate component of accumulated other

comprehensive income. Transactions in foreign currencies are recorded at the exchange rate in effect at the

transaction date.

Since the first quarter of 1992, Luxottica Group has converted its consolidated results of operations in public

releases of such results into U.S. Dollars at the average rate of exchange for each period or fiscal year, as the case

may be, based on rates in effect in Milan, Italy on each business day in such period or year, divided by the total

number of such business days. The conversion of the statements of operations from Euro into U.S. Dollars at the

average exchange rate for each period, rather than the period-end exchange rate (which Luxottica Group uses to

convert the assets and liabilities statement), is consistent with the policy, in accordance with U.S. GAAP, of converting

the results of non-Euro subsidiaries from the local currencies into Euro at the respective average exchange rates

during the applicable periods when calculating the consolidated financial statements in Euro.

Notwithstanding the foregoing, however, amounts in Euro set forth in Luxottica Group’s audited consolidated

financial statements, its annual report on Form 20-F and its quarterly reports on Form 6-K will, to the extent required

by U.S. law and the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”), be translated for

convenience into U.S. Dollars applying the noon buying rate of the Euro, as certified for custom purposes by the

Federal Reserve Bank of New York (the so-called “noon buying rate”) as at the end of each period.

It must be noted that, in Luxottica Group’s view, the presentation of its consolidated financial statements

denominated in Euro is a more accurate measure of its results, due to the distorting effects caused by translations of

results in other currencies. Such translations should not be construed as representations that the Euro amounts could

be converted into U.S. Dollars at that or any other rate. Set forth below, for the convenience of the readers of this

report, is a table indicating the average rate of exchange Euro/U.S. Dollar used for each significant period and for ten

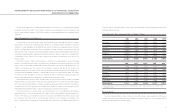

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS