LensCrafters 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9594

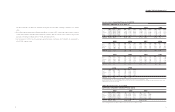

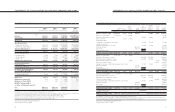

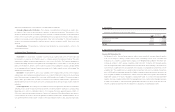

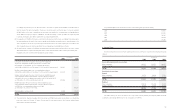

earnings per share calculations for the years ended December 31, 2001, 2002, and 2003. Basic earnings per share

are based on the weighted average number of shares of common stock outstanding during the period. Diluted

earnings per share are based on the weighted average number of shares of common stock and common stock

equivalents (options and warrants) outstanding during the period, except when the common stock equivalents are

anti-dilutive. The following is a reconciliation from basic to diluted shares outstanding used in the calculation of

earnings per share:

(Thousands) 2001 2002 2003

Weighted average shares outstanding – basic 451,037.0 453,174.0 448,664.4

Effect of dilutive stock options 2,928.5 2,179.5 1,537.7

Weighted average shares outstanding – dilutive 453,965.5 455,353.5 450,202.1

Options not included in calculation of dilutive shares

as the exercise price was greater than the average

price during the respective period - 1,974.7 4,046.6

Fair Value of Financial Instruments - Financial instruments consist primarily of cash, marketable securities,

trade account receivables, accounts payable, long-term debt and derivative financial instruments. Luxottica Group

estimates the fair value of financial instruments based on interest rates available to the Company and by comparison

to quoted market prices. At December 31, 2002, and 2003, the fair value of the Company's financial instruments

approximated the carrying value except as otherwise disclosed.

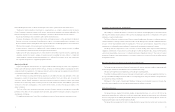

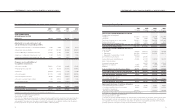

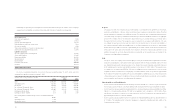

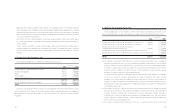

Stock-based Compensation - The Company has elected to follow the accounting provisions of Accounting

Principles Board (“APB”) Opinion No. 25, Accounting for Stock Issued to Employees, for stock-based compensation

and to provide the disclosures required under SFAS No. 123, Accounting for Stock-Based Compensation, as

amended by SFAS No. 148, Accounting for Stock-based Compensation – Transition and Disclosure (Note 10). No

stock-based employee compensation cost is reflected in the net income, as all options granted under the plans have

an exercise price equal to the market value of the underlying stock on the date of the grant. The following table

illustrates the effect on the net income and earnings per share had the compensation costs of the plans been

determined under a fair value based method as stated in SFAS No. 123:

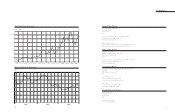

December 31, 2001 2002 2003

Net income (Thousands of Euro): As reported 316,373 372,077 267,343

Pro-forma (Unaudited) 307,345 362,718 256,216

Basic earnings per share (Euro): As reported 0.70 0.82 0.60

Pro-forma (Unaudited) 0.68 0.80 0.57

Diluted earnings per share (Euro): As reported 0.70 0.82 0.59

Pro-forma (Unaudited) 0.68 0.80 0.57

their eventual disposition. If the sum of the expected undiscounted future cash flows are less than the carrying amount

of the assets, the Company would recognize an impairment loss, if determined to be necessary. Such impairment loss

is measured as the amount by which the carrying amount of the asset exceeds the fair value of the asset in

accordance with SFAS No. 144. The Company determined that, for the years ended December 31, 2001, 2002, and

2003, there had been no impairment in the carrying value of its long-lived assets.

Accrual for Customers’ Right of Return - Luxottica Group records an accrual for estimated returns of

merchandise in connection with their conditions of sale. Such amount is included in the caption “Accrued expenses-

customers’ right of return.”

Store Opening and Closing Costs - Store opening costs are charged to operations as incurred in accordance

with Statement of Position No. 98-5, Accounting for the Cost of Start-up Activities. The costs associated with closing

stores or facilities are recorded at fair value as such costs are incurred.

Income Taxes - Income taxes are recorded in accordance with SFAS No. 109, Accounting for Income Taxes,

which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events

that have been included in the Company's consolidated financial statements or tax returns. Under this method,

deferred tax liabilities and assets are determined based on the difference between the consolidated financial

statements and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences

are expected to reverse.

Liability for Termination Indemnities - Termination indemnities represent amounts accrued for employees in

Australia, Austria, Greece, Israel, Italy and Japan, determined in accordance with labor laws and agreements in each

country (see Note 9).

Revenue Recognition - Revenues from sales of products are recognized at the time of shipment, when title and

the risks and rewards of ownership of the goods have been assumed by the customer, or upon receipt by the

customer, depending on the terms of the sales agreement. In connection with the conditions of sale in certain

countries, certain subsidiaries of the Company record as a liability an amount based on an estimate of anticipated

returns of merchandise by customers in subsequent periods. Such amount is included in the consolidated balance

sheets under the caption "Accrued expenses-customers’ right of return.” Revenues from retail sales, including Internet

and catalog sales, are recorded upon customer purchase.

Pervasiveness of Estimates - The preparation of financial statements in accordance with U.S. GAAP requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of

revenues and expenses for the reporting period. Actual results could differ from those estimates.

Earnings per Share - Luxottica Group calculates the basic and diluted earnings per share in accordance with

SFAS No. 128, Earnings per Share. Net income available to shareholders is the same for the basic and diluted