LensCrafters 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

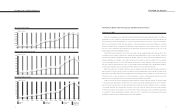

35

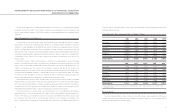

December 31, 2002, and excluding the effect of the 53rd week from results for 2003, the year-over-year decline in

consolidated income from operations for 2003, as adjusted, would have been 30.5 percent (see following table).

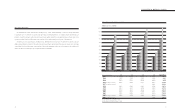

(Millions of Euro) Consolidated Income from Operations

FY 2002 FY 2003 % change

U.S. GAAP results 601.5 431.8 (28.2)

% of net sales 18.9% 15.3%

OPSM results in 2002 6.1

with OPSM in both years 607.6 431.8 (28.9)

% of net sales 18.5% 15.3%

w/o 53rd week in 2003(1) (1) (9.6)

Consistent basis (1) 607.6 422.2 (30.5)

% of net sales 18.5% 15.1%

(1) US$ 10.9 million converted in Euro at FY 2003 average exchange rate of 1.00 = US$ 1.1307. Differently from previous reconciliations on net sales,

Luxottica Group is not calculating for income from operations the exchange rate effect.

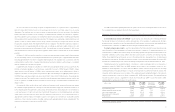

Operating margin for the Company’s manufacturing and wholesale distribution division for the year declined to

19.2 percent, from 25.5 percent for 2002. Operating margin for the Company’s retail division for the year declined to

13.5 percent, from 14.5 percent for 2002. On a consolidated adjusted basis, including OPSM’s results for the five-

month period ended December 31, 2002, and excluding the effect of the 53rd week from 2003 results, operating

margin for the Company’s retail division for the year would have declined year-over-year to 13.2 percent, as adjusted,

from 14.2 percent for 2002, as adjusted (see following table).

34

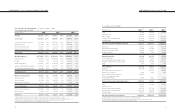

Comparable store sales for 2003 in constant U.S. Dollars, excluding OPSM and the 53rd week, declined year-

over-year by 1.1 percent.

In 2003, net sales to third parties for the Company’s manufacturing and wholesale distribution division declined

year-over-year by 15.6 percent to 822.4 million, from 973.8 million for 2002. Assuming constant exchange rates,

manufacturing and wholesale distribution sales to third parties for 2003 would have declined year-over-year by

10.6 percent. This decline was primarily attributable to the year-over-year nearly 80 percent decline in sales of Armani-

licensed eyewear for the year, following the above-mentioned termination of the Armani licenses agreement.

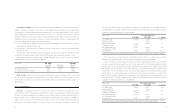

Cost of Sales - Consolidated cost of sales for 2003 declined 5.0 percent to 878.3 million, from 924.4 million

for 2002, while increasing as a percentage of consolidated net sales to 31.1 percent, from 29.1 percent, respectively.

This increase in consolidated cost of sales, as a percentage of consolidated net sales, was mainly attributable to lower

consolidated net sales for 2003, resulting primarily from the weakening of the U.S. Dollar against the Euro. As a

consequence, consolidated gross profit for 2003 declined 13.7 percent to 1,946.3 million, from

2,254.2 million for 2002. As a percentage of consolidated net sales, gross profit for 2003 declined to 68.9 percent,

from 70.9 percent for 2002.

Operating Expenses - Consolidated operating expenses for 2003 declined 8.4 percent to 1,514.5 million,

from 1,652.7 million for 2002. As a percentage of consolidated net sales, consolidated operating expenses for 2003

increased to 53.6 percent, from 52.0 percent for 2002.

Consolidated selling, royalty and advertising expenses for 2003 declined 9.2 percent to 1,233.5 million, from

1,358.9 million for 2002. As a percentage of consolidated net sales, consolidated selling, royalty and advertising

expenses for 2003 increased to 43.7 percent, from 42.8 percent for 2002. While the decline in this line item in Euro

was largely due to the weakening of the U.S. Dollar against the Euro, the increase, as a percentage of consolidated

net sales, was mainly due to the greater percentage of fixed costs to total costs in the Company’s retail division.

Consolidated general and administrative expenses for the year, including intangible assets amortization, declined

year-over-year by 4.3 percent to 281.0 million, from 293.8 million for 2002. As a percentage of consolidated net

sales, consolidated general and administrative expenses for the year increased to 9.9 percent, from 9.2 percent for

2002. While the decline in this line item in Euro was primarily due to the weakening of the U.S. Dollar against the Euro,

the increase, as a percentage of consolidated net sales, was mainly due to the greater percentage of fixed costs to

total costs in the Company’s manufacturing and wholesale distribution division, due to the decline in sales.

Income from Operations - Consolidated income from operations for 2003 declined 28.2 percent to 431.8

million, from 601.5 million for 2002. As a percentage of consolidated net sales, consolidated income from

operations for the year declined to 15.3 percent, from 18.9 percent for 2002. The year-over-year comparison was also

affected by the consolidation of results of operations of OPSM as of August 1, 2003, and by the 53rd week of the

North American retail calendar. The effect of the 53rd week on consolidated income from operations for the year was

equal to US$ 10.9 million. On a consolidated adjusted basis, including OPSM’s results for the five-month period to